Does Coronavirus threaten your business? - 5 home loan tips for small business owners

Posted by: Connie

Since January 2020, a new type of coronavirus, known as 2019 -nCoV has been spreading across the globe. We’ve seen that the new strain of coronavirus has impacted on economy in New Zealand, with the trend for it becoming a more serious issue as a small business owner in the service industry.

Last weekend, I went out with my family to have dinner. This restaurant is in a busy street, used to welcome hundreds of customers daily, but since the coronavirus outbreak globally, the number of visitors dwindled down. I was shocked as there was no customer in the dining hall and all the lights were off, except a small light on at the reception area. While I was waiting for my order, I could feel the restaurant owner was desperate as her business has been affected seriously by the virus.

The owner said: “The coronavirus makes people more concerned about going out, which have already made our small business owners experienced a decline in sales volume. The situation associated with coronavirus is so dire that some may be unable to pay the rent and wages.”

The scene pulled me back for what happened two years ago -- New Zealand property market went through the slump stage of the property cycle and at the same time the bank tightened up their credit policies, which affected my business as well.

Small businesses are vulnerable to some external factors that are largely outside the control, such as tough economic times. How, then, to make your business overcome these obstacles? It’s crucial to perceive the risks and then deal with them as early as possible. I am not able to help small business owners on making drastic moves to survive on the recession. But as a financial advisor in New Zealand, I’ll share with you five home loan tips that could help small business owners protect their valued personal assets from external shocks.

Does Coronavirus threaten your business? Here are 5 home loan tips for small business owners

Video Timeline

Tip 1: Don’t put all your eggs in one basket -- 02:21

Tip 2: Have either a revolving credit account or offset account -- 04:39

Tip 3: Only pay principal and interest loan against one property, and meanwhile keep others as interest-only loans -- 06:21

Tip 4: Personal Assets Protection - Make sure your assets are not under your personal name -- 07:25

Tips 5: Split your home loan if the loan size is big -- 08:18

Tip 1: Don’t put all your eggs in one basket

Firstly, your property securities are split with different banks. If you have a family home and some investment properties, make sure your properties are used to secure your loans by different lenders.

If you only borrow from one lender, there are many pitfalls you need to be aware of. One of the most important reasons among these is: your sale proceeds could be at risk. Say you’re thinking about selling one of your rental properties because you need some cash to support your business. You might expect that you only need to pay off the loan against the property you just sold and keep the remaining net sale proceeds. However, what actually going to happen is, when your other properties are secured with the same bank, should you sell down one of your properties they decide how much you need to repay from the sale proceeds. So, the bank will take a fresh look and reassess your borrowing capacity based on your ongoing income and LVR. In a worst-case scenario, if your business is not doing well, they may take all your sale proceeds. We’ve seen clients who were forced to pay back full net sale proceeds to their bank – with nothing left for themselves. That’s how the bank assesses partial discharge and we need to avoid having other loans and other property securities with the same bank.

What’s more, separate the bank that you have a business account from your home loan bank. Some people may consider keeping their business account and home loan account in one bank, then it would be convenient to borrow money from that bank because they can see everything easily. However, we don’t recommend you keep your business funds and personal finances in one bank. When you keep them all in one bank, your home loan loses the protection and might be affected if your business doesn’t perform well.

Tip 2: Have either a revolving credit account or offset account

What is revolving credit?

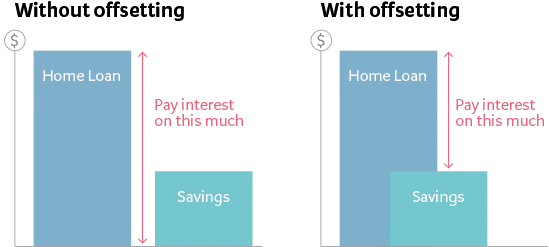

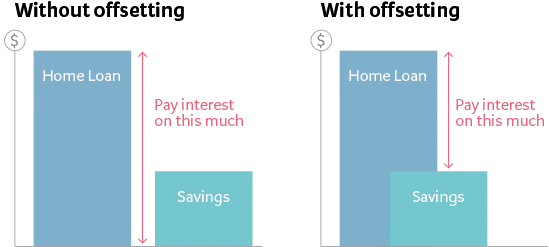

A revolving facility is a type of home loan product secured against residential property that works like a large overdraft or credit card. It gives you the flexibility to withdraw or deposit money up to your credit limit when you need them. Most of the banks have a revolving credit account but call it fancy names: ANZ have Flexi, BNZ have Rapid Repay, Westpac have Choice Everyday and ASB have Orbit. Some banks also have an offset account. The difference between them is subtle.

