Changes you need to know about 2022 First home grant and first home loan

Posted by: Connie in First Home Buyer

Welcome to our Channel this week.

In the recent budget announcement, New Zealand government have made some changes to first home loan and first home grants to help people to gain property ownership in New Zealand. This sounds like welcome news. If you are trying to buy your first home in New Zealand, you need to be aware of what these changes are. So today I will quickly explain these two terms' jargon and outline the changes. And then in the next episode, I'm going to share my analysis and see how effective these changes are. Are they really helping you to gain property ownership?

let's firstly look at what is the first home grant. Well, in a nutshell, it's free money. You can get up to $5,000 if you buy on your own, or up to $10,000 if you buy a property with your other half. But to qualify, you must meet certain criteria.

To be eligible for a First Home Grant, you must:

- be over 18 years old

- have earned less than the income caps in the last 12 months

- not currently own any property, this does not include ownership of Māori land

- have been contributing at least the minimum amount to KiwiSaver (or complying fund or exempt employer scheme) for 3 years or more

- purchase a property that is within the regional house price caps

- agree to live in your new house for at least 6 months.

- You must also make sure the house or land you want to buy meets the property requirements.

In the 12 months before you apply, you must have earned:

- $95,000 or less before tax for an individual buyer

- $150,000 or less before tax for an individual buyer with one or more dependents

- $150,000 or less before tax for 2 or more buyers, regardless of the number of dependants.

(Check You Are Eligible for First Home Grant, 2022)

The first home grant is not new, but in the budget, the New Zealand government has made 4 changes to that.

