New housing policy 2021: Can investors still afford to hold the properties they have?

Posted by: Connie in Property Investing

In March 2021, New Zealand government announced a new housing policy package targeted at relieving pressure on the property market and tipping the balance away from speculators and back towards first-home buyers and long-term investors. The new housing policy announcements include two significant changes closely related to property investors:

- The bright-line test rule is extended from the current five years to 10 years. In other words, if you buy an investment property and sell it within 10 years, you’ll be liable to be taxed on the capital gain.

- No interest deductions on residential investment property acquired after 27 March 2021. For the property acquired before 27 March 2021, the interests on the home loan will become progressively non-tax deductible against rental income from 1 October 2021.

In our view, if you plan to hold your investment properties for the long term (such as for retirement), rather than flipping property purpose, then the extension of bright-line test will not affect you.

However, the removal of interest deductions on residential property can have a severe effect on investors’ cash flow, particularly those who have borrowed to the eyeballs. Investors have to pay extra cash to cover the tax obligation, resulting in a lack of cash flow to hold the property.

The question is: since removing the tax deductibility of interest, can investors still afford to hold the properties they already have? What will the actual cash flow be required to service all the expenses on investment properties, including extra tax obligations?

That's why we designed a “cash flow projection” calculator helping you to quantify the actual cash flow on your investment properties acquired before 27 March 2021, so that you can have a clear mind if you can afford the property or not.

Free rental property cash flow excel calculator download link: bit.ly/2OvPuUD

Disclaimer: The hypothetical case studies used in the calculator below are provided for illustrative purposes only and do not represent your actual cash flow nor tax advice. Your circumstances may be different from the case studies, and therefore, there can be no assurance that you will be able to achieve similar results in comparable situations by using this calculator.

New housing policy 2021: Can investors still afford to hold the properties they have?

