How to save $300k interest on the home loan? (case study)

Posted by: Connie in Interest Rates

Josh bought his first home in New Zealand around one year ago. His purchase price of the house was $620,000. He borrowed against this property was just over $576,000.

This was a high LVR (loan to value ratio) loan as josh’s deposit was lower than the preferred percentage (20%) for his family home. Generally, high LVR loans have higher interest rates due to its higher risks. BNZ approved his home loan application with a relatively higher interest rate (5.69%).

Several months later, Josh was referred by his friend to us and asked us to help him re-fix his loan with a lower interest rate.

After careful analysis, not only did we help him re-fix his loan with a lower rate (3.39%), which means we could help him save nearly $300k in total interest expense over the next two decades, but also he was offered $5,000 cash back from the new lender. Furthermore, the client saved $5k of interests on his personal loan.

In this week’s blog, using a case study, we discuss how we helped the client save interest on home loan and personal loan. This will give you an idea of how a good loan structure can help you save more in the long term.

How to save $300k interest on the home loan?

Video Timeline

1. Since the property value has increased significantly, the home loan was no longer a high LVR loan, we negotiated a lower rate. As a result, the client can potentially save $300k of total interest paid on his home loan. 00:16

2. By reducing the interest rates of the personal loan and implementing a right loan structure, the client saved $5k of interests on the personal loan. 06:49

Since the property value has increased significantly, the home loan was no longer a high LVR loan, we negotiated a lower rate. As a result, the client can potentially save $300k of total interest paid on his home loan.

