Evaluate your property development project by conducting a simple financial feasibility analysis

Posted by: Connie in Property Investing

We all know when applying for a residential loan, it is straightforward for banks or other lending companies to evaluate loan applications mainly depending on the applicant’s deposit and income. However, it is an entirely different scenario when applying for a property development loan. Property development finance depends mainly on projections and feasibility.

The Importance of Understanding Feasibility

Why is understanding feasibility such important? Because ultimately, the feasibility comes down to the profit. As a property developer, you should conduct a feasibility analysis by yourself or some other experts during the due diligence stage before purchasing any development site. On the other hand, the financial lenders will also consider the project feasibility as significant metric in measuring risks and returns. Therefore, understanding feasibility will give both property developers and lenders confidence to make decisions and determine whether the development project will be a financial success or not.

In today’s video, we are going to share a generic example of feasibility analysis excel table with a simple case study background, explain the meaning of different ratios in the feasibility analysis table and other factors that impact on the approval outcome.

1. Why feasibility is important to the property development? - 01:30

2. Feasibility analysis table explanation - 03:24

3. Other factors that impact on develop project approval outcome - 14:39

Background

The client has purchased a land recently for 1.5 million for future development. The plan is to demolish the original property and build 6 new houses.

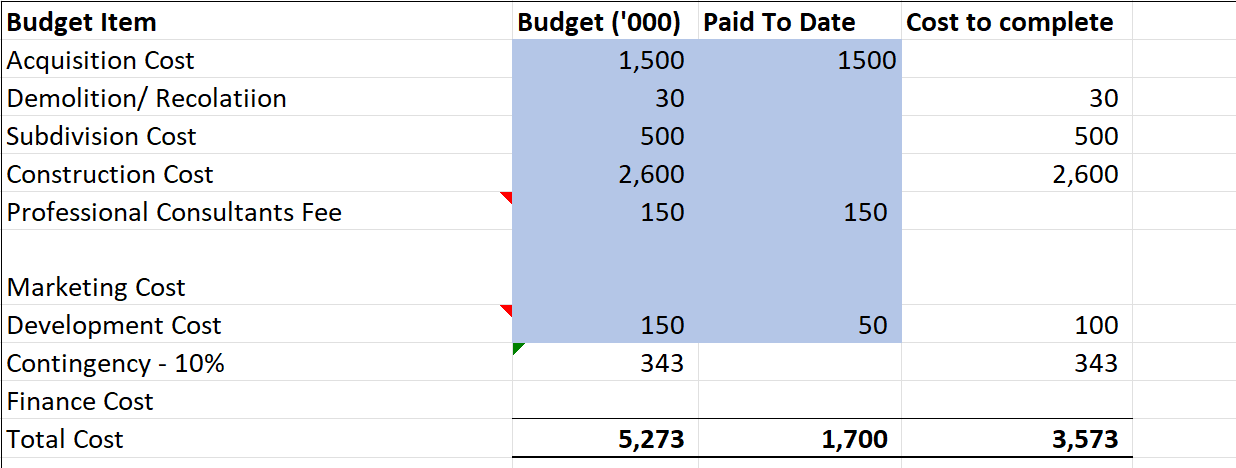

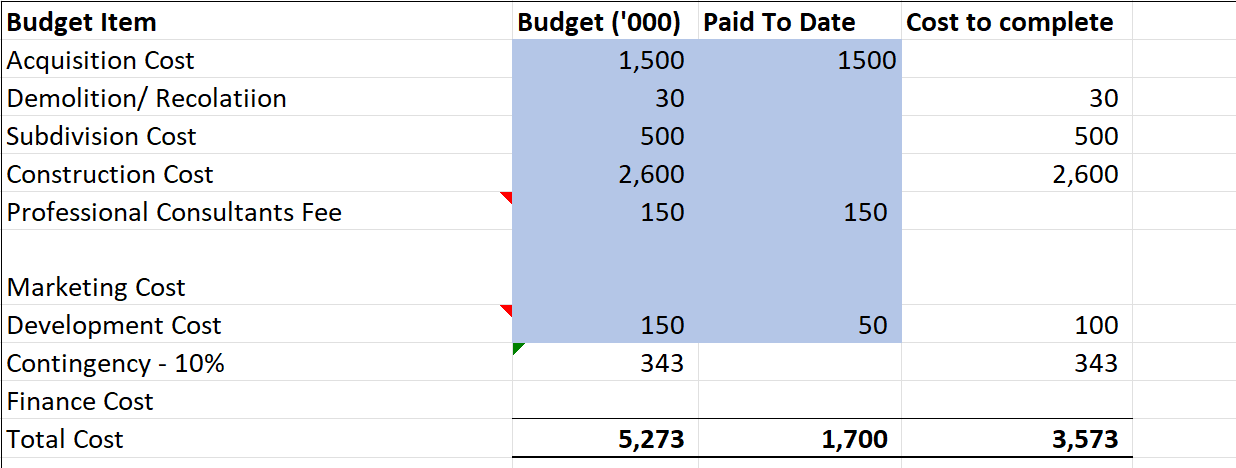

Figure 1: Feasibility Analysis Table

Feasibility Analysis Calculation

There are four metrics catalogues in the feasibility analysis, which are Budget Item, Budget, Paid to Date and Cost to complete.

