Does house price cap removal really help first home buyers

Posted by: Connie 小宇 in First Home Buyer

In the last episode, we explained the changes to the first home loan and first home grant in the 2022 budget. They are indeed excellent news to first home buyers. In this episode, we will share my analysis of the effectiveness of the policies, in particular, the house price removal, and see how they can help more people gain property ownership in New Zealand.

Firstly, what is the first home loan? The first home loan is designed for people with less than 20% deposit, but they can come up with at least 5%, including the KiwiSaver withdrawal and grant. In the past, it was not very practical because one of the criteria is that the purchase price can’t exceed the regional housing price cap set at a very low level. Now the price cap has been removed by the government. Let's see how this policy affects first home buyers.

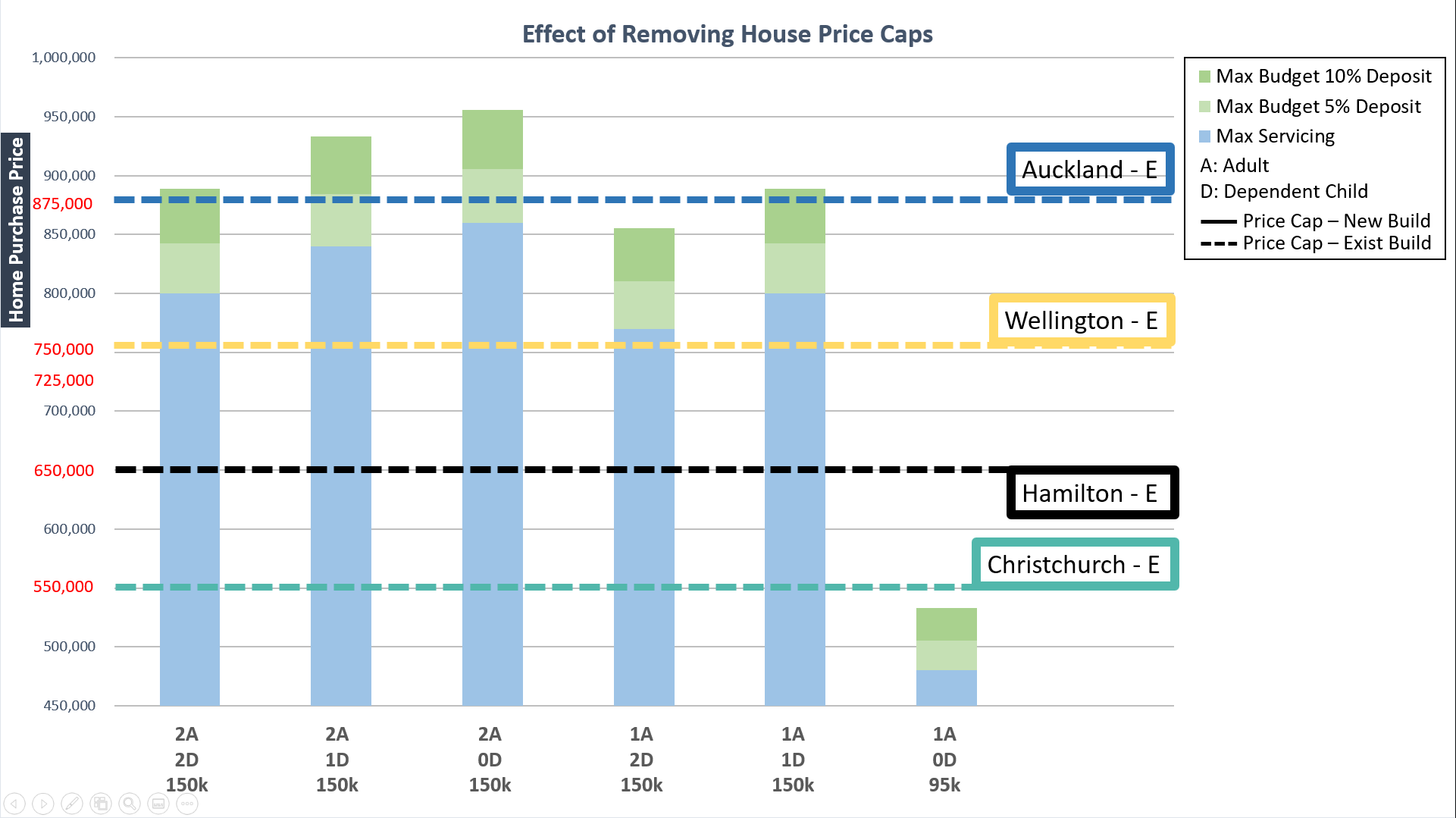

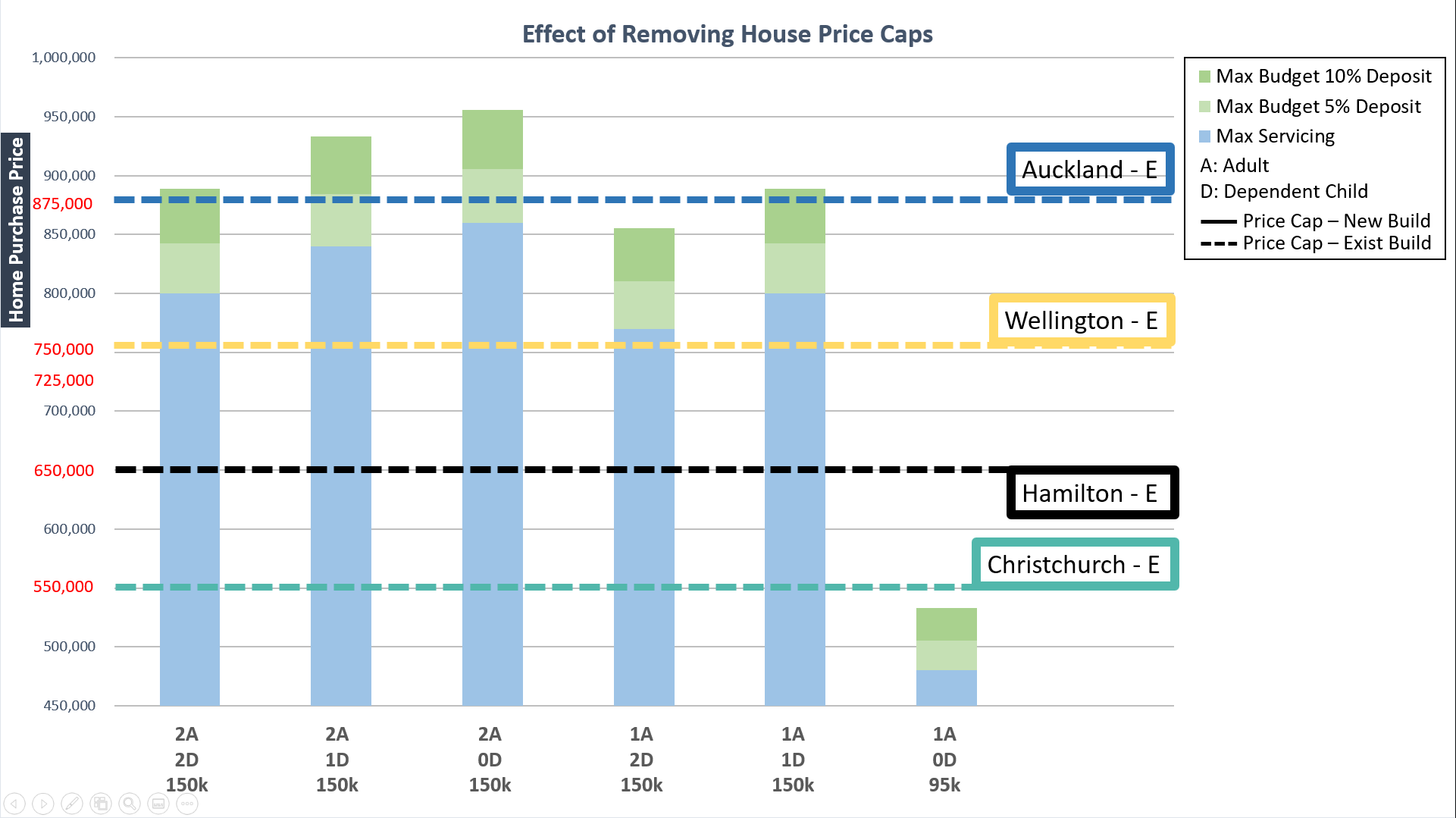

The horizontal line represents each regional price cap based on each region’s lower quota price. Six bars represent a different family group (A is the number of adults, and D is the number of children). The blue portion represents their maximum borrowing capacity based on their family structure and their family income, and the current lending policies. And then, the lighter green bar above the blue represents the 5% deposit. And then the darker green bar represents another 5% deposit. So, the height of the bar represents the budget of each group based on the income and the deposit, which is no more than 10%.