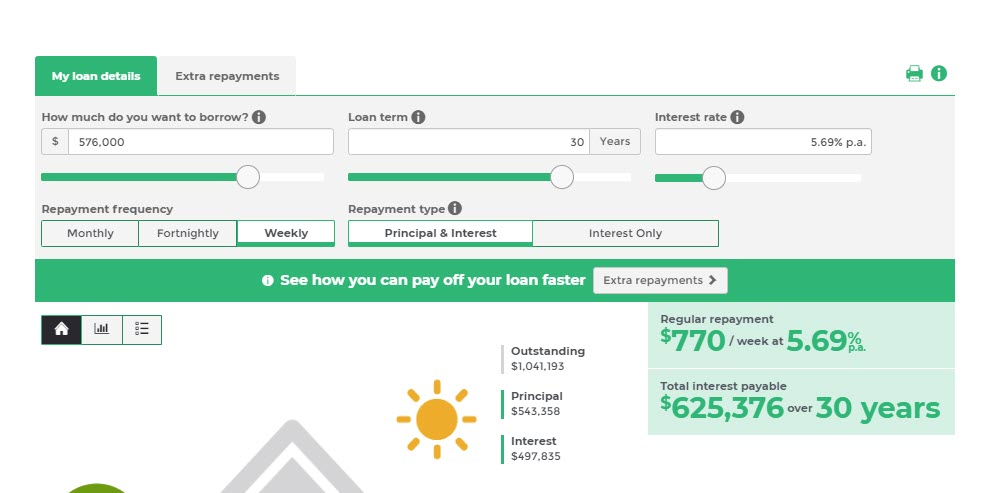

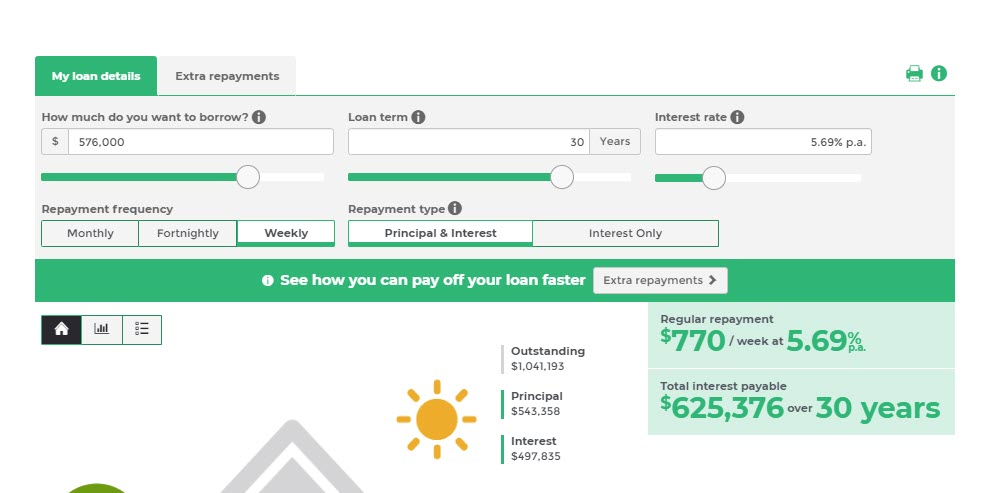

The purchase price of the house was $620k. His remaining balance of loan against this property was $576k. Based on the interest rate of 5.69%, his weekly loan repayment was $770, which means in the following 30 years, he would have to pay $620k in total interest cost, even more than the principle ($576k).

After investigation, we found the market value for the property had increased from $620k to $714k.

This was a good new for the client. Because the LVR for the property had decreased to 80%, the loan would not be categorized as a high LVR loan, which means the client could access more favourable interest rates and more lenders.

As the loan was no longer a high LVR loan, BNZ could lower his interest rate. But we recommend him refinance his loan to a new bank. By doing that, not only could he enjoy the lowest mortgage rate (3.39%) at that time, but also he could get $5k cash back.