We will look at the metric from the first Budget Item catalogues. The first metric we are going to look at is Acquisition Cost. Acquisition cost means land cost, which indicates how much buyers can acquire the land. Under most circumstances, lenders will use the current market value as an evaluation standard to determine acquisition cost. In this case, because the buyer has recently purchased the land, the market value equals the purchase price. If developers bought the land a few years ago, the buyer needs to re-evaluate the current land market value. The second metric is Demolition Cost. In this case, demolition of the original house will cost $30,000. The third metric is subdivision cost which is the civil work cost. The developer will need to get six new subdivided property titles. The following metric is Construction Cost, covering the construction process right up from the foundation stage to getting CCC. The next metric is the Professional fees, meaning the cost for paying professionals such as architects, engineers, project managers, geo-tech professionals, quantity surveyors and valuers. Marketing cost means advertising on a different platform, photo or video shooting when selling the properties. Development cost is the cost you pay to the council for development contribution, building consent and resource consent fees. Before adding up all the costs, there is a minimum 10-15% contingency cost. The contingency cost is the additional cost that is not included in the budget. It’s an unforeseen cost. In this feasibility analysis, we are using 10% as an example. By adding up all the costs above, the total cost for this project is 5.2 million.

Moving on to the following Paid to Date metric column. Because the land has been fully paid, the land Paid to Date cost equals the Acquisition Cost, which is 1.5 million. The client has not incurred any subdivide cost yet as they have just submitted the resource consent. However, there is also paid to date cost for professionals and development expenses. Altogether, the client has paid 1.7m.