Then we compare the budget with the regional house price cap and see if they are above or below. If it's above, it means people have more choices. If it's below, the policy change is ineffective because even without the house price cap, people can't borrow enough money to purchase the property in that region. On the first slide, we compare the budget with the existing house price cap, and we make the same comparison with new built property on the next page slide. Typically, the new property price cap is higher than the existing one. Auckland is an exception- both new and existing house price caps was$875,000.

I can see the last group, well below the dotted lines. This group represents a single buyer with no dependent with $95,000 annual income. That's not a bad income, isn’t it? But to buy property in the main centres, they must have a significant deposit. Otherwise, they are very hard to get into property ownership.

And then with other groups in Christchurch, Hamilton and Wellington have some choices because their budget is above the existing property price cap. First home buyers in Hamilton and Christchurch are the easiest to purchasing their first home. And for Wellington is easy, except for one adult with two dependents, but they still have choices. Whereas for Auckland, the only two groups that could benefit from the house price removal are the second and third groups. This means they have to be two adults without a dependent or only one dependent with a $150,000 income. But other groups are struggling to buy property in Auckland.

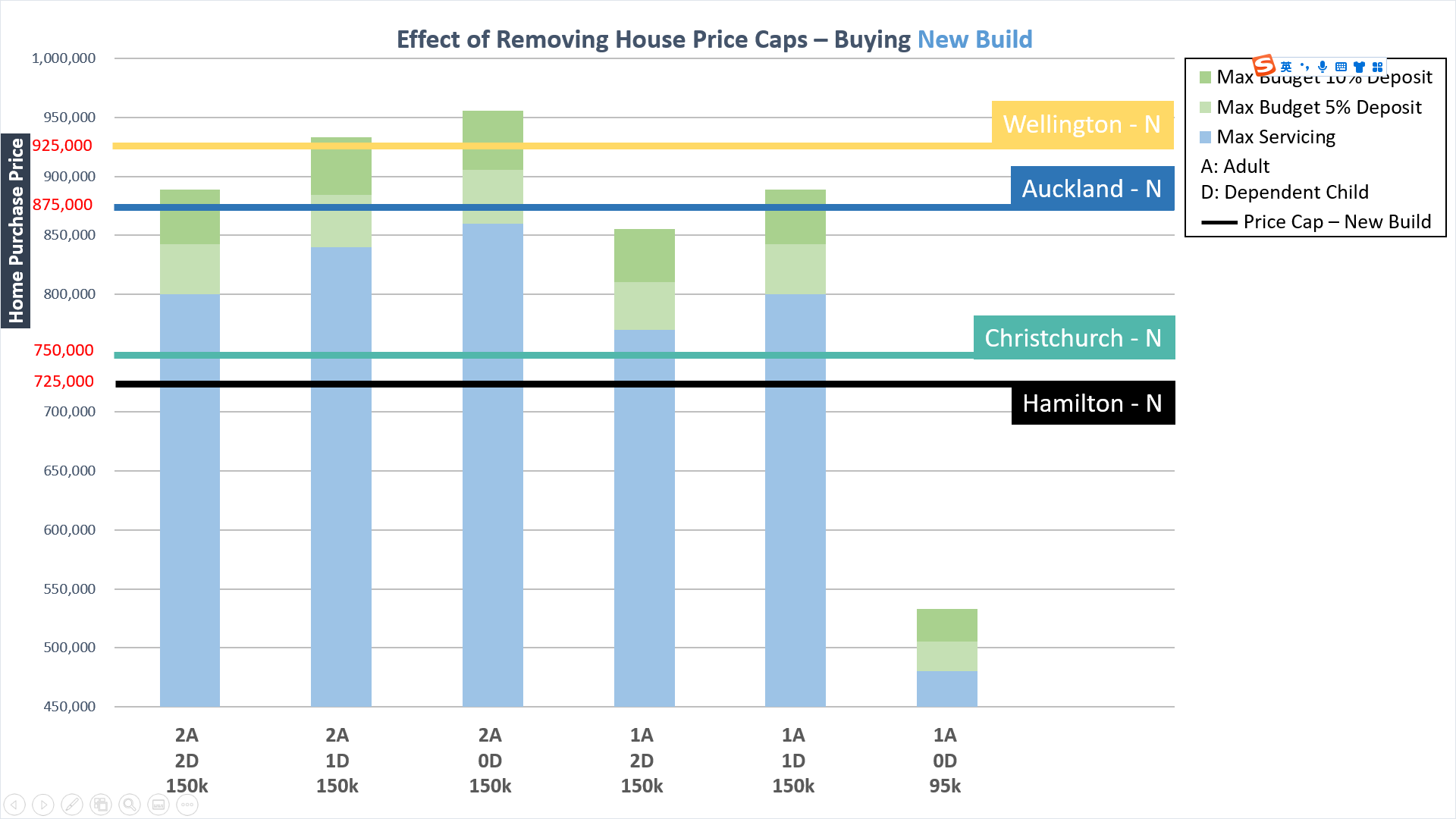

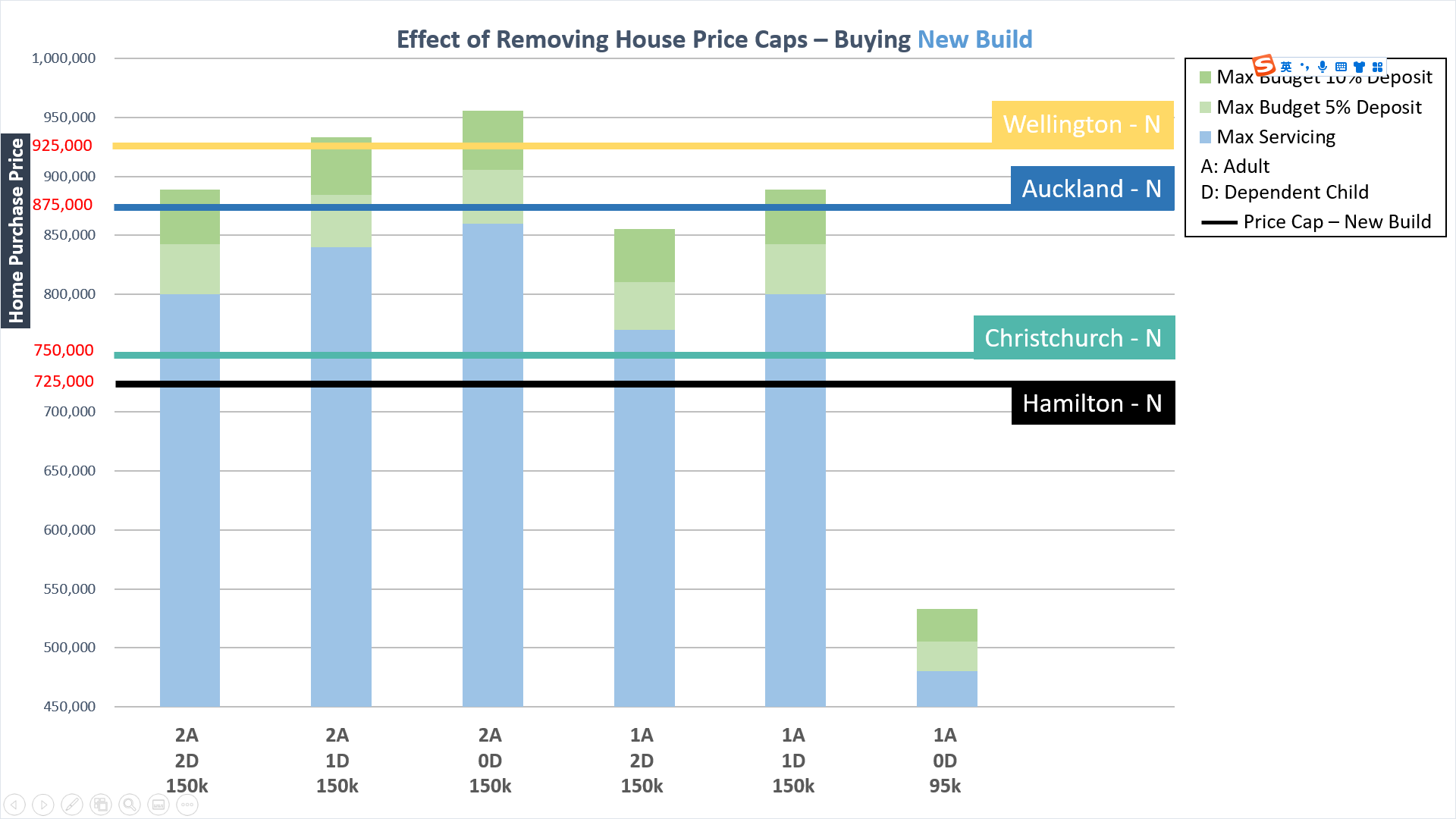

Now let's move on to the next slide. The only difference in this slide is the regional price cap we used is for new build property. Therefore, we have an N next to the name of the region.