Video Timeline

1. Removing interest deductions on residential property, how will the new housing policy affect your cashflow? – 02:31

2. Other factors that may negatively affect cashflow on rental properties – 10:26

1. Removing interest deductions on residential property, how will the new housing policy affect your cashflow?

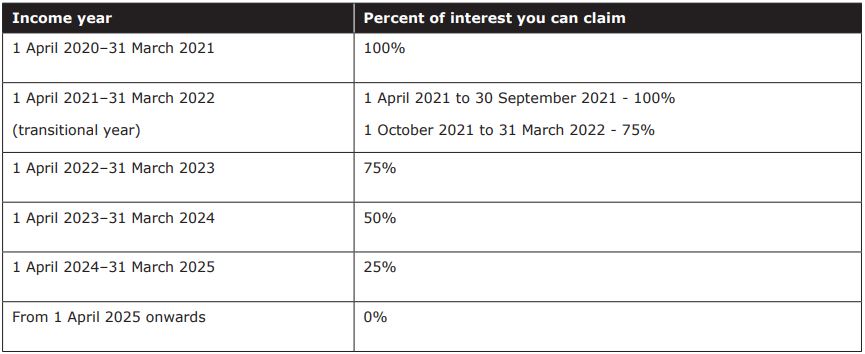

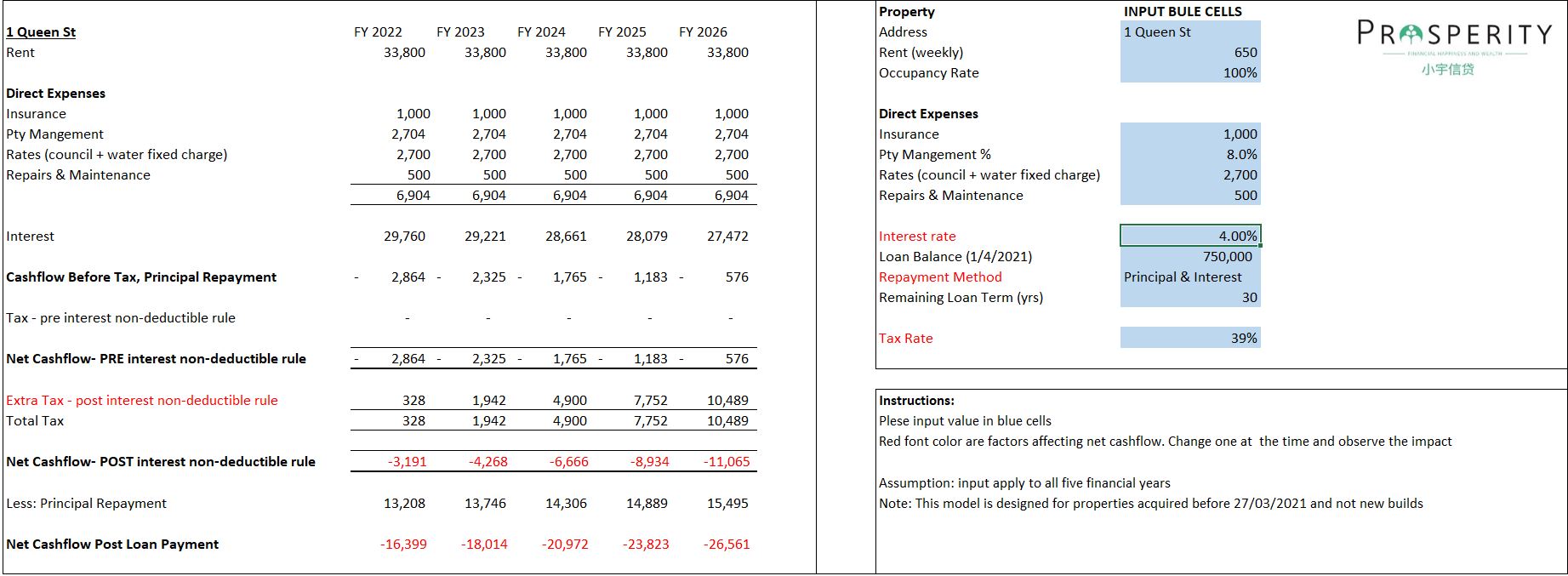

If you acquired an investment property after 27 March 2021, the interest costs are completely not be able to offset against the rental income from 1st October 2021. If you acquired the property before 27 March 2021, you can still claim interest cost against your rental income, but this amount will reduce by 25% each financial year until the tax deductibility is completely phased out from 1 April 2025. The proposed change will be phased in as follows:

Note: this “cash flow projection” calculator is designed for property acquired before 27 March 2021.

How to use this rental property “cash flow projection” calculator?