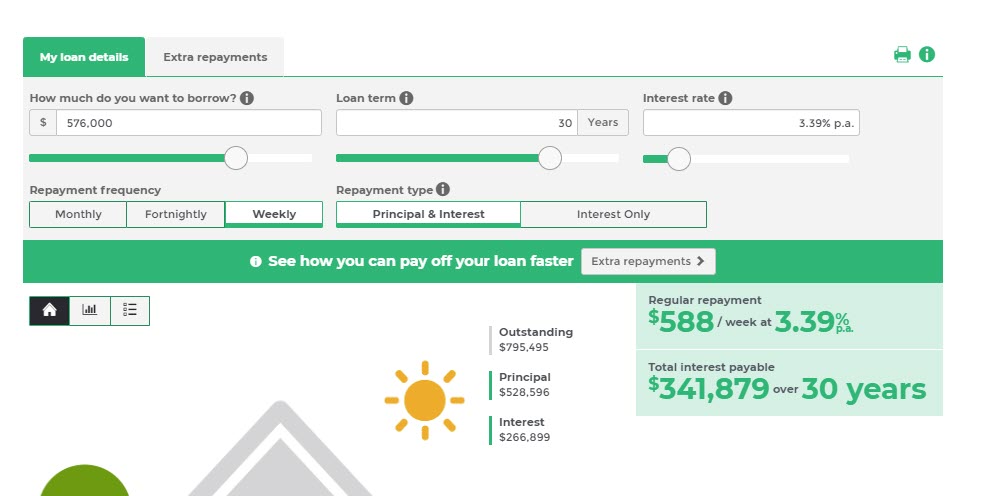

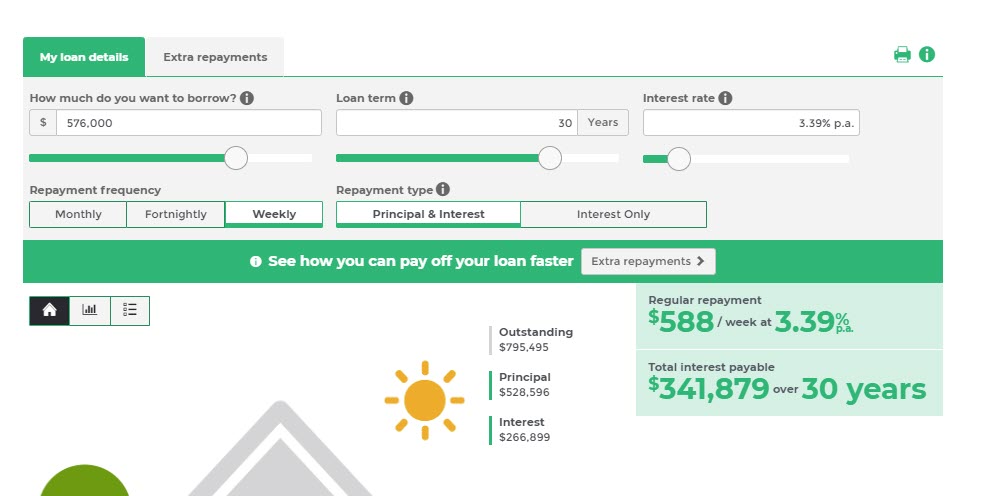

Benefiting from the lower interest rates, the total interest paid on a 30-year loan almost reduced by half, decreasing from $620k to $341k, and the minimum payment can be reduced from $770 to $588 per week. He was going to have a baby and his wife was going to have a maternity leave, so probably it’s better to accept a lower payment to release some cashflow pressure until his wife goes back to work.

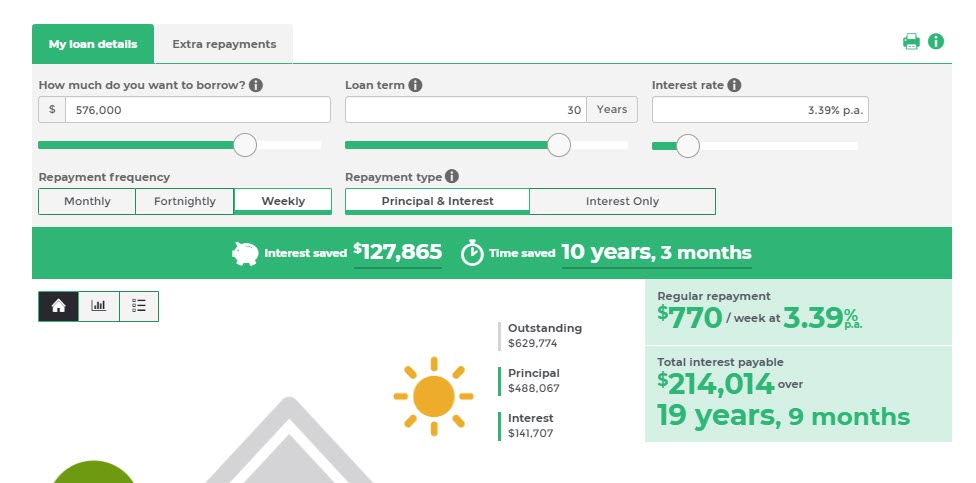

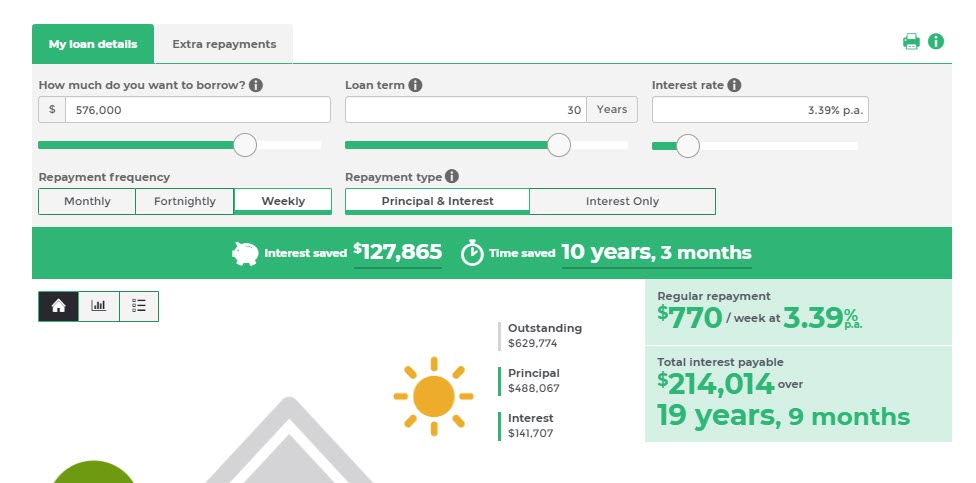

However, if the client could keep repaying $770 weekly as before, then the total interest paid on his loan could reduce dramatically from $620k to $210k. By implementing a better loan structure, he could save more than $400k in the total interest paid on loan, and pay off the home loan 10 years faster.

