How much more mortgage can I afford? (Tips to quickly increase your borrowing power by 800k)

Posted by: Connie in Property Investing

Clients of ours, Mike and Mary, are a couple with two children with a combined income of $180k. Currently, they own a home and two investment properties with a total remaining loan balance of $1.7 million.

They wanted to apply for a new loan of $400k to purchase another investment property. Before they found us, they tried to apply for an ANZ loan but, unfortunately, they got declined.

When it comes to how much you can borrow for an investment property, there is never a single, nor a simple answer. You might think that you can’t borrow more money to purchase more rental properties because you’ve been told by some major New Zealand banks that you have already reached your borrowing limit. But you do still have options. That’s why, in this week’s blog, we discuss how to maximize your borrowing power on rental properties, even if you’ve been told that you can’t borrow more.

How much more mortgage can I afford? (Tips to quickly increase your borrowing power by 800k)

Video Timeline:

1. Why do some investors have 10 rental properties but I don’t have enough borrowing capacity to buy more myself? -- 00:14

2. How do you calculate your borrowing power? Three main factors that banks consider differently -- 01:58

3. Compared to New Zealand’s major banks, what are the other advantages that Bank of China and Select have, except maximising your borrowing capacity? -- 06:56

1. Why do some investors have 10 rental properties but I don’t have enough borrowing capacity to buy more myself?

Our clients often ask us why some New Zealand investors have many rental properties in their portfolio, but they can only buy a few properties due to their limited borrowing capacity.

Here are the reasons. New Zealand bank policies have become a lot more conservative recently, which means you might now have the borrowing power of less than two million, compared with the ability to borrow up to five or six million seven years ago. What’s more, the average New Zealand housing price is much higher than before. Seven years ago, the Auckland median house price was $500k, however it has climbed to around $900k now. Taking advantage of their abundant borrowing power and comparatively low house prices several years ago, investors could have owned ten or eleven rental properties, whereas they might only be able to afford two or three now.

