Offset vs Revolving in New Zealand Mortgages — Which Structure Works Best for You?

Posted by: Prosperity Finance

If you’ve ever heard that an offset account or revolving account can help reduce your NZ mortgage interest - you’re absolutely right.

Both tools can save thousands in interest, but they work differently:

- Revolving account: like a super-sized credit card - you pay interest only on what you actually use.

- Offset account: links one or more savings accounts to your mortgage - interest is charged only on the balance after offset.

Knowing which suits your cashflow and tax situation can make a big difference to your long-term home loan strategy NZ.

-

Why Understanding Offset and Revolving Matters

Many homeowners in New Zealand focus only on interest rates, but loan structure optimisation often delivers greater savings.

Choosing between a revolving home loan NZ and a mortgage offset NZ structure affects not only how much interest you pay, but also your tax-deductible interest NZ opportunities if you own investment properties.

-

What is a revolving account?

A revolving account is essentially a home-loan-sized credit facility that allows you to borrow, repay, and re-borrow funds as needed.

It’s flexible and ideal for those with irregular income or strong cashflow discipline.

How it works:

You pay interest only on your current outstanding balance.

Depositing spare cash immediately reduces interest charges.

You can withdraw the funds again anytime without penalties.

Example:

You have a NZD 100,000 revolving home loan NZ facility.

After settlement, you use the full amount.

Later, you deposit NZD 20,000 — now you only pay interest on NZD 80,000.

If you need that NZD 20,000 again, you can draw it out anytime.

Interest is calculated daily on the remaining balance — making this one of the most flexible NZ mortgage tools available.

-

What is an Offset account?

An offset account serves the same goal — saving interest — but uses a different mechanism.

Instead of transferring savings into your loan account, you keep them in linked savings accounts under your name (or your family’s).

The combined balances in those accounts "offset" your loan balance, reducing the amount of interest you pay.

Example:

Your parents hold NZD 100,000 in savings.

By linking their account to your offset mortgage, you’ll only pay interest on your loan minus that NZD 100,000.

They can still access their money anytime, and your mortgage interest saving continues automatically.

It’s simple, safe, and highly effective — especially when family funds are involved.

