Check how much you can borrow with our commercial property borrowing calculator

Posted by: Connie in Property Investing

Considering our current residential market, some New Zealand residential investors are interested in dipping their toes into the commercial market. In previous blogs, we discussed the various potential benefits of investing in commercial, such as high returns, fewer ongoing expenses and longer lease periods than residential property. As New Zealand council-issued capital values (CVs) can be confusing for inexperienced commercial property investors, we also discussedthe factors which affect commercial property value.

Interested in buying a commercial property in New Zealand? You can get an idea of how much you can borrow with Prosperity Finance's borrowing power calculator. It's a free tool that you can download and use on your own computer, through Microsoft Excel.

Click here to download the borrowing power calculator.

Check how much you can borrow with commercial property investment calculator nz

Video Timeline

1. Check how much you can borrow with our borrowing calculator -- 01:04

2. What other factors will lenders consider when evaluating commercial property loans? -- 03:07

1. Check how much you can borrow with our borrowing calculator

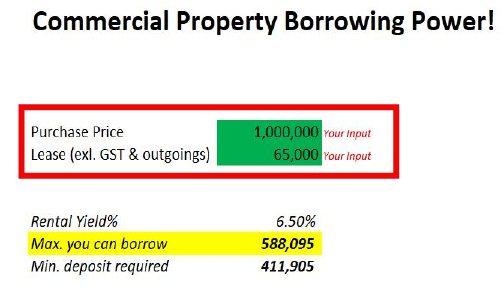

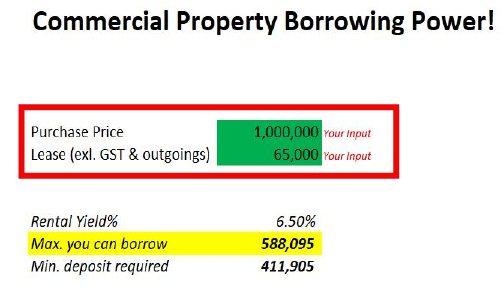

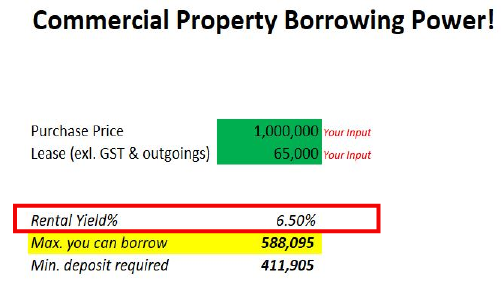

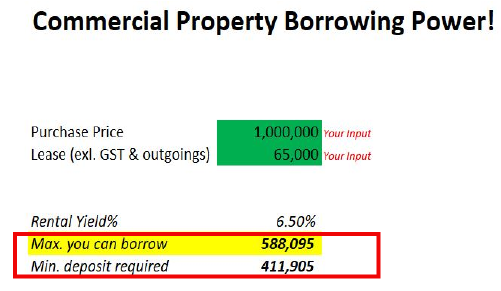

Our commercial property borrowing power calculator is easy to use. Enter the purchase price and yearly lease income, and you’ll get an idea of how much you can borrow.

Please note that, when entering the yearly lease income, you should exclude outgoings and GST. Tenants in New Zealand commercial properties often cover ongoing expenses such as property rates, insurance, water and power bills. You can find the yearly lease amount in your lease agreement.

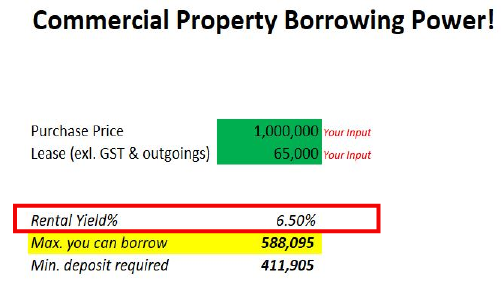

When it comes to investing in property, it’s crucial to consider your rental yield. Calculating the rental return on your commercial properties is something you cannot overlook.

For example, say you purchase a million-dollar commercial property and the estimated yearly lease income is $65,000. By simply inputting these figures into our borrowing power calculator, you will know your rental yield is 6.5%. New Zealand commercial property typically offers higher rental yields than residential property. Rental yields between 6.5% and 8% are fairly typical from commercial property, whereas a rental yield from an Auckland residential property can be less than 4%.

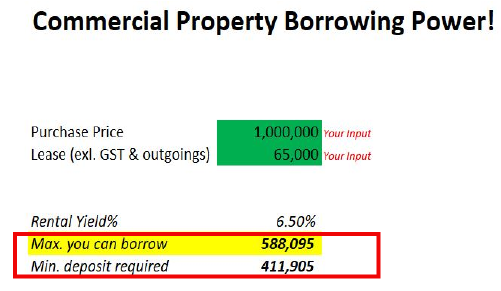

The yellow field in the table above shows you how much you can borrow with a deposit. You can use this figure to help you make a decision around investing in a commercial property. In this case, the maximum amount you can borrow for a million-dollar commercial property is $588,095 and the minimum required deposit is $411,905.