Free rental property cash flow excel calculator download link: bit.ly/2OvPuUD

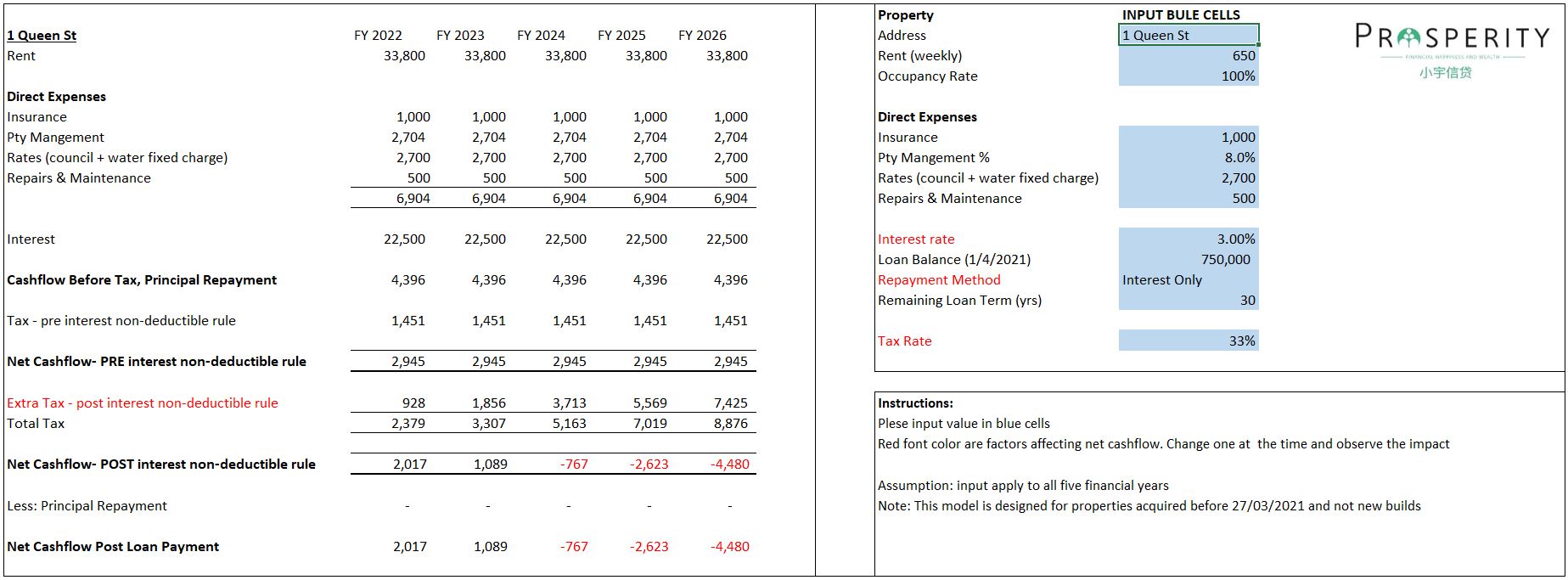

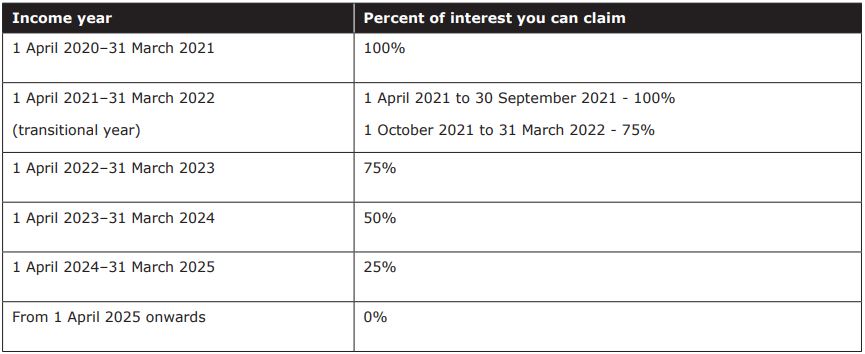

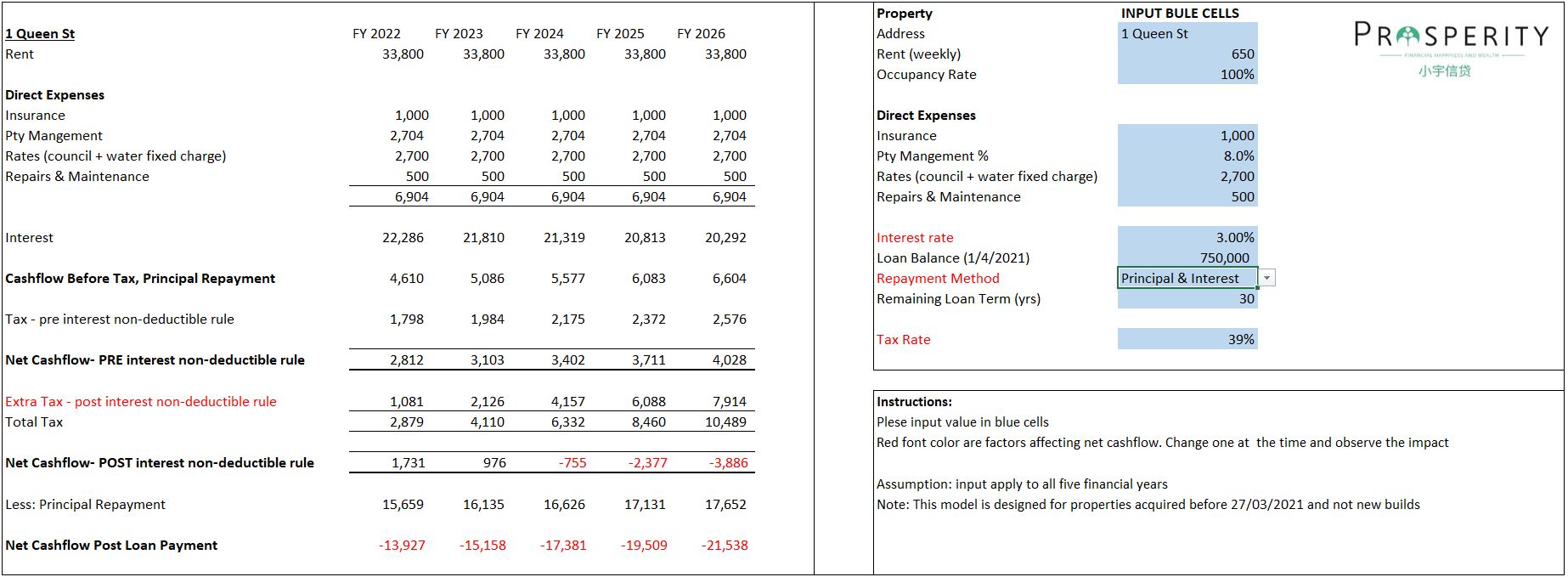

Step one: enter your numbers in the blue fields. Then you’ll notice the corresponding changes on the left side. It’s similar to a profit-loss report, but effectively it’s a cashflow forecast for the next five financial years.

Say your weekly rental income is $650 and assume 100% occupancy rate (you get a notice from your existing tenants so that you have enough time to find another one).

Apart from interest costs, there are some expenses related to rental property:

- Insurance – $1,000

- Property management fee (if apply) – 8% of the rent.

- Rates (council + water fixed charge) – In some areas like Auckland, landlords are responsible for water fixed charge, and tenants only pay for the usage. Let’s assume $2,700 in this case.

- Repair & maintenance costs – It depends on your property, new or a bit outdated. Say $500 in this case.

Here are some details about the current loan that you’ll need to input into the fields:

- Interest rate – Many borrowers are on low interest rates, some even less than 3%. We use 3% in this example.

- Loan balance (1 April 2021) – $750,000

- Repayment method – currently many investors choose to repay their loans on “interest-only”, if possible.

- Remaining loan term – 30 years

The last field you need to input is your tax rate. In this example, we use 33% tax rate.

Step two: once you enter the data into the correspondent fields, including weekly rental income, fixed expenses on the property, loan details and your tax rate, the calculator will automatically work out:

- Rental income per annum – $33,800

