What is a priority amount on a mortgage?

Posted by: Connie in Finance 101

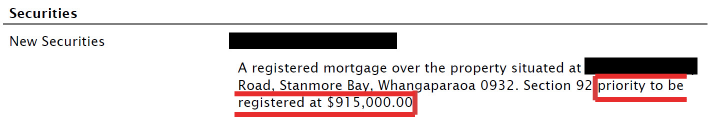

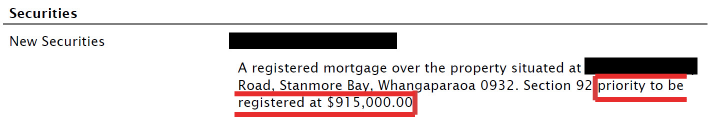

The loan offer often mentions “priority amount” under section 92. The priority amount appears much higher than the amount that borrowers are borrowing. What does a priority amount mean on a mortgage? Why the priority amount can be higher than the actual borrowing amount?

When receiving a loan offer, some of our clients might get confused about the legal term. That’s why in this video, our guest speaker, Joy Yuan from Turner Hopkins, explained the meaning of priority amount on mortgage and what it means for you.

Mortgage priority amount

1. What is a priority amount? - 01:53

2. Why does the bank specify a priority amount that is higher than my actual loan amount? - 02:36

3. Priority amount explained with an example - 03:23

4. What does priority amount mean to you? - 04:34

1. What is a priority amount?

The bank often specifies an amount on the mortgage, and this is referred to as the “priority amount”. A priority amount is the maximum amount the bank has priority over any subsequent mortgage. Priority amount will be referred to in a loan, and this amount will exceed the actual amount of the loan borrowed from the bank.

In general, the priority amount is usually around 1.5 times of the value of a property. Accepting the priority amount does not necessarily mean this amount is how much you owe to the bank.

2. Why does the bank specify a priority amount that is higher than my actual loan amount?

The primary purpose of specifying a priority amount is to protect the bank. It gives the bank the right to claim the loan from the borrower in some situations such as mortgagee sale, so that if the borrower does not repay the loan, the bank can fully recover all the money that owed to them.

The bank is the first mortgage, which means the bank is ranked ahead of any subsequent mortgage. If a second mortgage is registered later, their priority amount will be ranked after the first mortgage.

3. Priority amount explained with an example

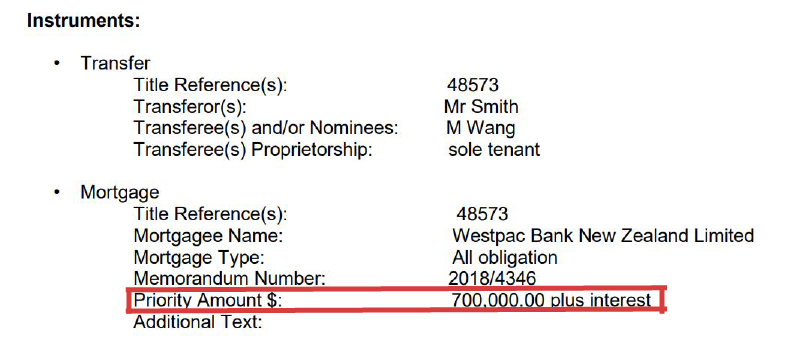

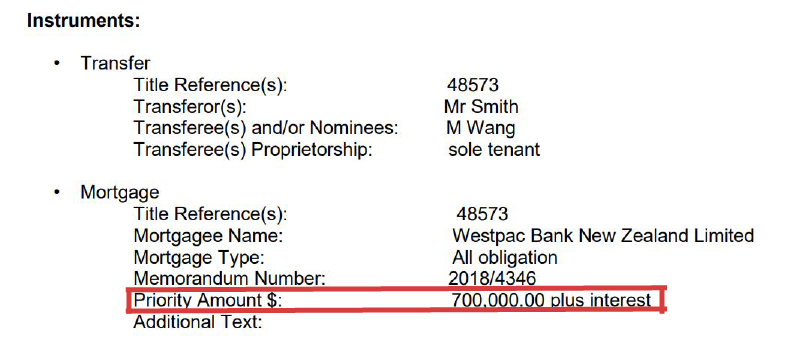

Here is an example of an A&I (Authority & Instruction) form that needs to be signed for transferring the registration of property title before the settlement. This form specifies the priority amount. In this case, Mr.Wang is borrowing the money from Westpac bank. The priority amount, $700,000, is higher than the actual borrowing amount, and this number is around 1.5 times of the property value.

