Westpac maybe the perfect lender for your next purchase!

Posted by: Alex

Today, we will share with you something we've recently noticed about Westpac's lending policy and how they calculate clients’ existing home loan repayment. With its special calculation, you may borrow much more than other banks.

Before the introduction of CCCFA at the end of last year, each bank had somewhat distinctive lending policies. Different lenders will have different appetites for different kinds of clients. Therefore, it’s easy to know which lender best fits your needs. However, after the introduction of CCCFA, all lenders are busy complying with regulations. That's why there was a time when all banks had the same lending policies, and you may get the same loan amount from all major banks. As the CCCFA settle down a bit now, we can start to see some uniqueness again.

How does Westpac calculate clients' existing home loans which allows clients to borrow more than other banks? Before we understand that, we need a basic understanding of how a loan approval or assessment works when you apply. Usually, each lender will have a rule of how much money you must have before this loan can be approved. Then, the lender will calculate the difference between your total income and expenses. If the difference in your account is higher than the threshold, your loan can be approved.

Furthermore, how do lenders calculate your existing loan repayment? The loan repayment is part of your expense. But no lender will use your actual loan repayment figure to calculate. Each of them always has its own rules. By tweaking those rules, lenders will have a slightly different strategy or selection criteria for what kind of clients they want. In this case, if you existing home loan with relatively low interest rate, Westpac potentially can lend you much more than other major banks due to their unique way of calculating your existing loan repayment amount.

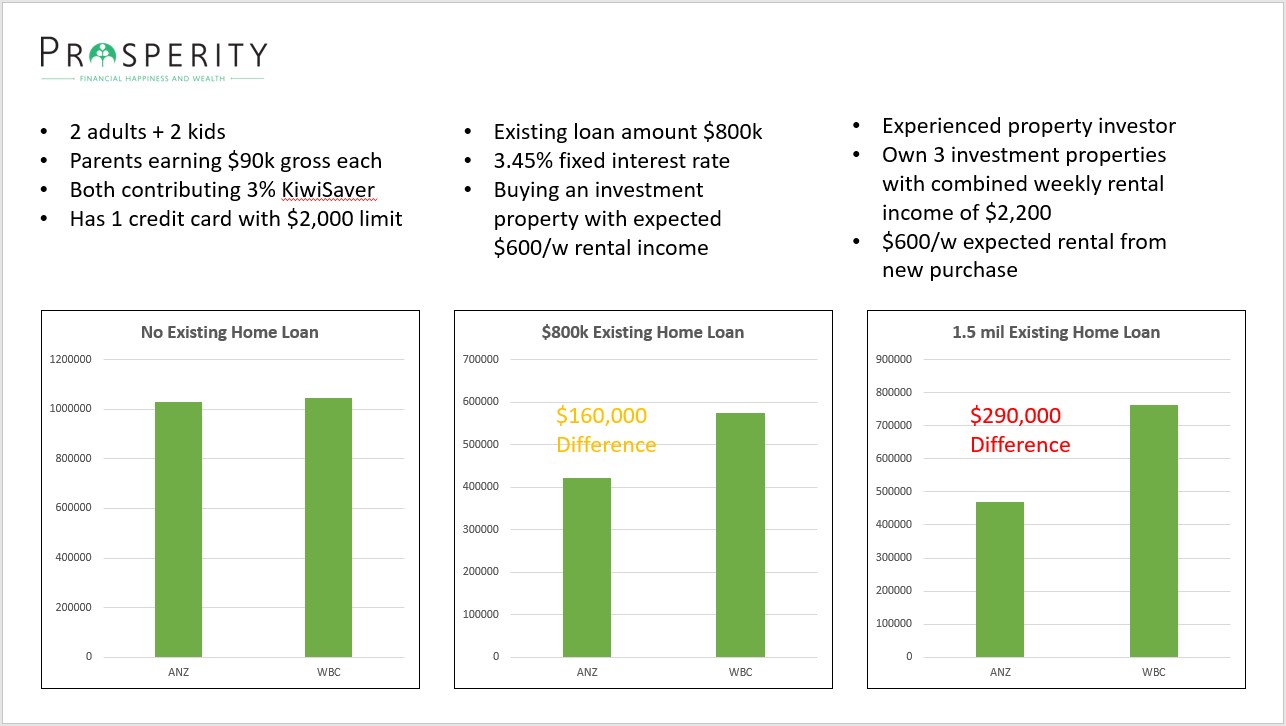

Let's look at this example and see what the difference are. For example, a family with two adults and two kids. Each parent earns $90k p.a. before tax with a 3% kiwi saver. In addition, they have a credit card with a $2k limit.