- Total expenses on the property per annum (apart from interest costs) – $6,904

- Annual interest costs – $750,000*3% = $22,500

- Net cashflow (Prior to interest non-deductible rule) – the cashflow before tax and principal repayment is: $33,800 - $6,904 - $22,500 = $4,396. According to the tax rate of 33%, you net cashflow will be $2,945.

In the past (before the new housing rules), you were very likely to have positive cashflow on the rental property. Even though you purchased the property last year at 80% of LVR and the loan amount was high, the interest rates were low, it was still likely to achieve positive cashflow.

However, removing the tax deductibility of interest can have a serious effect on investors’ net cashflow. Let’s take a closer look at how this new rule will affect your net cashflow:

For the 2021-22 financial year, you can claim 100% of the interest charged between 1 April 2021 and 30 September 2021. Between 1 October 2021 and 31 March 2022, you can only claim 75%. For the 2022-23 financial year, you can claim 75% of interest costs. For the 2023-24 financial year, you can claim 50%. From the 2025-26 financial year onwards, you will be longer able to claim any interest against your rental income.

In this case, with the phasing out interest deductibility, you’re going to pay extra tax of $928 for the FY2022, compared with the situation when interest cost was tax-deductible. This number will progressively grow to $7,425 for the FY2026.

So, from FY2022, the net cashflow after tax will reduce a bit to $2,017. With the percentage of interest you can claim reducing progressively, the net cashflow will start turning into a negative figure for FY2024 and reduce to negative $4,480 from FY2026 onwards.

