Unlocking Savings: A Guide to Offset Home Loans in High-Interest Times

Posted by: Prosperity Finance

Unlocking Savings: A Guide to Offset Home Loans in High-Interest Times

Introduction

In the current landscape of high-interest rates, many borrowers are exploring ways to minimize interest repayments while retaining the flexibility of their existing loan limits. One solution gaining popularity is the offset home loan. In this article, we'll delve into the intricacies of offset home loans, shedding light on how repayments work after the loan settlement.

Overview of Offset Home Loans

An offset home loan is a financial tool designed to expedite home loan repayment, allowing borrowers to utilize available funds without the need for a new top-up application. The key lies in maintaining the funds in an offset account within the same bank as the home loan.

Features of Offset Home Loans

Loan Term: Up to 30 years

Repayment Options: Principal and interest or interest-only

Interest Rate: Floating, providing flexibility for splitting, fixing, repaying, or restructuring the loan at any time.

Scenarios and Examples

Case 1: Property Purchase with Savings

Consider a scenario where a customer acquires a property with a $1 million loan, possessing $200,000 in savings post-settlement. To minimize interest while keeping funds accessible, an offset home loan of $200,000 is set up. The remainder is fixed at a lower interest rate. The offset account, a transactional account, allows the customer to offset 100% of the $200,000, saving interest on the corresponding home loan portion.

Case 2: Offsetting Overseas Funds

In another case, a borrower with an existing $500,000 home loan seeks to transfer overseas funds back to NZ and fully offset the loan. Restructuring the home loan into an offset arrangement facilitates this. The borrower can use the $500,000 while paying no mortgage interest when the funds are in the account.

Repayment Dynamics

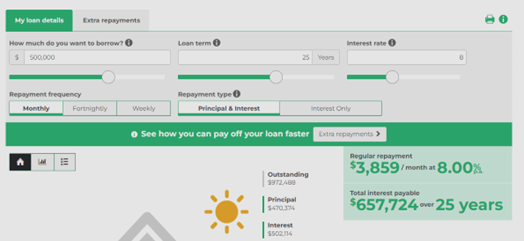

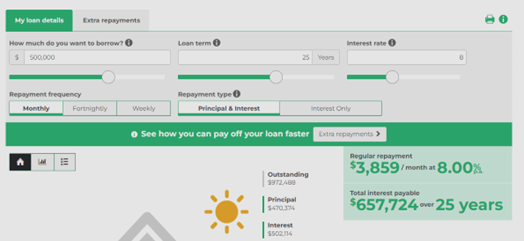

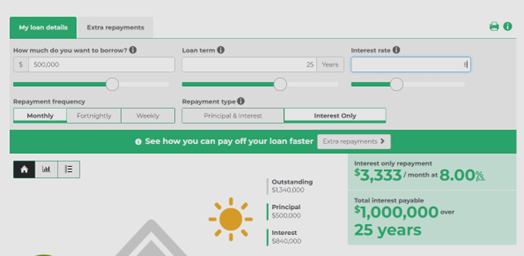

Let's delve into the repayment dynamics of the offset home loan, using Case 2 as an illustration. Consider a scenario where the borrower has 25 years remaining on a principal and interest repayment plan with an 8% floating interest rate.

Under these terms, the monthly repayment is $3859.00. Out of this amount, $3333 goes towards interest, and $529 contributes to the principal.

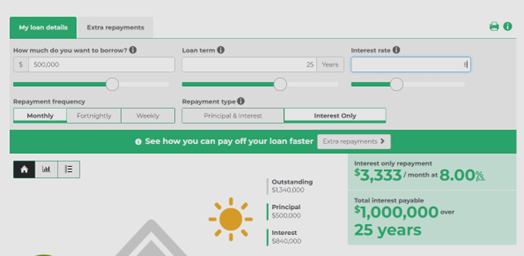

Even with a fully offset home loan amount of $500,000, the borrower continues to make the entire $3859 monthly repayment. However, the allocation differs, with a portion covering interest and the remainder directly reducing the principal balance.