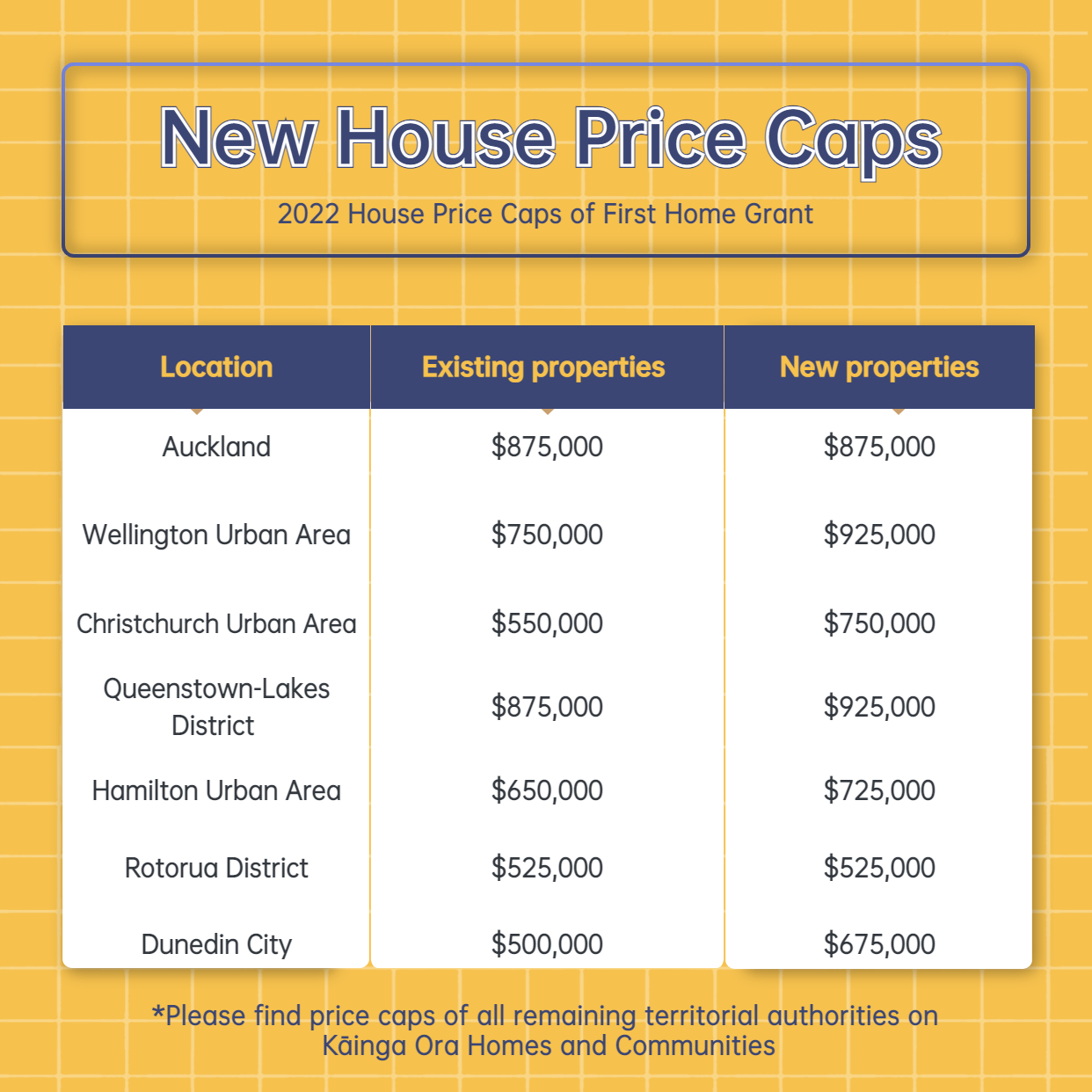

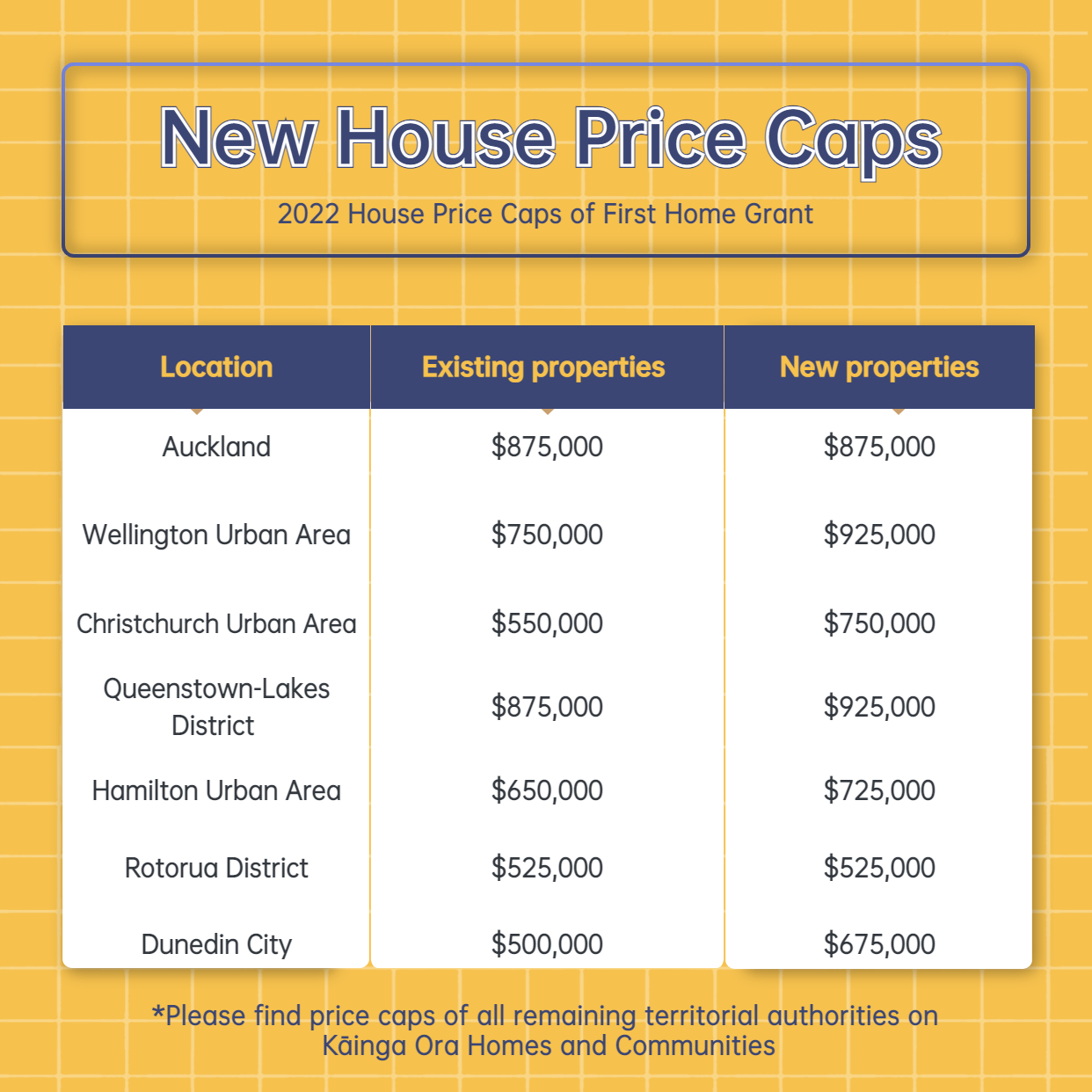

- lifting the house price cap

- Improving the income cap by including an individual with dependents

- Relocatable home

- Lower the KiwiSaver contribution requirements

For example, for Auckland, they have lifted the cap from $650k for existing property and $700k for purchasing a new property to $875K for both categories. So, if you buy a property within this category, you then can meet the criteria in terms of the house price cap.

In the past, if you are an individual buyer, then your income cap is set as $95k regardless of if you have a dependent or not. But now if you have a dependent, the income cap will lift to $150k. So that really help with single parent. If you are getting a relocatable home and the CCC is issued in the last 12 months. They will treat it as a new property. So you can potentially get up to a $10,000 home grant when you buy a relocatable home.

After changes, the requirement is not just 3%. It's either the 3% of your total income or $1,000 per year, which is less. They lower the KiwiSaver requirement to make it easier for people to qualify for the grant. I think it's really good news for first home buyers in terms of getting more people qualified for the grant.

Now let's talk about first home loans. The first home loan is designed for people who have less than 20% deposit, but they can come up with at least 5%, including the KiwiSaver withdrawal and grant. Again, it's not new, the benefit is always there, but it's not very practical in the past because one of the criteria in the past is the housing price cap.