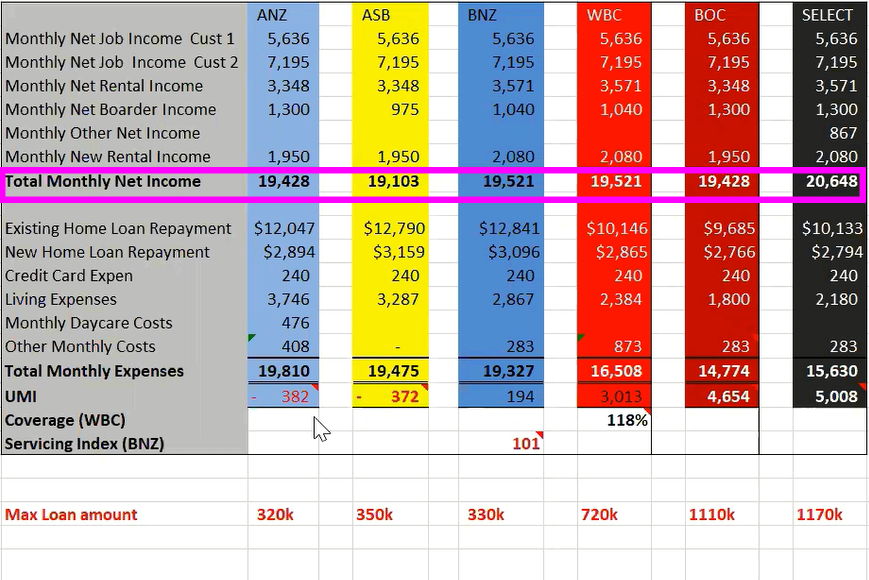

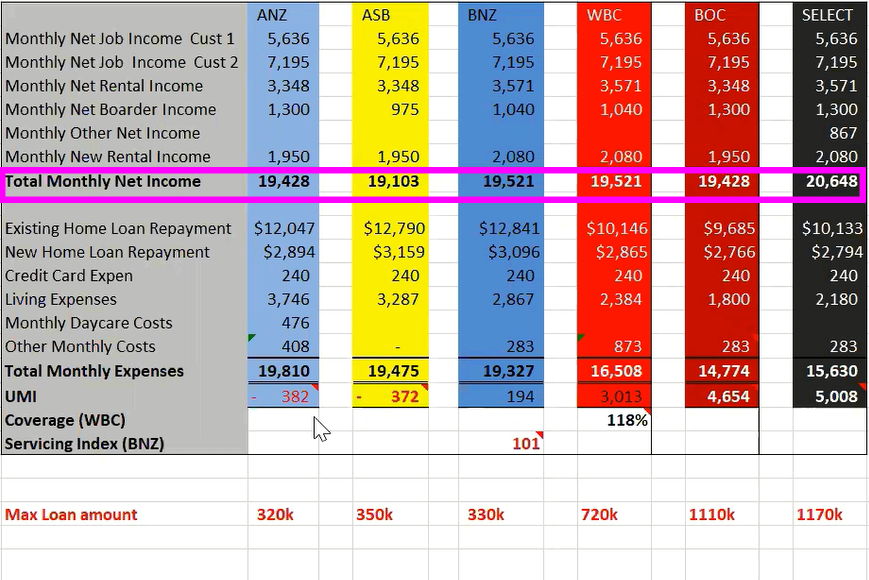

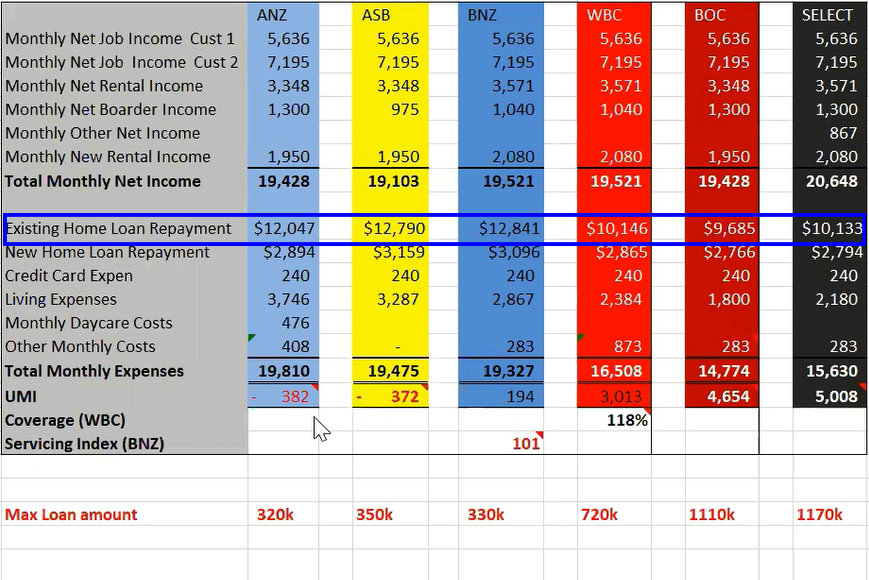

In today’s case that we mentioned earlier, we calculated our clients borrowing capacity with our loan calculator. Let’s take a close look on how much they could borrow from different New Zealand banks.

It came as no surprise to us that Mike and Mary’s application was declined by ANZ. If we submitted a loan application from ANZ on behalf of our clients, they could borrow up to $320k. In comparison, they could borrow $350k from ASB, $330k from BNZ, and $720k from Westpac. With the exception of Westpac, there was little difference in the loan amount they could borrow from four of New Zealand’s major banks.

However, if we apply for a loan from Bank of China (BOC) or Select, they could borrow up to $1.17 million - almost four times the amount of New Zealand’s major banks. This number was far beyond our clients’ expectations. It would allow them to purchase their dream house and even have another one or two investment properties.

You might not be familiar with Bank of China (BOC) or Select. BOC is an industrial and commercial bank. They have been open for lending in the New Zealand market for five years. Select is a product from a New Zealand non-bank lender. It’s a newly released loan product where only a few brokers can get access.