-

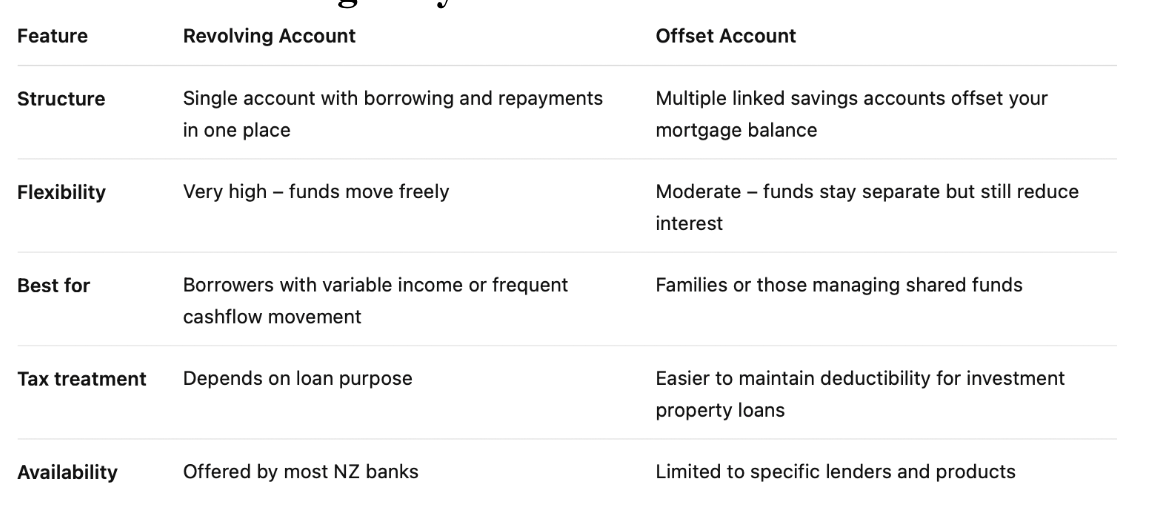

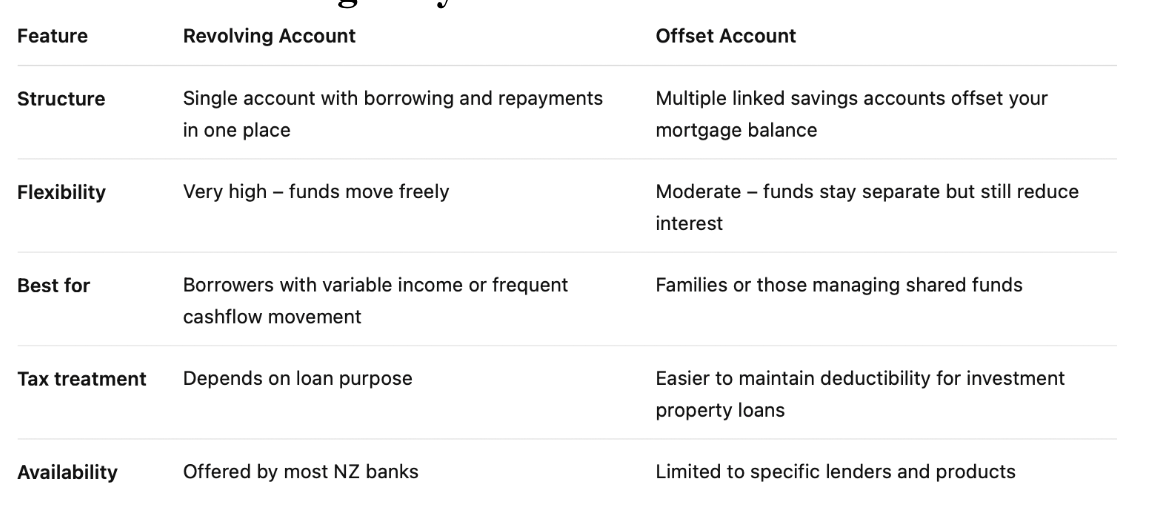

Offset vs Revolving: Key Differences

-

When to Use Offset Accounts

There are two main situations where an Offset Account works best:

Funds are not fully yours – such as your parents’ or children’s savings, or money set aside for future use.

Loan is for investment or business purposes – because interest may remain tax-deductible when offset funds are withdrawn.

In most other cases, a Revolving Account is simpler, widely available, and provides excellent flexibility for managing personal finances.

Real Client Example: Turning Structure Into Savings

A client came to us with NZD 300,000 cash and planned to use it as a deposit for a NZD 1 million investment property.

Our team at Prosperity Finance suggested a more strategic approach:

Convert NZD 300,000 from their home loan into a revolving facility.

Deposit their NZD 300,000 cash into that facility — immediately reducing their home loan interest.

Borrow the full NZD 1 million for the investment property.

Result:

That NZD 300,000 previously non-deductible home loan debt became tax-deductible investment loan interest.

At a 4.5% rate, that's about NZD 14,000 of deductible interest per year.

With a 39% tax rate, they saved roughly NZD 5,460 in annual tax.

That's the power of smart loan structuring — and exactly what a good mortgage adviser does: not just getting your loan approved, but helping you build long-term financial efficiency.

-

Final Thoughts

Both offset and revolving accounts are powerful tools for improving your NZ mortgage strategy.

Used correctly, they can significantly increase your mortgage interest saving, improve cashflow, and enhance long-term financial flexibility.

If you’re unsure which option fits your needs, our team at Prosperity Finance can help assess your structure and goals.

Even if your existing mortgage wasn’t arranged through us, we’re happy to provide a tailored, no-obligation review to help you optimise your plan.

-

Frequently Asked Questions

Q1: What’s the difference between an Offset Account and a Revolving Account?

The key difference lies in structure:

Revolving account: one account where money flows in and out directly.

Offset account: multiple linked accounts that reduce your mortgage balance indirectly.

Offset accounts are better suited for shared or family funds, while revolving accounts are ideal for individual borrowers who want flexibility.

-

Q2: Which option helps save more interest — Offset or Revolving?

Both can save substantial interest, but the right choice depends on your situation.

If your savings belong to multiple people or are set aside for another purpose, an offset account is safer.

If you’re using your own income and want daily flexibility, a revolving account usually provides greater efficiency.

-

Q3: Can I use both an Offset and a Revolving Account?

Yes. Many borrowers in New Zealand combine both to balance flexibility and tax benefits.

For example, using a revolving home loan NZ for personal cashflow and an offset account for family savings can deliver the best overall loan structure optimisation.

-

Q4: How do Offset and Revolving Accounts affect tax deductibility?

If your loan relates to an investment property loan NZ or business, structuring it correctly can make interest tax-deductible.

Offset accounts often provide clearer separation between personal and investment funds, which helps maintain tax efficiency.

Always confirm with your accountant before adjusting your structure.

-

Q5: What’s the main benefit of reviewing my mortgage structure regularly?

Regular reviews can uncover new opportunities to optimise your NZ mortgage, refine your loan structure optimisation, and ensure you’re maximising both interest savings and potential tax advantages.

Even small adjustments can make a major impact over time.

-

Q6: How can Prosperity Finance help me choose the right structure?

Our advisers specialise in smart mortgage structuring across offset and revolving home loan NZ products.

We assess your income flow, goals, and tax situation to design a strategy that balances flexibility, savings, and long-term growth.

Even if your mortgage isn’t currently with us, we’re happy to provide a tailored, no-obligation review.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

If you’ve ever heard that an offset account or revolving account can help reduce your NZ mortgage interest - you’re absolutely right.

Both tools can save thousands in interest, but they work differently:

- Revolving account: like a super-sized credit card - you pay interest only on what you actually use.

- Offset account: links one or more savings accounts to your mortgage - interest is charged only on the balance after offset.

Knowing which suits your cashflow and tax situation can make a big difference to your long-term home loan strategy NZ.