For the first home loan, there are 2 main changes:

- Remove the house price cap

- Improving the income cap by including an individual with dependents

the house price cap is removed, so they don't have this criterion anymore. You can just look at the income cap as long as you satisfy that criteria then you may be able to qualify for the first home loan.

Now in terms of the income cap, it's the same criteria for the first home grant. The main change is if you are a parent with a dependent, then your income cap will lift from $95K to $150k before tax.

To be eligible for a First Home Loan, you must meet:

- Income cap:

- Have an annual income of no more than $95,000 (before tax) for an individual buyer; or

- Have an income of no more than $150,000 (before tax) for an individual buyer who one or more dependents; or

- Have a combined income of no more than $150,000 (before tax) for two or more buyers, regardless of the number of dependents

- Minimum 5 % deposit

- First home buyer - Or a previous homeowner, in a similar financial position to a typical first home buyer.

(Check You Are Eligible for First Home Loan, 2022)

In the next episode, I'm going to share my analysis with you, and let's see if they really help. Stay in tune, I will see you in the next episode.

Reference:

Check you are eligible for First Home Grant. (2022, May 19). Kāinga Ora Homes and Communities. https://kaingaora.govt.nz/home...

Check you are eligible for First Home Loan. (2022, May 19). Kāinga Ora Homes and Communities. https://kaingaora.govt.nz/home...

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Welcome to our Channel this week.