2. How do you calculate your borrowing power? Three main factors that banks consider differently

When banks calculate your borrowing capacity, they take many factors into consideration. They include your monthly net income, your existing home loan repayment, your living expenses and other factors. Due to different policies, each New Zealand bank uses a different borrowing capacity formula to evaluate these factors. That’s the reason why there might be a big difference among each bank when calculating how much money you can borrow.

Total monthly net income

As you can see from the table below, when banks evaluate a client’s total monthly net income, there are only a few differences amongst the four New Zealand major banks, ANZ, ASB, BNZ and Westpac. Some of them take 75% of a client’s rental property income into consideration whilst the others take 80%.

You will find the total monthly net income calculated by Select is $10,000, which is higher than the average. This is because only Select takes bonuses into account when evaluating monthly net income.

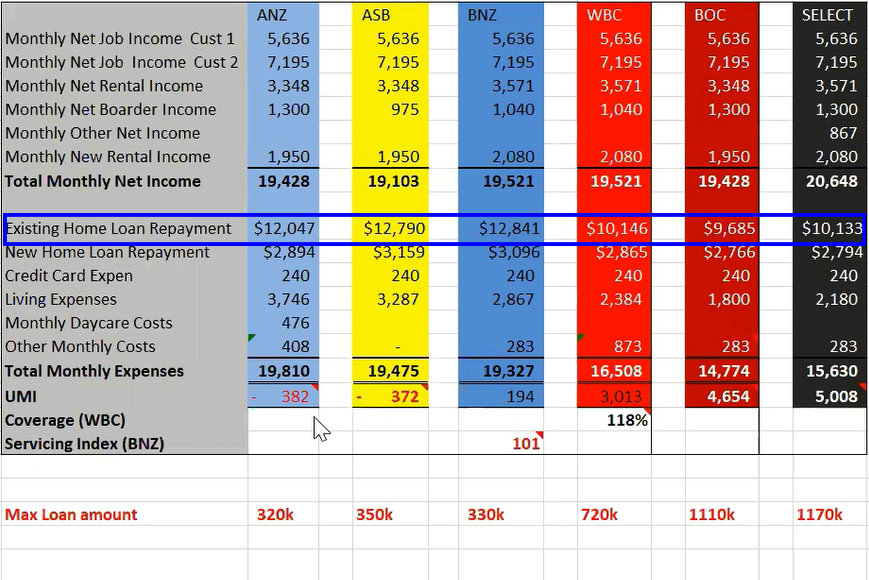

Existing home loan repayment

Currently, Mike and Mary repay their loan at $7k per month on an interest-only basis. However, based on the bank’s evaluation formula, ANZ, ASB and BNZ calculate around $12k on their existing home loan repayment, whereas Westpac and BOC calculate $10k and $9k respectively. You might wonder how banks assess your existing home loan repayment and how it affects your borrowing capacity.

You may assume that your bank will use your current interest rate and your loan repayment type -either principle and interest, or interest only - to calculate how much you can borrow. However, it’s not the case.

Rather, New Zealand banks use an assessed rate that is higher than your current rate to evaluate your existing home loan repayment. Some major New Zealand banks, ANZ, ASB and BNZ, use around 8%, which is much higher than the current mortgage rate of around 4% or 5%. Westpac and BOC might use an investor-friendly rate, which is usually lower than other major banks, but still higher than the current rate. This higher rate accounts for the possibility of future interest rate increases.

On the other hand, when it comes to buying a house, an interest-only loan can be an attractive option. This is a way to reduce mortgage payments and works well for investors, especially when their home loan hasn’t been paid off yet. Banks use your remaining loan amount, loan length and assessed interest rate to evaluate your existing home loan repayment. They assume that you repay your loan based on a principal and interest repayment type. That’s the reason why the home loan repayment amount calculated by the banks is much higher than a client’s current one.