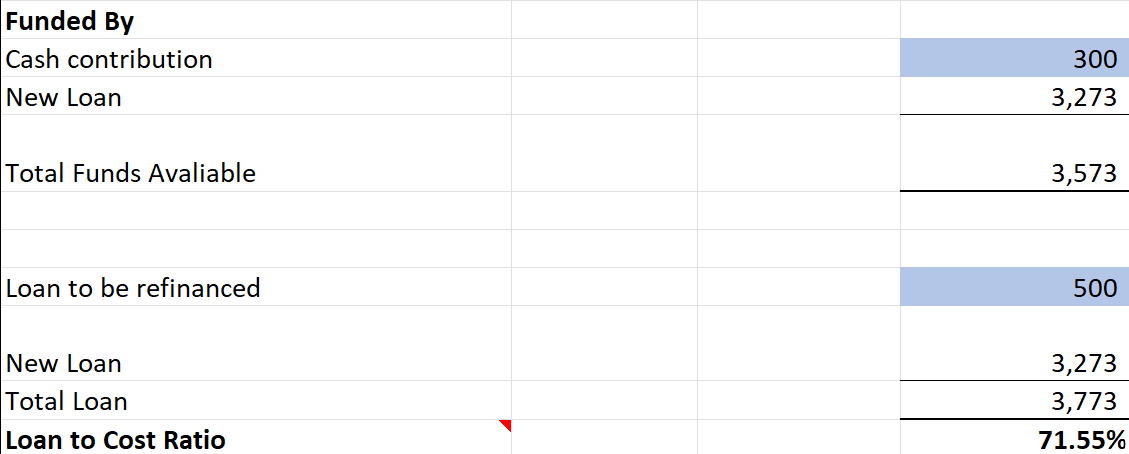

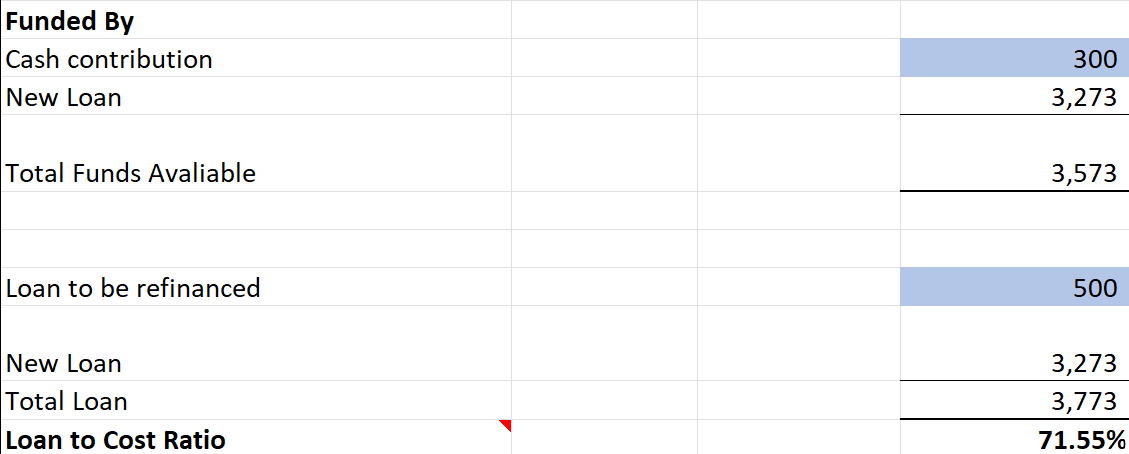

The last Cost to Complete metrics column is the difference between Budget and Paid to Date. It means how much need to be paid to complete the project. From the feasibility analysis table, we can see an additional 3.5 million needs to be paid to complete the development project. However, the client has contributed 300k as a cash contribution; therefore, there is a new loan of 3.273 million. The total cost to complete the figure must be equal to the combination of cash contribution and new loan cost.

Before calculating the final total cost, we need to pay attention to the existing loan attached to the property itself. The feasibility calculation table shows that the property carries a 500k loan. This 500k need to be refinanced to the same lender who provided the construction loan. Therefore, the lender needs to fund to developer a total of 3.7m which is 3.2m plus 500k. We must be aware that we have not taken the finance cost into account as there is a significant variation in the finance cost. The finance cost variation can be mainly caused by different project completion times and lender types (banks or financial companies). The total cost must be more than 3.7m.

Lastly, we need to calculate the Loan to Cost Ratio. The Loan to Cost Ratio evaluates your commitment level. The lenders want you to have skin in the game. Banks will consider this ratio, and they require the ratio need to be less than 75%, which means you have to contribute at least 25%. However, most finance companies do not consider the loan to cost ratio. From the feasibility analysis table, we can see that the Loan to Cost Ratio is 71.55% (Total Loan – 3.7m / Total Cost – 5.2m) without considering the finance cost.