By reducing the interest rates of the personal loan and implementing a right loan structure, the client saved $5k of interests on the personal loan.

Besides a home loan, we noticed the client has a personal loan where we might help him to save interests as well.

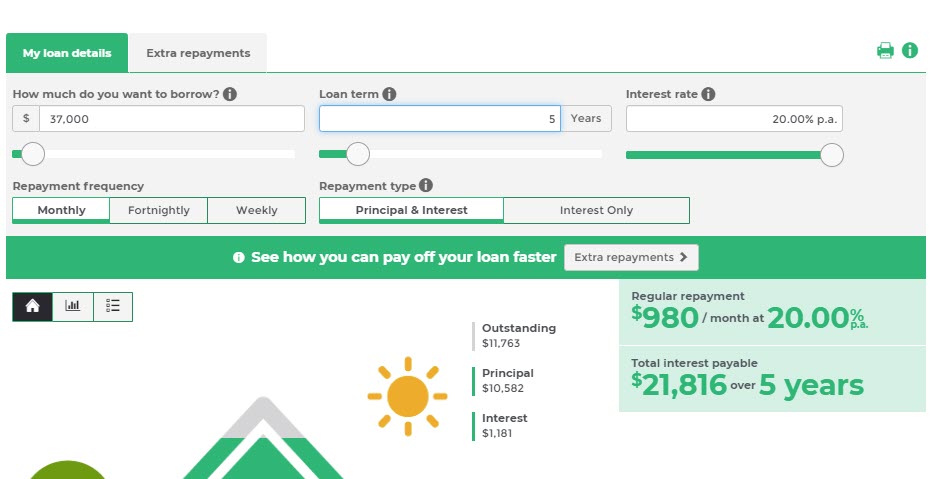

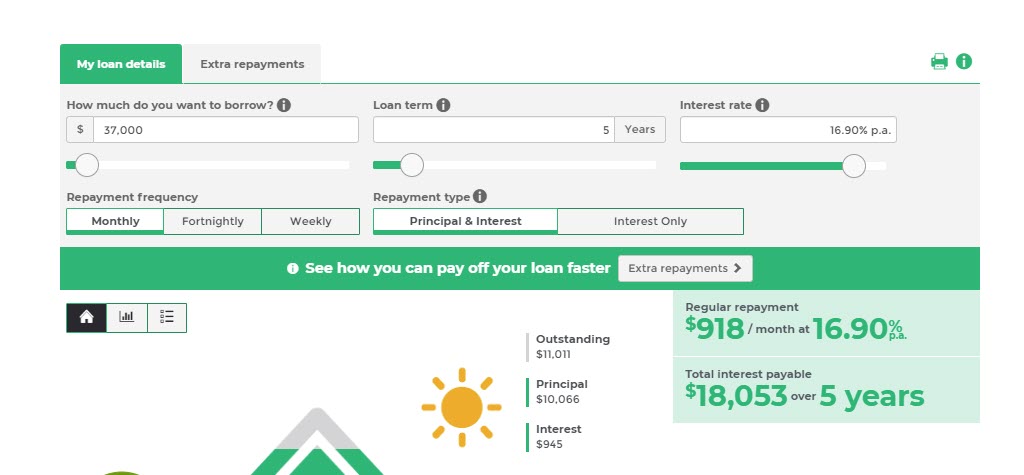

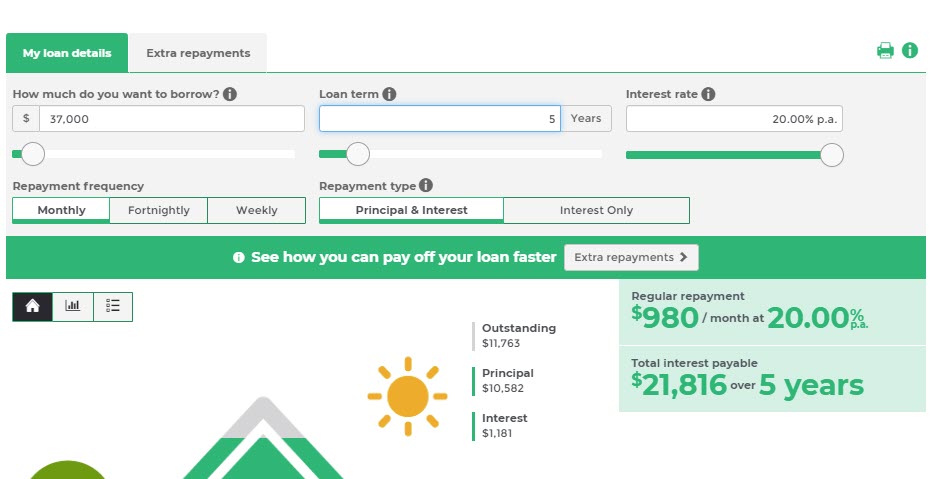

When he was just married and bought the house, he spent a lot on the new furniture and appliances and had to borrow another $37k. The interest rate he paid for the personal loan was quite high (20%), and his monthly loan repayment was $980 per month. Thanks to his high income, the high repayment of his personal loan won’t have a negative impact on his home loan regarding refinance application.

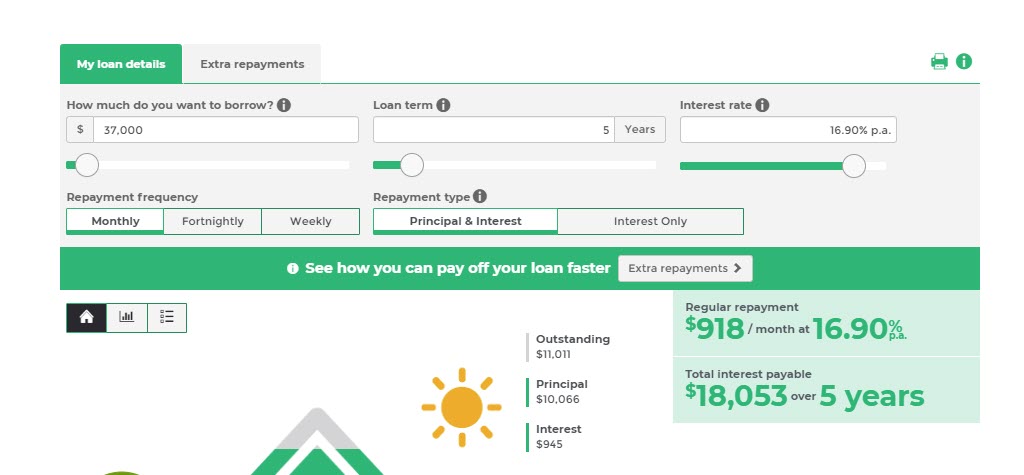

We keep strong relationships with many New Zealand banks and other reputable non-bank lenders, which enables us to find tailored solution for our clients. To secure a lower interest rate, we helped the client move his personal loan to another lender at the interest rate of 16.9%. The total interest paid on the personal loan reduced from $22k to $18k and the monthly loan repayment amount dropped accordingly ($918).