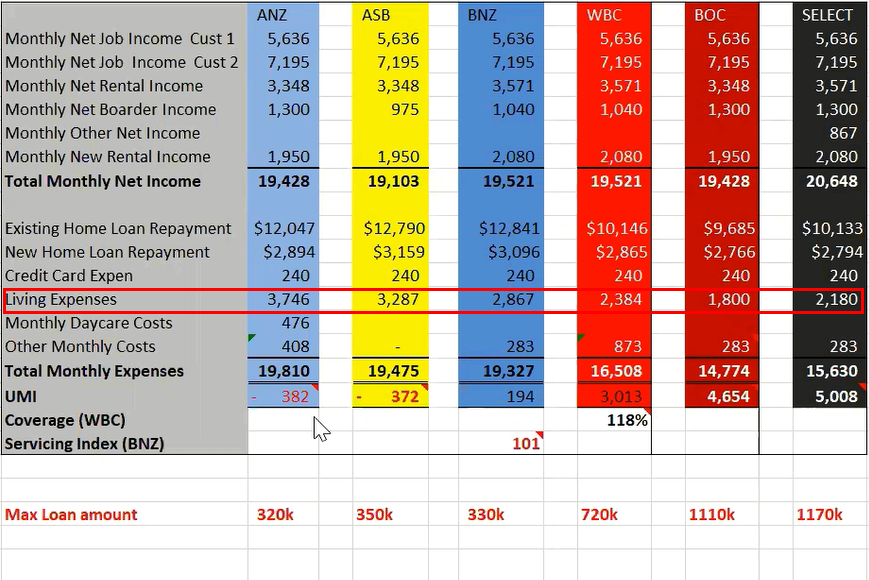

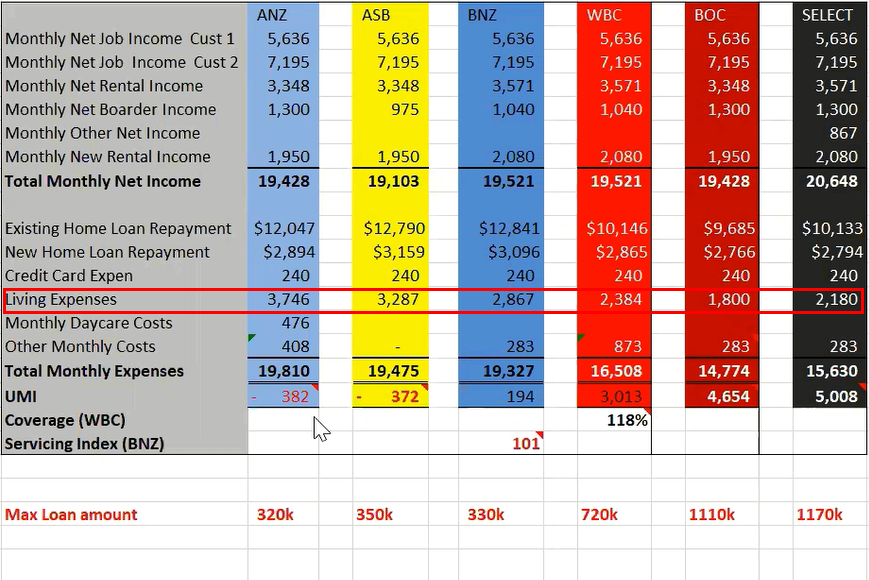

Living expenses

When banks evaluate how much you can borrow, they will take a look at your living expenses.

In our case study, the living expenses calculated by ANZ, ASB and BNZ is higher than BOC and Select. ANZ works out that the clients’ living expenses are $3.7k, whereas BOC calculates $1.8k.

Here’s the reason. BOC and Select only take your family structure into account – such as how many dependents you have - when evaluating your living expenses. Alternatively, New Zealand major banks assume that the higher your monthly income, the higher your living expenses will be.

3. Compared to New Zealand’s major banks, what are the other advantages that Bank of China and Select have, except maximising your borrowing capacity?

Bank of China (BOC)

- BOC used to focus on lending money to people who have overseas income. They changed their lending strategy to help those who have New Zealand income.