The above calculation is just based on the scenario of one rental property. What if you have two, three, or more properties? Can you really afford to hold these properties when the cashflow is negative?

2. Other factors that may negatively affect cashflow on rental properties

The removal of interest as a tax-deductible expense is just one of the factors that reduces your cashflow. It can be significant based on your inputs and the number of properties you have. On top of that, there are three variables that can affect the cashflow on your rental properties:

- Tax rates

- Loan repayment (“interest-only”, or “principal and interest”)

- Interest rates

(1) Tax rates

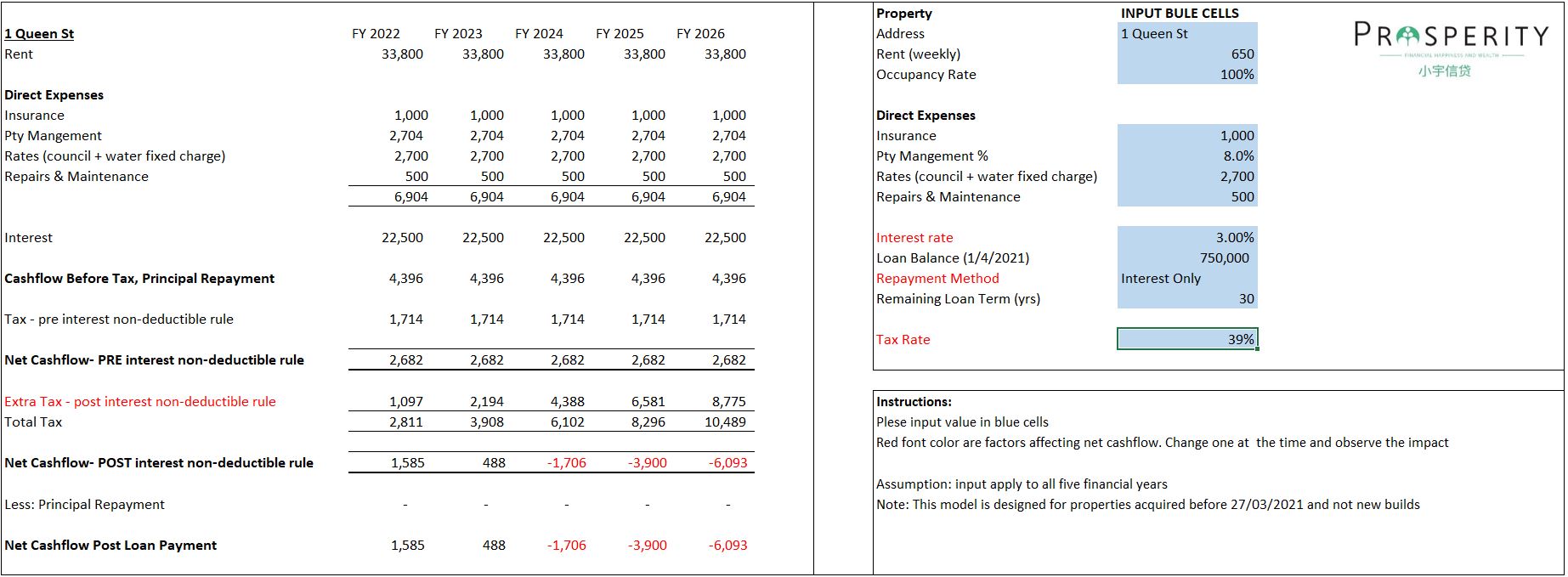

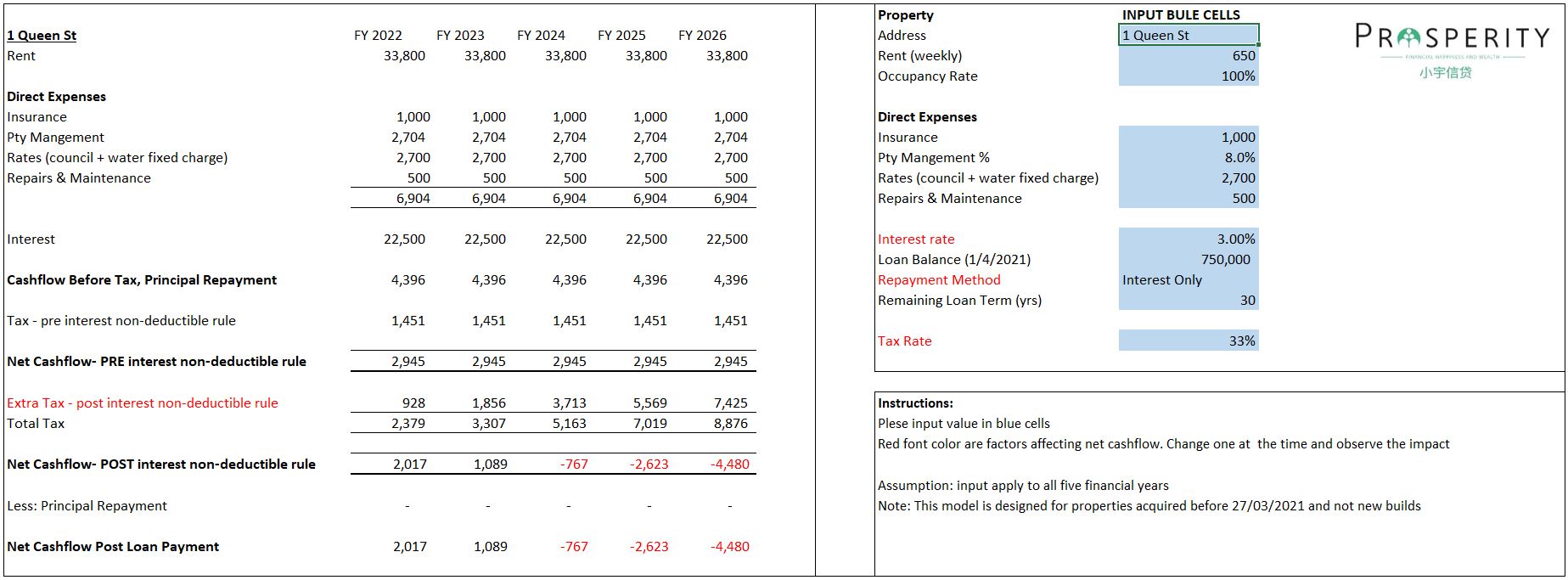

Effective from 1 April 2021, if you earn more than $180,000 per annum, you will be taxed at the rate of 39% instead of 33%. If this is the case, the net cashflow on your rental property will drop to negative $6,093, much worse than those at the rate of 33%.

Note, although not many people are earning above $180,000 a year but for some people who have job income over $100,000 a year, is more likely to reach $180,000 per annum threshold because without interest cost deduction their investment property business profit looks much higher than before. In the example above, in the FY2026, in IRD’s eye the taxable profit is $26,896 (= $33,800- $6,904) per property. If this is the case, 39% of tax rate will apply.