In the recent budget announcement, New Zealand government have made some changes to first home loan and first home grants to help people to gain property ownership in New Zealand. This sounds like welcome news. If you are trying to buy your first home in New Zealand, you need to be aware of what these changes are. So today I will quickly explain these two terms' jargon and outline the changes. And then in the next episode, I'm going to share my analysis and see how effective these changes are. Are they really helping you to gain property ownership?

let's firstly look at what is the first home grant. Well, in a nutshell, it's free money. You can get up to $5,000 if you buy on your own, or up to $10,000 if you buy a property with your other half. But to qualify, you must meet certain criteria.

To be eligible for a First Home Grant, you must:

- be over 18 years old

- have earned less than the income caps in the last 12 months

- not currently own any property, this does not include ownership of Māori land

- have been contributing at least the minimum amount to KiwiSaver (or complying fund or exempt employer scheme) for 3 years or more

- purchase a property that is within the regional house price caps

- agree to live in your new house for at least 6 months.

- You must also make sure the house or land you want to buy meets the property requirements.

In the 12 months before you apply, you must have earned:

- $95,000 or less before tax for an individual buyer

- $150,000 or less before tax for an individual buyer with one or more dependents

- $150,000 or less before tax for 2 or more buyers, regardless of the number of dependants.

(Check You Are Eligible for First Home Grant, 2022)

The first home grant is not new, but in the budget, the New Zealand government has made 4 changes to that.

- lifting the house price cap

- Improving the income cap by including an individual with dependents

- Relocatable home

- Lower the KiwiSaver contribution requirements

For example, for Auckland, they have lifted the cap from $650k for existing property and $700k for purchasing a new property to $875K for both categories. So, if you buy a property within this category, you then can meet the criteria in terms of the house price cap.

In the past, if you are an individual buyer, then your income cap is set as $95k regardless of if you have a dependent or not. But now if you have a dependent, the income cap will lift to $150k. So that really help with single parent. If you are getting a relocatable home and the CCC is issued in the last 12 months. They will treat it as a new property. So you can potentially get up to a $10,000 home grant when you buy a relocatable home.

After changes, the requirement is not just 3%. It's either the 3% of your total income or $1,000 per year, which is less. They lower the KiwiSaver requirement to make it easier for people to qualify for the grant. I think it's really good news for first home buyers in terms of getting more people qualified for the grant.

Now let's talk about first home loans. The first home loan is designed for people who have less than 20% deposit, but they can come up with at least 5%, including the KiwiSaver withdrawal and grant. Again, it's not new, the benefit is always there, but it's not very practical in the past because one of the criteria in the past is the housing price cap.

For the first home loan, there are 2 main changes:

- Remove the house price cap

- Improving the income cap by including an individual with dependents

the house price cap is removed, so they don't have this criterion anymore. You can just look at the income cap as long as you satisfy that criteria then you may be able to qualify for the first home loan.

Now in terms of the income cap, it's the same criteria for the first home grant. The main change is if you are a parent with a dependent, then your income cap will lift from $95K to $150k before tax.

To be eligible for a First Home Loan, you must meet:

- Income cap:

- Have an annual income of no more than $95,000 (before tax) for an individual buyer; or

- Have an income of no more than $150,000 (before tax) for an individual buyer who one or more dependents; or

- Have a combined income of no more than $150,000 (before tax) for two or more buyers, regardless of the number of dependents

- Minimum 5 % deposit

- First home buyer - Or a previous homeowner, in a similar financial position to a typical first home buyer.

(Check You Are Eligible for First Home Loan, 2022)

In the next episode, I'm going to share my analysis with you, and let's see if they really help. Stay in tune, I will see you in the next episode.

Reference:

Check you are eligible for First Home Grant. (2022, May 19). Kāinga Ora Homes and Communities. https://kaingaora.govt.nz/home...

Check you are eligible for First Home Loan. (2022, May 19). Kāinga Ora Homes and Communities. https://kaingaora.govt.nz/home...

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)