Benefits of revolving credit or offset account

Some small business owners are wondering is revolving credit good? Is offset account good? Here’s how a revolving credit or offset account can benefit business owners:

As a business owner, your cash flow is not constant. Sometimes you have a good month, while sometimes you have a bad month. Normally we set the repayment amounts for our home loan at a comfortable level, at least you can service that amount of regular payments. When you have a good month, you can use your extra money to offset your home loan, so that you can minimize the interest costs.

Secondly, a revolving credit facility or an offset account offers you flexibility. If you repay all your extra money into your home loan, you lose the flexibility as you can’t withdraw that money whenever you need. However, by offsetting against your home loan, your money is still yours and you can control them at any time.

Back to 2008, when the GFC (Global Financial Crisis) happened, some people had to, unfortunately, mortgagee sell their property. This was because their cash flow was broken, and they couldn’t service the repayment. If they had a revolving account, then they could have survived and their wealth could have probably doubled by now. It is important that you set up a revolving credit account or an offset account as an emergency fund, and always have some money put aside.

Tip 3: Only pay principal and interest loan against one property, and meanwhile keep others as interest-only loans

When you focus all your cashflow into one property and pay the minimum on the interest-only ones, you can pay off that home loan faster, and discharge your property (become mortgage free faster). So there will be less control from the bank against your personal assets.

The recommended way is to pay down the principal and interest on your family home loan while keeping your investment property loans on interest-only. Once your family home is mortgage free, you should start paying down the principal and interest on the investment property with the smallest loan amount whilst paying interest-only loans on the remaining. The property with the smallest investment loan is discharged first and you then move on to the next smallest loan size until all loans are paid off and properties are discharged.

In short, you should aim for discharging your family home first, then discharge your investment properties one by one in the sequence of smallest to largest in loan size.

Tip 4: Personal Assets Protection - Make sure your assets are not under your personal name.

As a business owner, you should separate personal assets and your business. Make sure your assets are not under your personal name. Otherwise, if something happens on your business, you're potentially liable for something, then your personal assets are also at risk - you might be ordered to sell your property to repay your obligation.

There are some entities that small business owners use, including family trust and company (LTC). We highly recommend you speak with your solicitor and accountant, so that they can advise on the entity that suits you best.

Tips 5: Split your home loan if the loan size is big

If your loan size is large, over half a million dollars, for example, we recommend you split the loan into two parts at least, and each part of loan is relatively small. By doing this, when the loan comes off a fixed term, if the rates go up then at least you only have to pay more interest costs on a portion of your loan. Otherwise, your entire loan will come off at the same time, and they will be paid at the same rate. So, it helps you minimize your loan repayment risk.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Prosperity Finance – here to help

The above are 5 home loan tips for small business owners who have home loans. No matter you run a restaurant or service in any other types of industry, you're always vulnerable to some external factors that outside your control. Make sure you tick all the boxes listed in this article. If not, our mortgage broker team is here to help with your home loan. Call 09 930 8999 for a no-obligation chat with our adviser.

Read further:

Do you have multiple properties secured with the same bank?

Why is property ownership structure more important than you think

What should you do when your interest-only mortgage ends within the next two years?

Since January 2020, a new type of coronavirus, known as 2019 -nCoV has been spreading across the globe. We’ve seen that the new strain of coronavirus has impacted on economy in New Zealand, with the trend for it becoming a more serious issue as a small business owner in the service industry.

Last weekend, I went out with my family to have dinner. This restaurant is in a busy street, used to welcome hundreds of customers daily, but since the coronavirus outbreak globally, the number of visitors dwindled down. I was shocked as there was no customer in the dining hall and all the lights were off, except a small light on at the reception area. While I was waiting for my order, I could feel the restaurant owner was desperate as her business has been affected seriously by the virus.

The owner said: “The coronavirus makes people more concerned about going out, which have already made our small business owners experienced a decline in sales volume. The situation associated with coronavirus is so dire that some may be unable to pay the rent and wages.”

The scene pulled me back for what happened two years ago -- New Zealand property market went through the slump stage of the property cycle and at the same time the bank tightened up their credit policies, which affected my business as well.

Small businesses are vulnerable to some external factors that are largely outside the control, such as tough economic times. How, then, to make your business overcome these obstacles? It’s crucial to perceive the risks and then deal with them as early as possible. I am not able to help small business owners on making drastic moves to survive on the recession. But as a financial advisor in New Zealand, I’ll share with you five home loan tips that could help small business owners protect their valued personal assets from external shocks.

Does Coronavirus threaten your business? Here are 5 home loan tips for small business owners

Video Timeline

Tip 1: Don’t put all your eggs in one basket -- 02:21

Tip 2: Have either a revolving credit account or offset account -- 04:39

Tip 3: Only pay principal and interest loan against one property, and meanwhile keep others as interest-only loans -- 06:21

Tip 4: Personal Assets Protection - Make sure your assets are not under your personal name -- 07:25

Tips 5: Split your home loan if the loan size is big -- 08:18

Tip 1: Don’t put all your eggs in one basket

Firstly, your property securities are split with different banks. If you have a family home and some investment properties, make sure your properties are used to secure your loans by different lenders.