Scenario 1:

They are planning to buy their first home with No lending and no property.

In this case, we can see that the two banks can lend almost the same amount. In fact, Westpac's loan amount is slightly higher than ANZ's by about $15,000.

Scenario 2:

They have a family home with $800k home loan. The fixed interest rate is 3.45%. And they are planning to buy an investment property with an expected rental income of $600.

Because of the special calculation of Westpac’s existing loan amount, Westpac can potentially lend $160,000 more than ANZ.

Scenario 3:

They are a couple of experienced property investors who own three investment properties with a $1.5m mortgage. The rental income is $2.2k per week. They are planning to buy their 4th investment property with an expected $600/w rental income.In this case, Westpac can potentially lend $290k more than ANZ because of the larger borrowing home loan amount.

In Summary, if you can take advantage of this particular calculation from Westpac, two things really affect the loan amount. An existing home loan and low existing home loan interest rate (under 4%). The more considerable the existing loan amount you have, the more significant the difference will be.

If you are thinking about how much you can borrow and if Westpac is a suitable lender for you, we’re here to help. Call us at 09 930 8999 for a chat with one of our mortgage advisors. We’ll look at your case, understand your needs and situation then make a tailored solution for you.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Today, we will share with you something we've recently noticed about Westpac's lending policy and how they calculate clients’ existing home loan repayment. With its special calculation, you may borrow much more than other banks.

Before the introduction of CCCFA at the end of last year, each bank had somewhat distinctive lending policies. Different lenders will have different appetites for different kinds of clients. Therefore, it’s easy to know which lender best fits your needs. However, after the introduction of CCCFA, all lenders are busy complying with regulations. That's why there was a time when all banks had the same lending policies, and you may get the same loan amount from all major banks. As the CCCFA settle down a bit now, we can start to see some uniqueness again.

How does Westpac calculate clients' existing home loans which allows clients to borrow more than other banks? Before we understand that, we need a basic understanding of how a loan approval or assessment works when you apply. Usually, each lender will have a rule of how much money you must have before this loan can be approved. Then, the lender will calculate the difference between your total income and expenses. If the difference in your account is higher than the threshold, your loan can be approved.

Furthermore, how do lenders calculate your existing loan repayment? The loan repayment is part of your expense. But no lender will use your actual loan repayment figure to calculate. Each of them always has its own rules. By tweaking those rules, lenders will have a slightly different strategy or selection criteria for what kind of clients they want. In this case, if you existing home loan with relatively low interest rate, Westpac potentially can lend you much more than other major banks due to their unique way of calculating your existing loan repayment amount.

Let's look at this example and see what the difference are. For example, a family with two adults and two kids. Each parent earns $90k p.a. before tax with a 3% kiwi saver. In addition, they have a credit card with a $2k limit.

Scenario 1:

They are planning to buy their first home with No lending and no property.

In this case, we can see that the two banks can lend almost the same amount. In fact, Westpac's loan amount is slightly higher than ANZ's by about $15,000.

Scenario 2:

They have a family home with $800k home loan. The fixed interest rate is 3.45%. And they are planning to buy an investment property with an expected rental income of $600.

Because of the special calculation of Westpac’s existing loan amount, Westpac can potentially lend $160,000 more than ANZ.

Scenario 3:

They are a couple of experienced property investors who own three investment properties with a $1.5m mortgage. The rental income is $2.2k per week. They are planning to buy their 4th investment property with an expected $600/w rental income.In this case, Westpac can potentially lend $290k more than ANZ because of the larger borrowing home loan amount.

In Summary, if you can take advantage of this particular calculation from Westpac, two things really affect the loan amount. An existing home loan and low existing home loan interest rate (under 4%). The more considerable the existing loan amount you have, the more significant the difference will be.

If you are thinking about how much you can borrow and if Westpac is a suitable lender for you, we’re here to help. Call us at 09 930 8999 for a chat with one of our mortgage advisors. We’ll look at your case, understand your needs and situation then make a tailored solution for you.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)