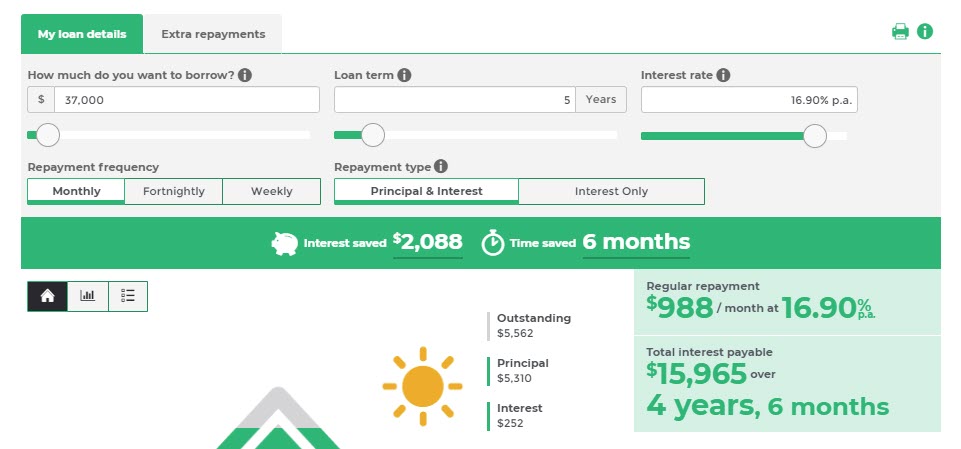

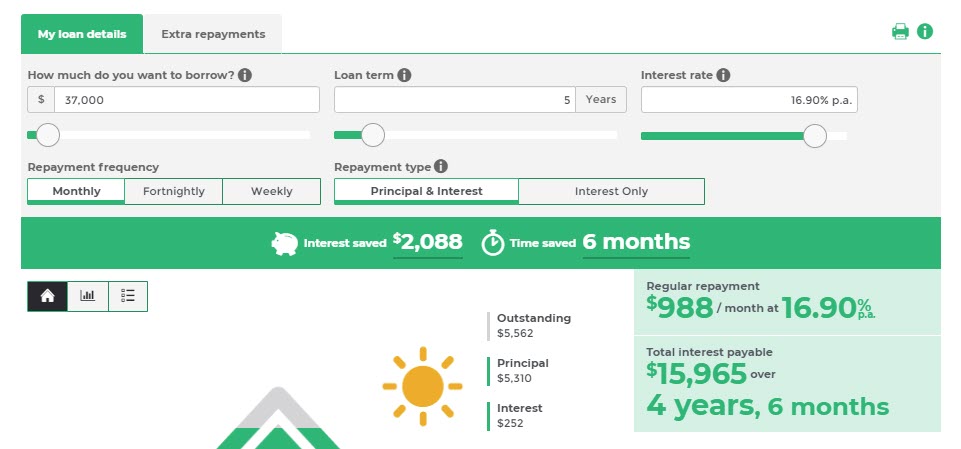

His personal loan amount was small. To pay off the personal loan faster and save more interests, we recommend the client keep repaying the same monthly loan amount ($988). Then:

- The total interest paid on the personal loan would reduce from $220k to $159k.

- He could pay off the personal loan for less than 5 years.

In a nutshell, we highly recommend you get in touch with a professional mortgage broker before you make any major decisions. At Prosperity Finance, we always move one step further and drill down to the root reason. In this case, when the client requested us to help him re-fix with a lower mortgage rate, we found out the reason behind his high interest rates. Not only did we helped him secure a lower home loan rate, but also found another lender with a lower rate for his personal loan by implementing a personalised loan structure, so that he could pay off the loans faster and save interest on home loans and personal loans.

Prosperity Finance – here to help

That’s kind of values we add to our clients every day. As experienced mortgage adviser, we take a strategic and long-term approach towards finding you the best loan structure. If you are thinking about buying a property or just want to review your current loan structure, please feel free to get in touch with us by calling 09 930 8999, or email: support@profin.co.nz. We’re happy to help.

Other Blogs You Might Like:

How to improve loan structure to save on interest, repay your debt faster, and become mortgage free?

How can a good loan structure work well for you to save $900 on tax per year?

When clients say: “I’ll contact you when I’m ready.” Why you shouldn’t wait until it’s too late.

Josh bought his first home in New Zealand around one year ago. His purchase price of the house was $620,000. He borrowed against this property was just over $576,000.

This was a high LVR (loan to value ratio) loan as josh’s deposit was lower than the preferred percentage (20%) for his family home. Generally, high LVR loans have higher interest rates due to its higher risks. BNZ approved his home loan application with a relatively higher interest rate (5.69%).

Several months later, Josh was referred by his friend to us and asked us to help him re-fix his loan with a lower interest rate.

After careful analysis, not only did we help him re-fix his loan with a lower rate (3.39%), which means we could help him save nearly $300k in total interest expense over the next two decades, but also he was offered $5,000 cash back from the new lender. Furthermore, the client saved $5k of interests on his personal loan.