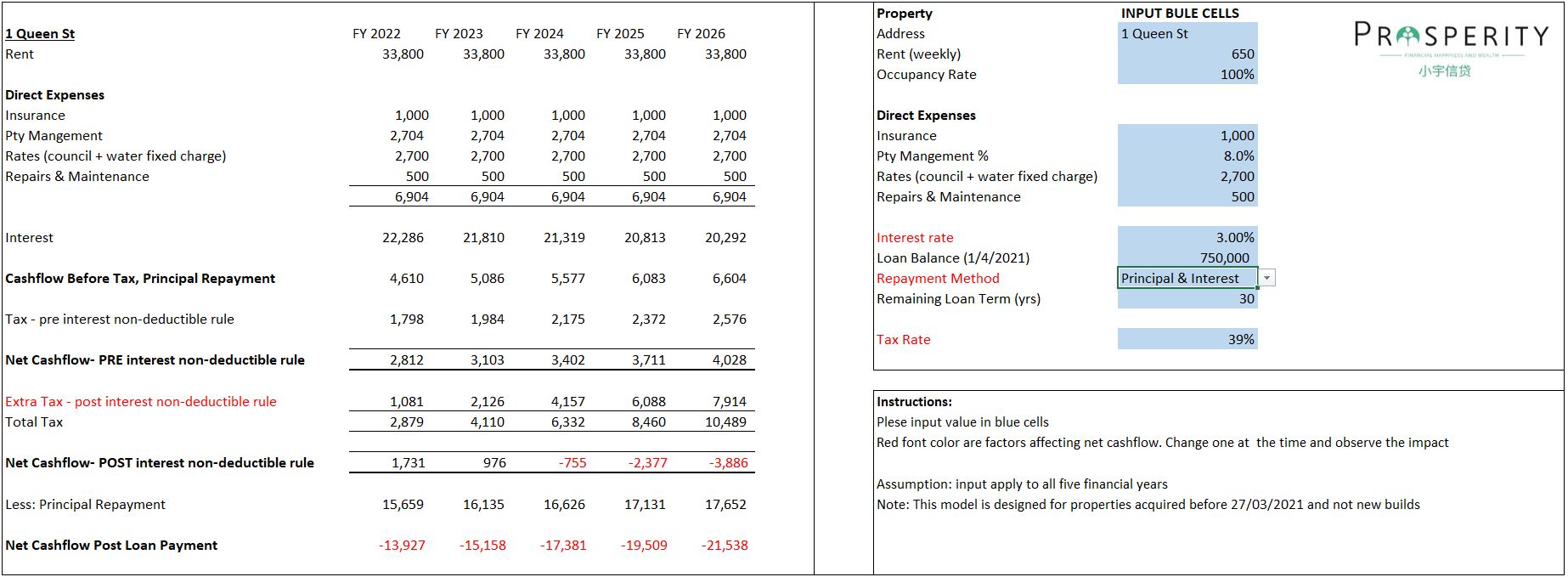

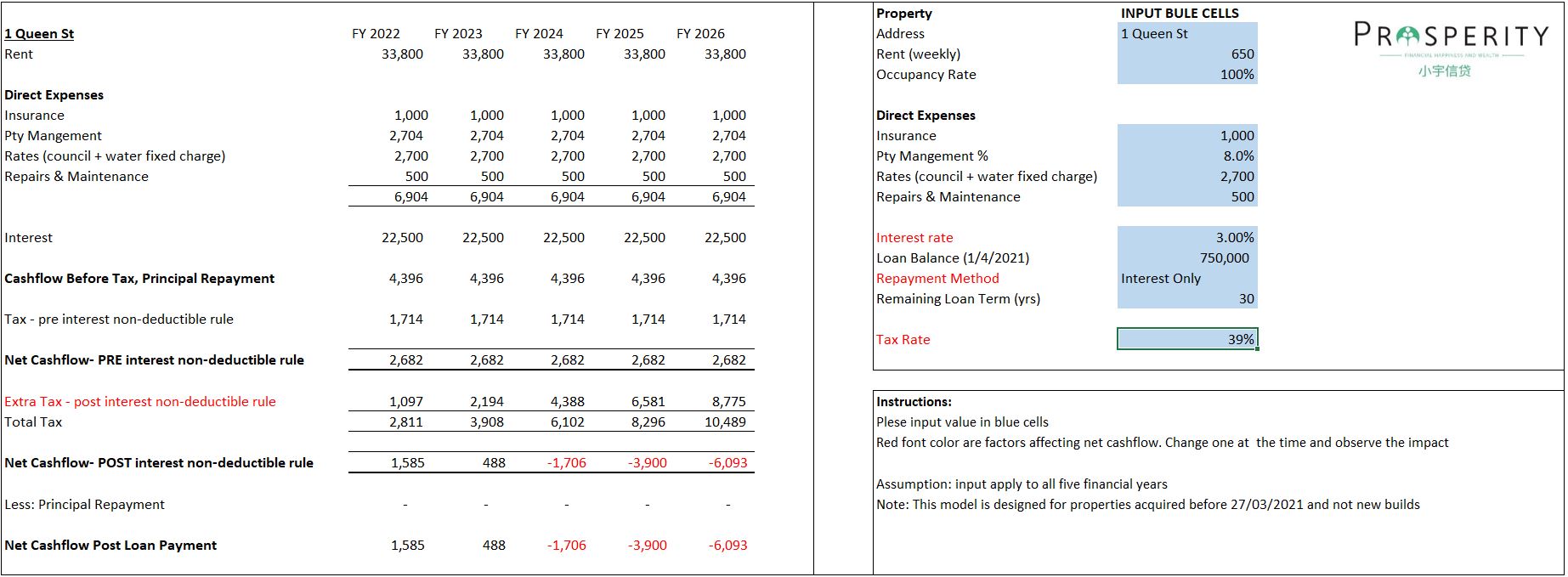

(2) Loan repayment

While most of New Zealand banks still allow you to repay your loan on interest-only, but it doesn’t mean this isn’t likely to be removed. In fact, the Reserve Bank is considering introducing a new policy that requires bank to remove interest-only loans for investors. If this happens, you’ll have no other choice but have to pay principal and interest altogether.

Once change the repayment method to “principal & interest” in the calculator and keep other variables (e.g., loan term, loan amount) the same, you’ll see for the year of 2026 you have to tap in $21,538 for one property. That’s a lot.

(3) Interest rates

Currently, many people fix their home loans below 3%, or a bit higher than 3% if they locked in for longer. Generally speaking, interest rates are at record lows.

However, the interest rates may increase later, and it’s a matter of time. So we need to ensure that we are able to withstand the effects of higher interest rates when they start to kick in.

Let’s say the interest rate increases by 1% to 4% (actually it can be higher than that), your net cashflow is turning into negative $26,561. What if you have more than one rental property? It's going to be a huge difference.

Free rental property cash flow excel calculator download link: bit.ly/2OvPuUD

To sum up, this calculator is designed to provide you with the quick overview of what your net cashflow position on one rental property is over the next 5 financial years under the new housing policy of removing the tax-deductibility of mortgage interest. In other words, use this calculator as a quick self-assessment to see whether you can afford to hold your existing property or not.

New Zealand government are starting to take much of the speculative heat out of the housing market. Removing the tax-deductibility of mortgage interest may be just one of their toolkits, may be followed by other big moves – interest rates may be higher, “interest-only” may be removed for example. So we need to be aware of these risks and prepare for the worst-case scenario and start planning now

What’s your next step? Are you going to cash up and exit the market? Or thinking about other strategies such as buying a new build or commercial property, or restructuring your debt, or increasing your yield? We highly recommend getting expert advice from professionals such as a property expert, tax accountant, and financial advisor, so that you can start planning as early as possible.

Prosperity Finance - Here to Help

Any questions? Or looking to get into your first home? We’re here to help. Call us at 09 930 8999 to have a no-obligation chat with one of the financial advisors at Prosperity Finance.

Read more:

How may the removal of interest deductions hurt your borrowing power?

Restructure your loan before it’s too late

Why is an interest-only loan better for an investment property?

LVR restrictions 2021: loan-to-value ratio for investment property reduced to 60%

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

In March 2021, New Zealand government announced a new housing policy package targeted at relieving pressure on the property market and tipping the balance away from speculators and back towards first-home buyers and long-term investors. The new housing policy announcements include two significant changes closely related to property investors:

- The bright-line test rule is extended from the current five years to 10 years. In other words, if you buy an investment property and sell it within 10 years, you’ll be liable to be taxed on the capital gain.

- No interest deductions on residential investment property acquired after 27 March 2021. For the property acquired before 27 March 2021, the interests on the home loan will become progressively non-tax deductible against rental income from 1 October 2021.

In our view, if you plan to hold your investment properties for the long term (such as for retirement), rather than flipping property purpose, then the extension of bright-line test will not affect you.

However, the removal of interest deductions on residential property can have a severe effect on investors’ cash flow, particularly those who have borrowed to the eyeballs. Investors have to pay extra cash to cover the tax obligation, resulting in a lack of cash flow to hold the property.