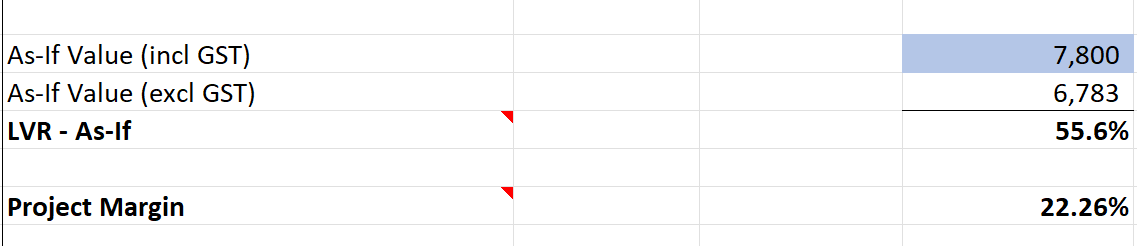

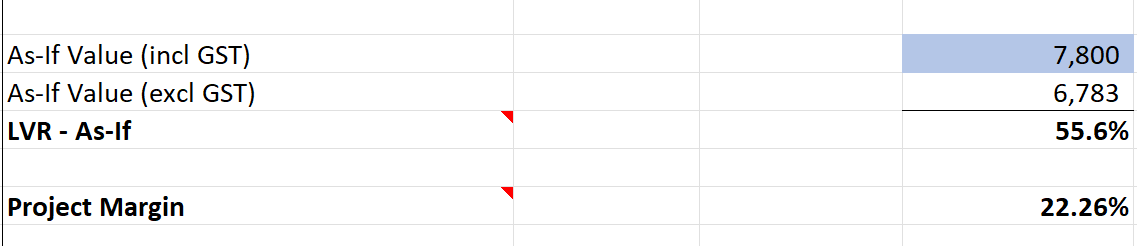

Overall, the finish value for this six properties development project in today’s market is 7.8m (incl GST) as we assume each property can be sold for 1.3m. The lender will only consider this figure without GST, approximately 6.7m (excl GST). The launch of Value Ratio (LVR) in this scenario is 55.6% (total loan / As-If value-excl GST). If you have intention to sell, the lender will only use excluding GST value as GST is paid to IRD, not security value. Banks and other financial companies companies will consider this LVR ratio the critical ratio to indicate the project development risks. Generally speaking, the banks and financial companies will only consider development project LVR under 60%. From the feasibility analysis table, we can see the LVR is 55.6% without considering the finical cost, which is feasible. The last metrics both lenders and property developers need to pay attention to are Project Margin. In this case, the project margin is 22% (value minus cost/value). Bank will not accept the application if the project margin ratio is less than 20%. Same as developers, considering to the unforeseen circumstances such as lockdown, police or any unpredictable issues, most developers will not start developing straight away if the project margin ratio is less than 20%.

Recap

As a developer, you need to know the total cost, including Land Acquisition cost, Demolition / Relocation cost, Subdivision cost, Construction cost, Professional Consultants cost, Marketing cost, Development cost and Contingency. The actual total loan from either bank or financial companies is equal to the real cost minus paid to date minus cash contribution. Any additional loan that needs to be refinanced will also add to the total loan.

After figuring out the total loan is, both developers and lenders will need to pay attention to three different critical ratios. The first ratio is the Loan to Cost Ratio, which requires less than 75%. The second ratio is the LVR-As-If ratio, which needs less than 60%. Both these two ratios need to consider the financial cost. The third ratio is the Project Margin ratio; it needs more than 20%.

Other Factors That Impact on Develop Project Approval Outcome

Appetite

The principle of Appetite applies to both banks and financial companies; it means the lender will also consider other causal factors or risks that may have a negative impact on project development. The development approval outcome will not guarantee success even though the project has passed all the critical feasibility ratios. Significantly, limited funds are available under the current New Zealand property development market, which means more people are seeking for finance than the funds available for lending. The lenders will cherry-picking the best projects according to their appetite.

The lenders will consider three different aspects to evaluate the risk. First, it is Sponsor Risks which means the lenders will evaluate borrower’s background, experience and financial position. It is important for developer to have some certain project development experience in the past with a good tracking record. The financial position outlines the borrowers’ capacity to cover uncertainty overrun, which may occur under some unexpected circumstances.

Second is the project risks regarding different location, land size, building types, contract types, project team experience, track records and other risks such as powerline or soil contamination. In terms of location, without a doubt, A better and more prominent area will bring a better investment return. If the site is too far away, the market is hard to predict, and it is hard for lenders to visit or do a property inspection. The lender will also consider the property types: e.g. commercial or apartment, terrace houses, single houses or mixed. The contract types are either fix price or non-fix price contract. Banks prefer fix price than non-fix price contract. On the other hand, non-bank lenders are far more flexible on price contract. The project team experience and track records need to be specifically relevant.