In this week’s blog, using a case study, we discuss how we helped the client save interest on home loan and personal loan. This will give you an idea of how a good loan structure can help you save more in the long term.

How to save $300k interest on the home loan?

Video Timeline

1. Since the property value has increased significantly, the home loan was no longer a high LVR loan, we negotiated a lower rate. As a result, the client can potentially save $300k of total interest paid on his home loan. 00:16

2. By reducing the interest rates of the personal loan and implementing a right loan structure, the client saved $5k of interests on the personal loan. 06:49

Since the property value has increased significantly, the home loan was no longer a high LVR loan, we negotiated a lower rate. As a result, the client can potentially save $300k of total interest paid on his home loan.

The purchase price of the house was $620k. His remaining balance of loan against this property was $576k. Based on the interest rate of 5.69%, his weekly loan repayment was $770, which means in the following 30 years, he would have to pay $620k in total interest cost, even more than the principle ($576k).

After investigation, we found the market value for the property had increased from $620k to $714k.

This was a good new for the client. Because the LVR for the property had decreased to 80%, the loan would not be categorized as a high LVR loan, which means the client could access more favourable interest rates and more lenders.

As the loan was no longer a high LVR loan, BNZ could lower his interest rate. But we recommend him refinance his loan to a new bank. By doing that, not only could he enjoy the lowest mortgage rate (3.39%) at that time, but also he could get $5k cash back.

Benefiting from the lower interest rates, the total interest paid on a 30-year loan almost reduced by half, decreasing from $620k to $341k, and the minimum payment can be reduced from $770 to $588 per week. He was going to have a baby and his wife was going to have a maternity leave, so probably it’s better to accept a lower payment to release some cashflow pressure until his wife goes back to work.

However, if the client could keep repaying $770 weekly as before, then the total interest paid on his loan could reduce dramatically from $620k to $210k. By implementing a better loan structure, he could save more than $400k in the total interest paid on loan, and pay off the home loan 10 years faster.

By reducing the interest rates of the personal loan and implementing a right loan structure, the client saved $5k of interests on the personal loan.

Besides a home loan, we noticed the client has a personal loan where we might help him to save interests as well.

When he was just married and bought the house, he spent a lot on the new furniture and appliances and had to borrow another $37k. The interest rate he paid for the personal loan was quite high (20%), and his monthly loan repayment was $980 per month. Thanks to his high income, the high repayment of his personal loan won’t have a negative impact on his home loan regarding refinance application.

We keep strong relationships with many New Zealand banks and other reputable non-bank lenders, which enables us to find tailored solution for our clients. To secure a lower interest rate, we helped the client move his personal loan to another lender at the interest rate of 16.9%. The total interest paid on the personal loan reduced from $22k to $18k and the monthly loan repayment amount dropped accordingly ($918).

His personal loan amount was small. To pay off the personal loan faster and save more interests, we recommend the client keep repaying the same monthly loan amount ($988). Then:

- The total interest paid on the personal loan would reduce from $220k to $159k.

- He could pay off the personal loan for less than 5 years.

In a nutshell, we highly recommend you get in touch with a professional mortgage broker before you make any major decisions. At Prosperity Finance, we always move one step further and drill down to the root reason. In this case, when the client requested us to help him re-fix with a lower mortgage rate, we found out the reason behind his high interest rates. Not only did we helped him secure a lower home loan rate, but also found another lender with a lower rate for his personal loan by implementing a personalised loan structure, so that he could pay off the loans faster and save interest on home loans and personal loans.

Prosperity Finance – here to help

That’s kind of values we add to our clients every day. As experienced mortgage adviser, we take a strategic and long-term approach towards finding you the best loan structure. If you are thinking about buying a property or just want to review your current loan structure, please feel free to get in touch with us by calling 09 930 8999, or email: support@profin.co.nz. We’re happy to help.

Other Blogs You Might Like:

How to improve loan structure to save on interest, repay your debt faster, and become mortgage free?

How can a good loan structure work well for you to save $900 on tax per year?

When clients say: “I’ll contact you when I’m ready.” Why you shouldn’t wait until it’s too late.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)