As you can see, people looking to buy in Christchurch and Hamilton also have many choices. If you have a good income, you can buy an existing or new house. The house price cap removal really helps. On the other hand, it is even more difficult for the last group, the single buyer, to get into property ownership unless they have a huge deposit.

Now for Wellington, it’s very interesting. People living in Wellington easily qualify for the first home loan if they buy an existing house. But only the third group (two adults, no dependent with a $150,000 family income, and they need a 10% deposit) can afford new houses in Wellington.

Lastly, let’s look at the Auckland region. It's tough for Auckland developers to see properties around that price, given the construction costs have increased so much over the last year. For the buyers, only two groups (two adults with no more than one child) can afford to buy a new property in Auckland with close to a 10% deposit.

That’s all the insights we shared with you. We hope they are valuable to you. If you have any questions, feel free to get in touch with us. We are inspired to help you get into property ownership and have a house you can call your own home.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

In the last episode, we explained the changes to the first home loan and first home grant in the 2022 budget. They are indeed excellent news to first home buyers. In this episode, we will share my analysis of the effectiveness of the policies, in particular, the house price removal, and see how they can help more people gain property ownership in New Zealand.

Firstly, what is the first home loan? The first home loan is designed for people with less than 20% deposit, but they can come up with at least 5%, including the KiwiSaver withdrawal and grant. In the past, it was not very practical because one of the criteria is that the purchase price can’t exceed the regional housing price cap set at a very low level. Now the price cap has been removed by the government. Let's see how this policy affects first home buyers.

The horizontal line represents each regional price cap based on each region’s lower quota price. Six bars represent a different family group (A is the number of adults, and D is the number of children). The blue portion represents their maximum borrowing capacity based on their family structure and their family income, and the current lending policies. And then, the lighter green bar above the blue represents the 5% deposit. And then the darker green bar represents another 5% deposit. So, the height of the bar represents the budget of each group based on the income and the deposit, which is no more than 10%.

Then we compare the budget with the regional house price cap and see if they are above or below. If it's above, it means people have more choices. If it's below, the policy change is ineffective because even without the house price cap, people can't borrow enough money to purchase the property in that region. On the first slide, we compare the budget with the existing house price cap, and we make the same comparison with new built property on the next page slide. Typically, the new property price cap is higher than the existing one. Auckland is an exception- both new and existing house price caps was$875,000.

I can see the last group, well below the dotted lines. This group represents a single buyer with no dependent with $95,000 annual income. That's not a bad income, isn’t it? But to buy property in the main centres, they must have a significant deposit. Otherwise, they are very hard to get into property ownership.

And then with other groups in Christchurch, Hamilton and Wellington have some choices because their budget is above the existing property price cap. First home buyers in Hamilton and Christchurch are the easiest to purchasing their first home. And for Wellington is easy, except for one adult with two dependents, but they still have choices. Whereas for Auckland, the only two groups that could benefit from the house price removal are the second and third groups. This means they have to be two adults without a dependent or only one dependent with a $150,000 income. But other groups are struggling to buy property in Auckland.

Now let's move on to the next slide. The only difference in this slide is the regional price cap we used is for new build property. Therefore, we have an N next to the name of the region.

As you can see, people looking to buy in Christchurch and Hamilton also have many choices. If you have a good income, you can buy an existing or new house. The house price cap removal really helps. On the other hand, it is even more difficult for the last group, the single buyer, to get into property ownership unless they have a huge deposit.

Now for Wellington, it’s very interesting. People living in Wellington easily qualify for the first home loan if they buy an existing house. But only the third group (two adults, no dependent with a $150,000 family income, and they need a 10% deposit) can afford new houses in Wellington.

Lastly, let’s look at the Auckland region. It's tough for Auckland developers to see properties around that price, given the construction costs have increased so much over the last year. For the buyers, only two groups (two adults with no more than one child) can afford to buy a new property in Auckland with close to a 10% deposit.

That’s all the insights we shared with you. We hope they are valuable to you. If you have any questions, feel free to get in touch with us. We are inspired to help you get into property ownership and have a house you can call your own home.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)