Lastly, it is the market risk & concentration risk. The lenders will evaluate the current property market cycle to analyze the risks. The concentration risk has nothing wrong with the developer’s project; the lender will not be interested fund your project if they have lent too many projects in the same area.

In conclusion, feasibility analysis ratios, metrics, appetite are equally important aspects for developers to evaluate before purchasing any development project. Our professional Prosperity Finance advisers will help you go through all the details step by step. Our goal is to ensure all the investors and developers get maximum profit out of their development project and avoid potential financial risks.

Read More:

What you need to be aware of before applying for a construction loan

The four challenges in property development

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

We all know when applying for a residential loan, it is straightforward for banks or other lending companies to evaluate loan applications mainly depending on the applicant’s deposit and income. However, it is an entirely different scenario when applying for a property development loan. Property development finance depends mainly on projections and feasibility.

The Importance of Understanding Feasibility

Why is understanding feasibility such important? Because ultimately, the feasibility comes down to the profit. As a property developer, you should conduct a feasibility analysis by yourself or some other experts during the due diligence stage before purchasing any development site. On the other hand, the financial lenders will also consider the project feasibility as significant metric in measuring risks and returns. Therefore, understanding feasibility will give both property developers and lenders confidence to make decisions and determine whether the development project will be a financial success or not.

In today’s video, we are going to share a generic example of feasibility analysis excel table with a simple case study background, explain the meaning of different ratios in the feasibility analysis table and other factors that impact on the approval outcome.

1. Why feasibility is important to the property development? - 01:30

2. Feasibility analysis table explanation - 03:24

3. Other factors that impact on develop project approval outcome - 14:39

Background

The client has purchased a land recently for 1.5 million for future development. The plan is to demolish the original property and build 6 new houses.

Figure 1: Feasibility Analysis Table

Feasibility Analysis Calculation

There are four metrics catalogues in the feasibility analysis, which are Budget Item, Budget, Paid to Date and Cost to complete.

We will look at the metric from the first Budget Item catalogues. The first metric we are going to look at is Acquisition Cost. Acquisition cost means land cost, which indicates how much buyers can acquire the land. Under most circumstances, lenders will use the current market value as an evaluation standard to determine acquisition cost. In this case, because the buyer has recently purchased the land, the market value equals the purchase price. If developers bought the land a few years ago, the buyer needs to re-evaluate the current land market value. The second metric is Demolition Cost. In this case, demolition of the original house will cost $30,000. The third metric is subdivision cost which is the civil work cost. The developer will need to get six new subdivided property titles. The following metric is Construction Cost, covering the construction process right up from the foundation stage to getting CCC. The next metric is the Professional fees, meaning the cost for paying professionals such as architects, engineers, project managers, geo-tech professionals, quantity surveyors and valuers. Marketing cost means advertising on a different platform, photo or video shooting when selling the properties. Development cost is the cost you pay to the council for development contribution, building consent and resource consent fees. Before adding up all the costs, there is a minimum 10-15% contingency cost. The contingency cost is the additional cost that is not included in the budget. It’s an unforeseen cost. In this feasibility analysis, we are using 10% as an example. By adding up all the costs above, the total cost for this project is 5.2 million.

Moving on to the following Paid to Date metric column. Because the land has been fully paid, the land Paid to Date cost equals the Acquisition Cost, which is 1.5 million. The client has not incurred any subdivide cost yet as they have just submitted the resource consent. However, there is also paid to date cost for professionals and development expenses. Altogether, the client has paid 1.7m.

The last Cost to Complete metrics column is the difference between Budget and Paid to Date. It means how much need to be paid to complete the project. From the feasibility analysis table, we can see an additional 3.5 million needs to be paid to complete the development project. However, the client has contributed 300k as a cash contribution; therefore, there is a new loan of 3.273 million. The total cost to complete the figure must be equal to the combination of cash contribution and new loan cost.

Before calculating the final total cost, we need to pay attention to the existing loan attached to the property itself. The feasibility calculation table shows that the property carries a 500k loan. This 500k need to be refinanced to the same lender who provided the construction loan. Therefore, the lender needs to fund to developer a total of 3.7m which is 3.2m plus 500k. We must be aware that we have not taken the finance cost into account as there is a significant variation in the finance cost. The finance cost variation can be mainly caused by different project completion times and lender types (banks or financial companies). The total cost must be more than 3.7m.