- The fixed-term mortgage rate that BOC can offer is often lower than what New Zealand major banks can offer.

So, if you can’t get your loan application approved from any of New Zealand’s major banks, you might need to consider BOC as your potential lender.

Select

Select is not a bank. It’s a new loan product offered by a New Zealand non-bank.

Select offers higher mortgage rates, around 4.8% to 5% now, than major New Zealand banks.

However, in some instances, you might need to consider Select:

- If you’ve got a bad credit history, you might find it difficult to get your loan application approved from a New Zealand major bank. In BOC, a bad credit history is not necessarily a barrier to your loan application being approved.

- BOC can take bonuses and other job benefits into account when they work out how much you can borrow. This would help you increase your borrowing capacity. However, many New Zealand major banks don’t include this.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Prosperity Finance – here to help

Prosperity Finance looks at property investment strategically, empowering you to make the best long-term, informed decisions. We are professional mortgage brokers and are here to help. Give us a call today on 09 930 8999.

Other Blogs You Might Like:

Why should you consider refinancing your mortgage?

All you need to know about New Zealand’s ring-fencing of residential rental losses bill

What should you do when your interest-only mortgage ends within the next two years?

Clients of ours, Mike and Mary, are a couple with two children with a combined income of $180k. Currently, they own a home and two investment properties with a total remaining loan balance of $1.7 million.

They wanted to apply for a new loan of $400k to purchase another investment property. Before they found us, they tried to apply for an ANZ loan but, unfortunately, they got declined.

When it comes to how much you can borrow for an investment property, there is never a single, nor a simple answer. You might think that you can’t borrow more money to purchase more rental properties because you’ve been told by some major New Zealand banks that you have already reached your borrowing limit. But you do still have options. That’s why, in this week’s blog, we discuss how to maximize your borrowing power on rental properties, even if you’ve been told that you can’t borrow more.

How much more mortgage can I afford? (Tips to quickly increase your borrowing power by 800k)

Video Timeline:

1. Why do some investors have 10 rental properties but I don’t have enough borrowing capacity to buy more myself? -- 00:14

2. How do you calculate your borrowing power? Three main factors that banks consider differently -- 01:58

3. Compared to New Zealand’s major banks, what are the other advantages that Bank of China and Select have, except maximising your borrowing capacity? -- 06:56

1. Why do some investors have 10 rental properties but I don’t have enough borrowing capacity to buy more myself?

Our clients often ask us why some New Zealand investors have many rental properties in their portfolio, but they can only buy a few properties due to their limited borrowing capacity.

Here are the reasons. New Zealand bank policies have become a lot more conservative recently, which means you might now have the borrowing power of less than two million, compared with the ability to borrow up to five or six million seven years ago. What’s more, the average New Zealand housing price is much higher than before. Seven years ago, the Auckland median house price was $500k, however it has climbed to around $900k now. Taking advantage of their abundant borrowing power and comparatively low house prices several years ago, investors could have owned ten or eleven rental properties, whereas they might only be able to afford two or three now.

In today’s case that we mentioned earlier, we calculated our clients borrowing capacity with our loan calculator. Let’s take a close look on how much they could borrow from different New Zealand banks.

It came as no surprise to us that Mike and Mary’s application was declined by ANZ. If we submitted a loan application from ANZ on behalf of our clients, they could borrow up to $320k. In comparison, they could borrow $350k from ASB, $330k from BNZ, and $720k from Westpac. With the exception of Westpac, there was little difference in the loan amount they could borrow from four of New Zealand’s major banks.

However, if we apply for a loan from Bank of China (BOC) or Select, they could borrow up to $1.17 million - almost four times the amount of New Zealand’s major banks. This number was far beyond our clients’ expectations. It would allow them to purchase their dream house and even have another one or two investment properties.

You might not be familiar with Bank of China (BOC) or Select. BOC is an industrial and commercial bank. They have been open for lending in the New Zealand market for five years. Select is a product from a New Zealand non-bank lender. It’s a newly released loan product where only a few brokers can get access.