This is to ensure that in the event of Westpac bank into mortgagee sale of the house, Westpac can recover the $500,000 loan plus interest they lend to Mr.Wang and any other creditors were ranked after that $700,000.

4. What does priority amount mean to you?

Priority amount is just to make sure the bank can be fully recovered from the borrowers by having this priority amount registered as part of the mortgage. The inclusion of priority amount shouldn't be of immediate concern. Remember that the priority amount is not the amount that the bank lends to you.

In most of cases, especially for a residential property loan, you don't need to worry about it because you can only get one mortgage from one bank. But for a commercial loan, it’s a different story.

What’s more, if you need to top up in the future, the inclusion of a higher priority amount will give you convenience because you don't need to see your lawyer to update the priority amount. That’s why sometimes the bank allow a bigger priority amount in some situations.

Joy is an associate at Turner Hopkins. She is very experienced in a broad range of legal matters. She has extensive expertise in commercial and property law. Feel free to contact her via call 09 975 2624 or email: joy@turnerhopkins.co.nz

Prosperity Finance - Here to Help

Got questions? Or seek help? We’re more than happy to chat. Call us at 09 930 8999 for a chat with one of our mortgage advisors. At Prosperity Finance, we don’t have a one-size-fits-all solution for your home loan. We look at your case, understand your needs and situation then make a tailored solution for you.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

The loan offer often mentions “priority amount” under section 92. The priority amount appears much higher than the amount that borrowers are borrowing. What does a priority amount mean on a mortgage? Why the priority amount can be higher than the actual borrowing amount?

When receiving a loan offer, some of our clients might get confused about the legal term. That’s why in this video, our guest speaker, Joy Yuan from Turner Hopkins, explained the meaning of priority amount on mortgage and what it means for you.

Mortgage priority amount

1. What is a priority amount? - 01:53

2. Why does the bank specify a priority amount that is higher than my actual loan amount? - 02:36

3. Priority amount explained with an example - 03:23

4. What does priority amount mean to you? - 04:34

1. What is a priority amount?

The bank often specifies an amount on the mortgage, and this is referred to as the “priority amount”. A priority amount is the maximum amount the bank has priority over any subsequent mortgage. Priority amount will be referred to in a loan, and this amount will exceed the actual amount of the loan borrowed from the bank.

In general, the priority amount is usually around 1.5 times of the value of a property. Accepting the priority amount does not necessarily mean this amount is how much you owe to the bank.

2. Why does the bank specify a priority amount that is higher than my actual loan amount?

The primary purpose of specifying a priority amount is to protect the bank. It gives the bank the right to claim the loan from the borrower in some situations such as mortgagee sale, so that if the borrower does not repay the loan, the bank can fully recover all the money that owed to them.

The bank is the first mortgage, which means the bank is ranked ahead of any subsequent mortgage. If a second mortgage is registered later, their priority amount will be ranked after the first mortgage.

3. Priority amount explained with an example

Here is an example of an A&I (Authority & Instruction) form that needs to be signed for transferring the registration of property title before the settlement. This form specifies the priority amount. In this case, Mr.Wang is borrowing the money from Westpac bank. The priority amount, $700,000, is higher than the actual borrowing amount, and this number is around 1.5 times of the property value.

This is to ensure that in the event of Westpac bank into mortgagee sale of the house, Westpac can recover the $500,000 loan plus interest they lend to Mr.Wang and any other creditors were ranked after that $700,000.

4. What does priority amount mean to you?

Priority amount is just to make sure the bank can be fully recovered from the borrowers by having this priority amount registered as part of the mortgage. The inclusion of priority amount shouldn't be of immediate concern. Remember that the priority amount is not the amount that the bank lends to you.

In most of cases, especially for a residential property loan, you don't need to worry about it because you can only get one mortgage from one bank. But for a commercial loan, it’s a different story.

What’s more, if you need to top up in the future, the inclusion of a higher priority amount will give you convenience because you don't need to see your lawyer to update the priority amount. That’s why sometimes the bank allow a bigger priority amount in some situations.

Joy is an associate at Turner Hopkins. She is very experienced in a broad range of legal matters. She has extensive expertise in commercial and property law. Feel free to contact her via call 09 975 2624 or email: joy@turnerhopkins.co.nz

Prosperity Finance - Here to Help

Got questions? Or seek help? We’re more than happy to chat. Call us at 09 930 8999 for a chat with one of our mortgage advisors. At Prosperity Finance, we don’t have a one-size-fits-all solution for your home loan. We look at your case, understand your needs and situation then make a tailored solution for you.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)