Lastly, we need to calculate the Loan to Cost Ratio. The Loan to Cost Ratio evaluates your commitment level. The lenders want you to have skin in the game. Banks will consider this ratio, and they require the ratio need to be less than 75%, which means you have to contribute at least 25%. However, most finance companies do not consider the loan to cost ratio. From the feasibility analysis table, we can see that the Loan to Cost Ratio is 71.55% (Total Loan – 3.7m / Total Cost – 5.2m) without considering the finance cost.

Overall, the finish value for this six properties development project in today’s market is 7.8m (incl GST) as we assume each property can be sold for 1.3m. The lender will only consider this figure without GST, approximately 6.7m (excl GST). The launch of Value Ratio (LVR) in this scenario is 55.6% (total loan / As-If value-excl GST). If you have intention to sell, the lender will only use excluding GST value as GST is paid to IRD, not security value. Banks and other financial companies companies will consider this LVR ratio the critical ratio to indicate the project development risks. Generally speaking, the banks and financial companies will only consider development project LVR under 60%. From the feasibility analysis table, we can see the LVR is 55.6% without considering the finical cost, which is feasible. The last metrics both lenders and property developers need to pay attention to are Project Margin. In this case, the project margin is 22% (value minus cost/value). Bank will not accept the application if the project margin ratio is less than 20%. Same as developers, considering to the unforeseen circumstances such as lockdown, police or any unpredictable issues, most developers will not start developing straight away if the project margin ratio is less than 20%.

Recap

As a developer, you need to know the total cost, including Land Acquisition cost, Demolition / Relocation cost, Subdivision cost, Construction cost, Professional Consultants cost, Marketing cost, Development cost and Contingency. The actual total loan from either bank or financial companies is equal to the real cost minus paid to date minus cash contribution. Any additional loan that needs to be refinanced will also add to the total loan.

After figuring out the total loan is, both developers and lenders will need to pay attention to three different critical ratios. The first ratio is the Loan to Cost Ratio, which requires less than 75%. The second ratio is the LVR-As-If ratio, which needs less than 60%. Both these two ratios need to consider the financial cost. The third ratio is the Project Margin ratio; it needs more than 20%.

Other Factors That Impact on Develop Project Approval Outcome

Appetite

The principle of Appetite applies to both banks and financial companies; it means the lender will also consider other causal factors or risks that may have a negative impact on project development. The development approval outcome will not guarantee success even though the project has passed all the critical feasibility ratios. Significantly, limited funds are available under the current New Zealand property development market, which means more people are seeking for finance than the funds available for lending. The lenders will cherry-picking the best projects according to their appetite.

The lenders will consider three different aspects to evaluate the risk. First, it is Sponsor Risks which means the lenders will evaluate borrower’s background, experience and financial position. It is important for developer to have some certain project development experience in the past with a good tracking record. The financial position outlines the borrowers’ capacity to cover uncertainty overrun, which may occur under some unexpected circumstances.

Second is the project risks regarding different location, land size, building types, contract types, project team experience, track records and other risks such as powerline or soil contamination. In terms of location, without a doubt, A better and more prominent area will bring a better investment return. If the site is too far away, the market is hard to predict, and it is hard for lenders to visit or do a property inspection. The lender will also consider the property types: e.g. commercial or apartment, terrace houses, single houses or mixed. The contract types are either fix price or non-fix price contract. Banks prefer fix price than non-fix price contract. On the other hand, non-bank lenders are far more flexible on price contract. The project team experience and track records need to be specifically relevant.

Lastly, it is the market risk & concentration risk. The lenders will evaluate the current property market cycle to analyze the risks. The concentration risk has nothing wrong with the developer’s project; the lender will not be interested fund your project if they have lent too many projects in the same area.

In conclusion, feasibility analysis ratios, metrics, appetite are equally important aspects for developers to evaluate before purchasing any development project. Our professional Prosperity Finance advisers will help you go through all the details step by step. Our goal is to ensure all the investors and developers get maximum profit out of their development project and avoid potential financial risks.

Read More:

What you need to be aware of before applying for a construction loan

The four challenges in property development

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)