2. What other factors will lenders consider when evaluating commercial property loans?

Compared to home loans, commercial property loans have a unique set of rules and factors that affect how much you can borrow. Our calculator is a simple tool to help you get a rough picture on your borrowing power. However, when your lender evaluates your commercial property loan, they will consider other factors, such as:

• When was the commercial property built?

• What’s the seismic protection index of the commercial property?

• What’s the location?

• Who are the current tenants?

• How many existing tenants are there?

• What’s the yearly rental income?

• What industry are the tenants in? (For example, retail shops or office buildings.)

All in all, the amount you can borrow for a commercial property will be determined on a case-by-case basis. A good commercial loan specialist can determine your borrowing power based on a number of aspects, such as the purchase price, lease income and other factors we mentioned above. So, engage a commercial property loan specialist to ensure that you make the right decision.

Click here to download the borrowing power calculator.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Prosperity Finance - here to help

Prosperity Finance looks at property investment strategically, empowering you to make the best long-term, informed decisions. We are professional mortgage brokers and are here to help. Give us a call today on 09 930 8999.

Other Recommended Blogs:

Is commercial property now a more attractive investment than residential property?

Why capital valuation (CV) of commercial property might be hugely different from real market value?

Considering our current residential market, some New Zealand residential investors are interested in dipping their toes into the commercial market. In previous blogs, we discussed the various potential benefits of investing in commercial, such as high returns, fewer ongoing expenses and longer lease periods than residential property. As New Zealand council-issued capital values (CVs) can be confusing for inexperienced commercial property investors, we also discussedthe factors which affect commercial property value.

Interested in buying a commercial property in New Zealand? You can get an idea of how much you can borrow with Prosperity Finance's borrowing power calculator. It's a free tool that you can download and use on your own computer, through Microsoft Excel.

Click here to download the borrowing power calculator.

Check how much you can borrow with commercial property investment calculator nz

Video Timeline

1. Check how much you can borrow with our borrowing calculator -- 01:04

2. What other factors will lenders consider when evaluating commercial property loans? -- 03:07

1. Check how much you can borrow with our borrowing calculator

Our commercial property borrowing power calculator is easy to use. Enter the purchase price and yearly lease income, and you’ll get an idea of how much you can borrow.

Please note that, when entering the yearly lease income, you should exclude outgoings and GST. Tenants in New Zealand commercial properties often cover ongoing expenses such as property rates, insurance, water and power bills. You can find the yearly lease amount in your lease agreement.

When it comes to investing in property, it’s crucial to consider your rental yield. Calculating the rental return on your commercial properties is something you cannot overlook.

For example, say you purchase a million-dollar commercial property and the estimated yearly lease income is $65,000. By simply inputting these figures into our borrowing power calculator, you will know your rental yield is 6.5%. New Zealand commercial property typically offers higher rental yields than residential property. Rental yields between 6.5% and 8% are fairly typical from commercial property, whereas a rental yield from an Auckland residential property can be less than 4%.

The yellow field in the table above shows you how much you can borrow with a deposit. You can use this figure to help you make a decision around investing in a commercial property. In this case, the maximum amount you can borrow for a million-dollar commercial property is $588,095 and the minimum required deposit is $411,905.

2. What other factors will lenders consider when evaluating commercial property loans?

Compared to home loans, commercial property loans have a unique set of rules and factors that affect how much you can borrow. Our calculator is a simple tool to help you get a rough picture on your borrowing power. However, when your lender evaluates your commercial property loan, they will consider other factors, such as:

• When was the commercial property built?

• What’s the seismic protection index of the commercial property?

• What’s the location?

• Who are the current tenants?

• How many existing tenants are there?

• What’s the yearly rental income?

• What industry are the tenants in? (For example, retail shops or office buildings.)

All in all, the amount you can borrow for a commercial property will be determined on a case-by-case basis. A good commercial loan specialist can determine your borrowing power based on a number of aspects, such as the purchase price, lease income and other factors we mentioned above. So, engage a commercial property loan specialist to ensure that you make the right decision.

Click here to download the borrowing power calculator.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Prosperity Finance - here to help

Prosperity Finance looks at property investment strategically, empowering you to make the best long-term, informed decisions. We are professional mortgage brokers and are here to help. Give us a call today on 09 930 8999.

Other Recommended Blogs:

Is commercial property now a more attractive investment than residential property?

Why capital valuation (CV) of commercial property might be hugely different from real market value?

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)