The question is: since removing the tax deductibility of interest, can investors still afford to hold the properties they already have? What will the actual cash flow be required to service all the expenses on investment properties, including extra tax obligations?

That's why we designed a “cash flow projection” calculator helping you to quantify the actual cash flow on your investment properties acquired before 27 March 2021, so that you can have a clear mind if you can afford the property or not.

Free rental property cash flow excel calculator download link: bit.ly/2OvPuUD

Disclaimer: The hypothetical case studies used in the calculator below are provided for illustrative purposes only and do not represent your actual cash flow nor tax advice. Your circumstances may be different from the case studies, and therefore, there can be no assurance that you will be able to achieve similar results in comparable situations by using this calculator.

New housing policy 2021: Can investors still afford to hold the properties they have?

Video Timeline

1. Removing interest deductions on residential property, how will the new housing policy affect your cashflow? – 02:31

2. Other factors that may negatively affect cashflow on rental properties – 10:26

1. Removing interest deductions on residential property, how will the new housing policy affect your cashflow?

If you acquired an investment property after 27 March 2021, the interest costs are completely not be able to offset against the rental income from 1st October 2021. If you acquired the property before 27 March 2021, you can still claim interest cost against your rental income, but this amount will reduce by 25% each financial year until the tax deductibility is completely phased out from 1 April 2025. The proposed change will be phased in as follows:

Note: this “cash flow projection” calculator is designed for property acquired before 27 March 2021.

How to use this rental property “cash flow projection” calculator?

Free rental property cash flow excel calculator download link: bit.ly/2OvPuUD

Step one: enter your numbers in the blue fields. Then you’ll notice the corresponding changes on the left side. It’s similar to a profit-loss report, but effectively it’s a cashflow forecast for the next five financial years.

Say your weekly rental income is $650 and assume 100% occupancy rate (you get a notice from your existing tenants so that you have enough time to find another one).

Apart from interest costs, there are some expenses related to rental property:

- Insurance – $1,000

- Property management fee (if apply) – 8% of the rent.

- Rates (council + water fixed charge) – In some areas like Auckland, landlords are responsible for water fixed charge, and tenants only pay for the usage. Let’s assume $2,700 in this case.

- Repair & maintenance costs – It depends on your property, new or a bit outdated. Say $500 in this case.

Here are some details about the current loan that you’ll need to input into the fields:

- Interest rate – Many borrowers are on low interest rates, some even less than 3%. We use 3% in this example.

- Loan balance (1 April 2021) – $750,000

- Repayment method – currently many investors choose to repay their loans on “interest-only”, if possible.

- Remaining loan term – 30 years

The last field you need to input is your tax rate. In this example, we use 33% tax rate.

Step two: once you enter the data into the correspondent fields, including weekly rental income, fixed expenses on the property, loan details and your tax rate, the calculator will automatically work out:

- Rental income per annum – $33,800

- Total expenses on the property per annum (apart from interest costs) – $6,904

- Annual interest costs – $750,000*3% = $22,500

- Net cashflow (Prior to interest non-deductible rule) – the cashflow before tax and principal repayment is: $33,800 - $6,904 - $22,500 = $4,396. According to the tax rate of 33%, you net cashflow will be $2,945.

In the past (before the new housing rules), you were very likely to have positive cashflow on the rental property. Even though you purchased the property last year at 80% of LVR and the loan amount was high, the interest rates were low, it was still likely to achieve positive cashflow.

However, removing the tax deductibility of interest can have a serious effect on investors’ net cashflow. Let’s take a closer look at how this new rule will affect your net cashflow:

For the 2021-22 financial year, you can claim 100% of the interest charged between 1 April 2021 and 30 September 2021. Between 1 October 2021 and 31 March 2022, you can only claim 75%. For the 2022-23 financial year, you can claim 75% of interest costs. For the 2023-24 financial year, you can claim 50%. From the 2025-26 financial year onwards, you will be longer able to claim any interest against your rental income.

In this case, with the phasing out interest deductibility, you’re going to pay extra tax of $928 for the FY2022, compared with the situation when interest cost was tax-deductible. This number will progressively grow to $7,425 for the FY2026.

So, from FY2022, the net cashflow after tax will reduce a bit to $2,017. With the percentage of interest you can claim reducing progressively, the net cashflow will start turning into a negative figure for FY2024 and reduce to negative $4,480 from FY2026 onwards.

The above calculation is just based on the scenario of one rental property. What if you have two, three, or more properties? Can you really afford to hold these properties when the cashflow is negative?

2. Other factors that may negatively affect cashflow on rental properties

The removal of interest as a tax-deductible expense is just one of the factors that reduces your cashflow. It can be significant based on your inputs and the number of properties you have. On top of that, there are three variables that can affect the cashflow on your rental properties:

- Tax rates

- Loan repayment (“interest-only”, or “principal and interest”)

- Interest rates

(1) Tax rates

Effective from 1 April 2021, if you earn more than $180,000 per annum, you will be taxed at the rate of 39% instead of 33%. If this is the case, the net cashflow on your rental property will drop to negative $6,093, much worse than those at the rate of 33%.

Note, although not many people are earning above $180,000 a year but for some people who have job income over $100,000 a year, is more likely to reach $180,000 per annum threshold because without interest cost deduction their investment property business profit looks much higher than before. In the example above, in the FY2026, in IRD’s eye the taxable profit is $26,896 (= $33,800- $6,904) per property. If this is the case, 39% of tax rate will apply.