-

Why Understanding Offset and Revolving Matters

Many homeowners in New Zealand focus only on interest rates, but loan structure optimisation often delivers greater savings.

Choosing between a revolving home loan NZ and a mortgage offset NZ structure affects not only how much interest you pay, but also your tax-deductible interest NZ opportunities if you own investment properties.

-

What is a revolving account?

A revolving account is essentially a home-loan-sized credit facility that allows you to borrow, repay, and re-borrow funds as needed.

It’s flexible and ideal for those with irregular income or strong cashflow discipline.

How it works:

You pay interest only on your current outstanding balance.

Depositing spare cash immediately reduces interest charges.

You can withdraw the funds again anytime without penalties.

Example:

You have a NZD 100,000 revolving home loan NZ facility.

After settlement, you use the full amount.

Later, you deposit NZD 20,000 — now you only pay interest on NZD 80,000.

If you need that NZD 20,000 again, you can draw it out anytime.

Interest is calculated daily on the remaining balance — making this one of the most flexible NZ mortgage tools available.

-

What is an Offset account?

An offset account serves the same goal — saving interest — but uses a different mechanism.

Instead of transferring savings into your loan account, you keep them in linked savings accounts under your name (or your family’s).

The combined balances in those accounts "offset" your loan balance, reducing the amount of interest you pay.

Example:

Your parents hold NZD 100,000 in savings.

By linking their account to your offset mortgage, you’ll only pay interest on your loan minus that NZD 100,000.

They can still access their money anytime, and your mortgage interest saving continues automatically.

It’s simple, safe, and highly effective — especially when family funds are involved.

-

Offset vs Revolving: Key Differences

-

When to Use Offset Accounts

There are two main situations where an Offset Account works best:

Funds are not fully yours – such as your parents’ or children’s savings, or money set aside for future use.

Loan is for investment or business purposes – because interest may remain tax-deductible when offset funds are withdrawn.

In most other cases, a Revolving Account is simpler, widely available, and provides excellent flexibility for managing personal finances.

Real Client Example: Turning Structure Into Savings

A client came to us with NZD 300,000 cash and planned to use it as a deposit for a NZD 1 million investment property.

Our team at Prosperity Finance suggested a more strategic approach:

Convert NZD 300,000 from their home loan into a revolving facility.

Deposit their NZD 300,000 cash into that facility — immediately reducing their home loan interest.

Borrow the full NZD 1 million for the investment property.

Result:

That NZD 300,000 previously non-deductible home loan debt became tax-deductible investment loan interest.

At a 4.5% rate, that's about NZD 14,000 of deductible interest per year.

With a 39% tax rate, they saved roughly NZD 5,460 in annual tax.

That's the power of smart loan structuring — and exactly what a good mortgage adviser does: not just getting your loan approved, but helping you build long-term financial efficiency.

-

Final Thoughts

Both offset and revolving accounts are powerful tools for improving your NZ mortgage strategy.

Used correctly, they can significantly increase your mortgage interest saving, improve cashflow, and enhance long-term financial flexibility.

If you’re unsure which option fits your needs, our team at Prosperity Finance can help assess your structure and goals.

Even if your existing mortgage wasn’t arranged through us, we’re happy to provide a tailored, no-obligation review to help you optimise your plan.

-

Frequently Asked Questions

Q1: What’s the difference between an Offset Account and a Revolving Account?

The key difference lies in structure:

Revolving account: one account where money flows in and out directly.

Offset account: multiple linked accounts that reduce your mortgage balance indirectly.

Offset accounts are better suited for shared or family funds, while revolving accounts are ideal for individual borrowers who want flexibility.

-

Q2: Which option helps save more interest — Offset or Revolving?

Both can save substantial interest, but the right choice depends on your situation.

If your savings belong to multiple people or are set aside for another purpose, an offset account is safer.

If you’re using your own income and want daily flexibility, a revolving account usually provides greater efficiency.

-

Q3: Can I use both an Offset and a Revolving Account?

Yes. Many borrowers in New Zealand combine both to balance flexibility and tax benefits.

For example, using a revolving home loan NZ for personal cashflow and an offset account for family savings can deliver the best overall loan structure optimisation.

-

Q4: How do Offset and Revolving Accounts affect tax deductibility?

If your loan relates to an investment property loan NZ or business, structuring it correctly can make interest tax-deductible.

Offset accounts often provide clearer separation between personal and investment funds, which helps maintain tax efficiency.

Always confirm with your accountant before adjusting your structure.

-

Q5: What’s the main benefit of reviewing my mortgage structure regularly?

Regular reviews can uncover new opportunities to optimise your NZ mortgage, refine your loan structure optimisation, and ensure you’re maximising both interest savings and potential tax advantages.

Even small adjustments can make a major impact over time.

-

Q6: How can Prosperity Finance help me choose the right structure?

Our advisers specialise in smart mortgage structuring across offset and revolving home loan NZ products.

We assess your income flow, goals, and tax situation to design a strategy that balances flexibility, savings, and long-term growth.

Even if your mortgage isn’t currently with us, we’re happy to provide a tailored, no-obligation review.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)