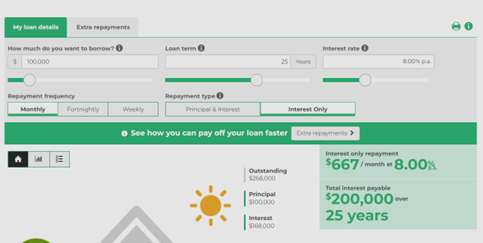

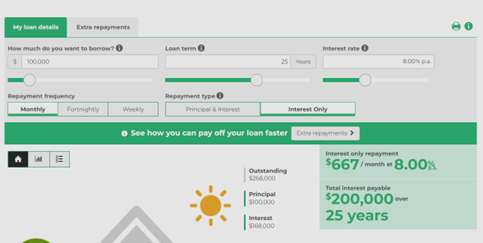

Now, let's explore a situation where the borrower opts to offset the full $500,000 but only has $400,000 in the offset account. In this case, there is a $100,000 shortfall, resulting in interest being applied to this difference.

Despite the shortfall, the monthly repayment remains $3859. Of this amount, $667 is directed towards interest, while the remaining $3192 goes towards reducing the principal. This highlights the importance of maintaining the full offset amount in the account to maximize interest savings.

Conclusion

An offset home loan offers a strategic approach to save on interest repayments while maintaining financial flexibility. This tool allows borrowers to use funds as needed, unlike lump sum repayments that might be challenging to withdraw. Understanding the dynamics of offset home loans empowers borrowers to make informed decisions in navigating the current high-interest environment. We hope this article provides valuable insights into the workings of offset facilities, helping you make informed financial decisions. Stay tuned for more financial insights in our next article.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Unlocking Savings: A Guide to Offset Home Loans in High-Interest Times

Introduction

In the current landscape of high-interest rates, many borrowers are exploring ways to minimize interest repayments while retaining the flexibility of their existing loan limits. One solution gaining popularity is the offset home loan. In this article, we'll delve into the intricacies of offset home loans, shedding light on how repayments work after the loan settlement.

Overview of Offset Home Loans

An offset home loan is a financial tool designed to expedite home loan repayment, allowing borrowers to utilize available funds without the need for a new top-up application. The key lies in maintaining the funds in an offset account within the same bank as the home loan.

Features of Offset Home Loans

Loan Term: Up to 30 years

Repayment Options: Principal and interest or interest-only

Interest Rate: Floating, providing flexibility for splitting, fixing, repaying, or restructuring the loan at any time.

Scenarios and Examples

Case 1: Property Purchase with Savings

Consider a scenario where a customer acquires a property with a $1 million loan, possessing $200,000 in savings post-settlement. To minimize interest while keeping funds accessible, an offset home loan of $200,000 is set up. The remainder is fixed at a lower interest rate. The offset account, a transactional account, allows the customer to offset 100% of the $200,000, saving interest on the corresponding home loan portion.

Case 2: Offsetting Overseas Funds

In another case, a borrower with an existing $500,000 home loan seeks to transfer overseas funds back to NZ and fully offset the loan. Restructuring the home loan into an offset arrangement facilitates this. The borrower can use the $500,000 while paying no mortgage interest when the funds are in the account.

Repayment Dynamics

Let's delve into the repayment dynamics of the offset home loan, using Case 2 as an illustration. Consider a scenario where the borrower has 25 years remaining on a principal and interest repayment plan with an 8% floating interest rate.

Under these terms, the monthly repayment is $3859.00. Out of this amount, $3333 goes towards interest, and $529 contributes to the principal.

Even with a fully offset home loan amount of $500,000, the borrower continues to make the entire $3859 monthly repayment. However, the allocation differs, with a portion covering interest and the remainder directly reducing the principal balance.

Now, let's explore a situation where the borrower opts to offset the full $500,000 but only has $400,000 in the offset account. In this case, there is a $100,000 shortfall, resulting in interest being applied to this difference.

Despite the shortfall, the monthly repayment remains $3859. Of this amount, $667 is directed towards interest, while the remaining $3192 goes towards reducing the principal. This highlights the importance of maintaining the full offset amount in the account to maximize interest savings.

Conclusion

An offset home loan offers a strategic approach to save on interest repayments while maintaining financial flexibility. This tool allows borrowers to use funds as needed, unlike lump sum repayments that might be challenging to withdraw. Understanding the dynamics of offset home loans empowers borrowers to make informed decisions in navigating the current high-interest environment. We hope this article provides valuable insights into the workings of offset facilities, helping you make informed financial decisions. Stay tuned for more financial insights in our next article.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)