If you only borrow from one lender, there are many pitfalls you need to be aware of. One of the most important reasons among these is: your sale proceeds could be at risk. Say you’re thinking about selling one of your rental properties because you need some cash to support your business. You might expect that you only need to pay off the loan against the property you just sold and keep the remaining net sale proceeds. However, what actually going to happen is, when your other properties are secured with the same bank, should you sell down one of your properties they decide how much you need to repay from the sale proceeds. So, the bank will take a fresh look and reassess your borrowing capacity based on your ongoing income and LVR. In a worst-case scenario, if your business is not doing well, they may take all your sale proceeds. We’ve seen clients who were forced to pay back full net sale proceeds to their bank – with nothing left for themselves. That’s how the bank assesses partial discharge and we need to avoid having other loans and other property securities with the same bank.

What’s more, separate the bank that you have a business account from your home loan bank. Some people may consider keeping their business account and home loan account in one bank, then it would be convenient to borrow money from that bank because they can see everything easily. However, we don’t recommend you keep your business funds and personal finances in one bank. When you keep them all in one bank, your home loan loses the protection and might be affected if your business doesn’t perform well.

Tip 2: Have either a revolving credit account or offset account

What is revolving credit?

A revolving facility is a type of home loan product secured against residential property that works like a large overdraft or credit card. It gives you the flexibility to withdraw or deposit money up to your credit limit when you need them. Most of the banks have a revolving credit account but call it fancy names: ANZ have Flexi, BNZ have Rapid Repay, Westpac have Choice Everyday and ASB have Orbit. Some banks also have an offset account. The difference between them is subtle.

Benefits of revolving credit or offset account

Some small business owners are wondering is revolving credit good? Is offset account good? Here’s how a revolving credit or offset account can benefit business owners:

As a business owner, your cash flow is not constant. Sometimes you have a good month, while sometimes you have a bad month. Normally we set the repayment amounts for our home loan at a comfortable level, at least you can service that amount of regular payments. When you have a good month, you can use your extra money to offset your home loan, so that you can minimize the interest costs.

Secondly, a revolving credit facility or an offset account offers you flexibility. If you repay all your extra money into your home loan, you lose the flexibility as you can’t withdraw that money whenever you need. However, by offsetting against your home loan, your money is still yours and you can control them at any time.

Back to 2008, when the GFC (Global Financial Crisis) happened, some people had to, unfortunately, mortgagee sell their property. This was because their cash flow was broken, and they couldn’t service the repayment. If they had a revolving account, then they could have survived and their wealth could have probably doubled by now. It is important that you set up a revolving credit account or an offset account as an emergency fund, and always have some money put aside.

Tip 3: Only pay principal and interest loan against one property, and meanwhile keep others as interest-only loans

When you focus all your cashflow into one property and pay the minimum on the interest-only ones, you can pay off that home loan faster, and discharge your property (become mortgage free faster). So there will be less control from the bank against your personal assets.

The recommended way is to pay down the principal and interest on your family home loan while keeping your investment property loans on interest-only. Once your family home is mortgage free, you should start paying down the principal and interest on the investment property with the smallest loan amount whilst paying interest-only loans on the remaining. The property with the smallest investment loan is discharged first and you then move on to the next smallest loan size until all loans are paid off and properties are discharged.

In short, you should aim for discharging your family home first, then discharge your investment properties one by one in the sequence of smallest to largest in loan size.

Tip 4: Personal Assets Protection - Make sure your assets are not under your personal name.

As a business owner, you should separate personal assets and your business. Make sure your assets are not under your personal name. Otherwise, if something happens on your business, you're potentially liable for something, then your personal assets are also at risk - you might be ordered to sell your property to repay your obligation.

There are some entities that small business owners use, including family trust and company (LTC). We highly recommend you speak with your solicitor and accountant, so that they can advise on the entity that suits you best.

Tips 5: Split your home loan if the loan size is big

If your loan size is large, over half a million dollars, for example, we recommend you split the loan into two parts at least, and each part of loan is relatively small. By doing this, when the loan comes off a fixed term, if the rates go up then at least you only have to pay more interest costs on a portion of your loan. Otherwise, your entire loan will come off at the same time, and they will be paid at the same rate. So, it helps you minimize your loan repayment risk.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Prosperity Finance – here to help

The above are 5 home loan tips for small business owners who have home loans. No matter you run a restaurant or service in any other types of industry, you're always vulnerable to some external factors that outside your control. Make sure you tick all the boxes listed in this article. If not, our mortgage broker team is here to help with your home loan. Call 09 930 8999 for a no-obligation chat with our adviser.

Read further:

Do you have multiple properties secured with the same bank?

Why is property ownership structure more important than you think

What should you do when your interest-only mortgage ends within the next two years?

Archive

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)