(2) Loan repayment

While most of New Zealand banks still allow you to repay your loan on interest-only, but it doesn’t mean this isn’t likely to be removed. In fact, the Reserve Bank is considering introducing a new policy that requires bank to remove interest-only loans for investors. If this happens, you’ll have no other choice but have to pay principal and interest altogether.

Once change the repayment method to “principal & interest” in the calculator and keep other variables (e.g., loan term, loan amount) the same, you’ll see for the year of 2026 you have to tap in $21,538 for one property. That’s a lot.

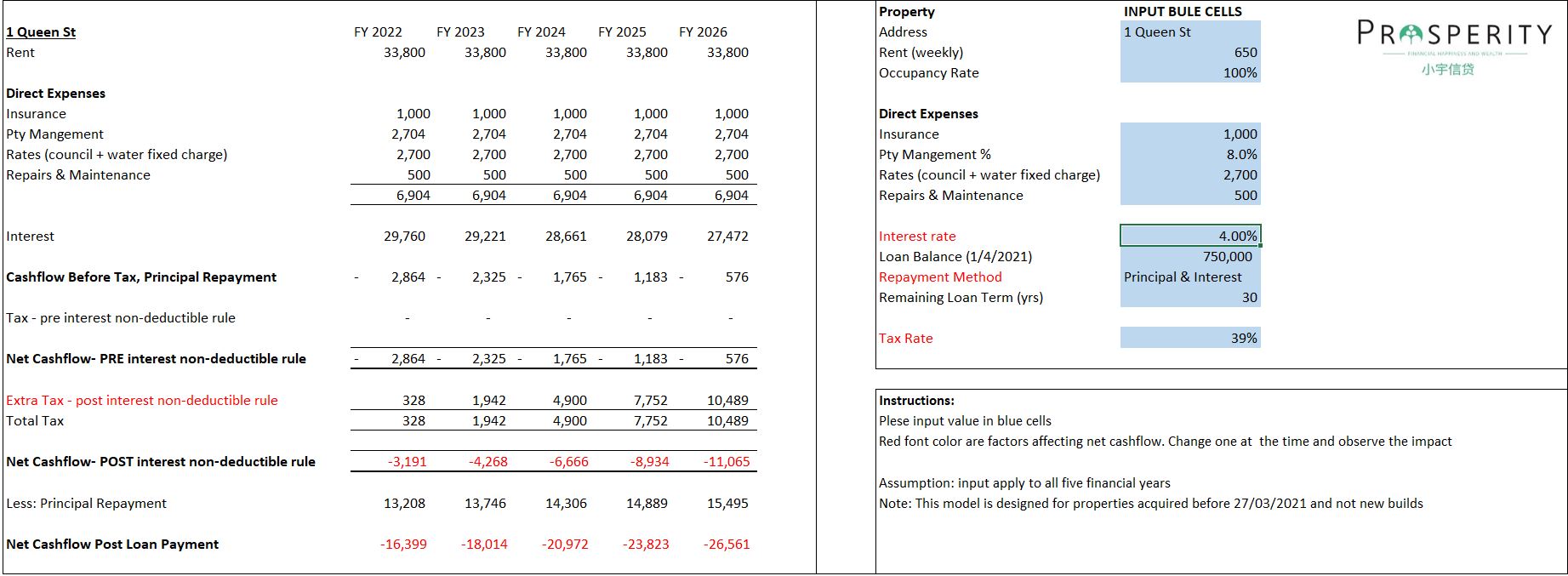

(3) Interest rates

Currently, many people fix their home loans below 3%, or a bit higher than 3% if they locked in for longer. Generally speaking, interest rates are at record lows.

However, the interest rates may increase later, and it’s a matter of time. So we need to ensure that we are able to withstand the effects of higher interest rates when they start to kick in.

Let’s say the interest rate increases by 1% to 4% (actually it can be higher than that), your net cashflow is turning into negative $26,561. What if you have more than one rental property? It's going to be a huge difference.

Free rental property cash flow excel calculator download link: bit.ly/2OvPuUD

To sum up, this calculator is designed to provide you with the quick overview of what your net cashflow position on one rental property is over the next 5 financial years under the new housing policy of removing the tax-deductibility of mortgage interest. In other words, use this calculator as a quick self-assessment to see whether you can afford to hold your existing property or not.

New Zealand government are starting to take much of the speculative heat out of the housing market. Removing the tax-deductibility of mortgage interest may be just one of their toolkits, may be followed by other big moves – interest rates may be higher, “interest-only” may be removed for example. So we need to be aware of these risks and prepare for the worst-case scenario and start planning now

What’s your next step? Are you going to cash up and exit the market? Or thinking about other strategies such as buying a new build or commercial property, or restructuring your debt, or increasing your yield? We highly recommend getting expert advice from professionals such as a property expert, tax accountant, and financial advisor, so that you can start planning as early as possible.

Prosperity Finance - Here to Help

Any questions? Or looking to get into your first home? We’re here to help. Call us at 09 930 8999 to have a no-obligation chat with one of the financial advisors at Prosperity Finance.

Read more:

How may the removal of interest deductions hurt your borrowing power?

Restructure your loan before it’s too late

Why is an interest-only loan better for an investment property?

LVR restrictions 2021: loan-to-value ratio for investment property reduced to 60%

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)