2. How do you calculate your borrowing power? Three main factors that banks consider differently

When banks calculate your borrowing capacity, they take many factors into consideration. They include your monthly net income, your existing home loan repayment, your living expenses and other factors. Due to different policies, each New Zealand bank uses a different borrowing capacity formula to evaluate these factors. That’s the reason why there might be a big difference among each bank when calculating how much money you can borrow.

Total monthly net income

As you can see from the table below, when banks evaluate a client’s total monthly net income, there are only a few differences amongst the four New Zealand major banks, ANZ, ASB, BNZ and Westpac. Some of them take 75% of a client’s rental property income into consideration whilst the others take 80%.

You will find the total monthly net income calculated by Select is $10,000, which is higher than the average. This is because only Select takes bonuses into account when evaluating monthly net income.

Existing home loan repayment

Currently, Mike and Mary repay their loan at $7k per month on an interest-only basis. However, based on the bank’s evaluation formula, ANZ, ASB and BNZ calculate around $12k on their existing home loan repayment, whereas Westpac and BOC calculate $10k and $9k respectively. You might wonder how banks assess your existing home loan repayment and how it affects your borrowing capacity.

You may assume that your bank will use your current interest rate and your loan repayment type -either principle and interest, or interest only - to calculate how much you can borrow. However, it’s not the case.

Rather, New Zealand banks use an assessed rate that is higher than your current rate to evaluate your existing home loan repayment. Some major New Zealand banks, ANZ, ASB and BNZ, use around 8%, which is much higher than the current mortgage rate of around 4% or 5%. Westpac and BOC might use an investor-friendly rate, which is usually lower than other major banks, but still higher than the current rate. This higher rate accounts for the possibility of future interest rate increases.

On the other hand, when it comes to buying a house, an interest-only loan can be an attractive option. This is a way to reduce mortgage payments and works well for investors, especially when their home loan hasn’t been paid off yet. Banks use your remaining loan amount, loan length and assessed interest rate to evaluate your existing home loan repayment. They assume that you repay your loan based on a principal and interest repayment type. That’s the reason why the home loan repayment amount calculated by the banks is much higher than a client’s current one.

Living expenses

When banks evaluate how much you can borrow, they will take a look at your living expenses.

In our case study, the living expenses calculated by ANZ, ASB and BNZ is higher than BOC and Select. ANZ works out that the clients’ living expenses are $3.7k, whereas BOC calculates $1.8k.

Here’s the reason. BOC and Select only take your family structure into account – such as how many dependents you have - when evaluating your living expenses. Alternatively, New Zealand major banks assume that the higher your monthly income, the higher your living expenses will be.

3. Compared to New Zealand’s major banks, what are the other advantages that Bank of China and Select have, except maximising your borrowing capacity?

Bank of China (BOC)

- BOC used to focus on lending money to people who have overseas income. They changed their lending strategy to help those who have New Zealand income.

- The fixed-term mortgage rate that BOC can offer is often lower than what New Zealand major banks can offer.

So, if you can’t get your loan application approved from any of New Zealand’s major banks, you might need to consider BOC as your potential lender.

Select

Select is not a bank. It’s a new loan product offered by a New Zealand non-bank.

Select offers higher mortgage rates, around 4.8% to 5% now, than major New Zealand banks.

However, in some instances, you might need to consider Select:

- If you’ve got a bad credit history, you might find it difficult to get your loan application approved from a New Zealand major bank. In BOC, a bad credit history is not necessarily a barrier to your loan application being approved.

- BOC can take bonuses and other job benefits into account when they work out how much you can borrow. This would help you increase your borrowing capacity. However, many New Zealand major banks don’t include this.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Prosperity Finance – here to help

Prosperity Finance looks at property investment strategically, empowering you to make the best long-term, informed decisions. We are professional mortgage brokers and are here to help. Give us a call today on 09 930 8999.

Other Blogs You Might Like:

Why should you consider refinancing your mortgage?

All you need to know about New Zealand’s ring-fencing of residential rental losses bill

What should you do when your interest-only mortgage ends within the next two years?

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)