How can a good loan structure work well for you to save $900 on tax per year?

Posted by: Connie in Property Investing

In this week’s blog, we look at one case study to discuss how a good loan structure could help our clients buy a new property without selling your current property, minimise bank’s control on your properties, and save 900 dollars on tax each year.

In the case study, a couple have $260k of annual family income. They have a child who is in middle school.

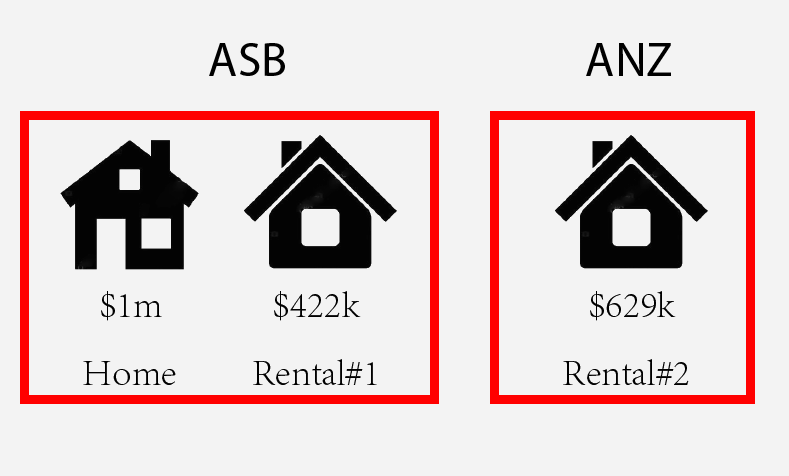

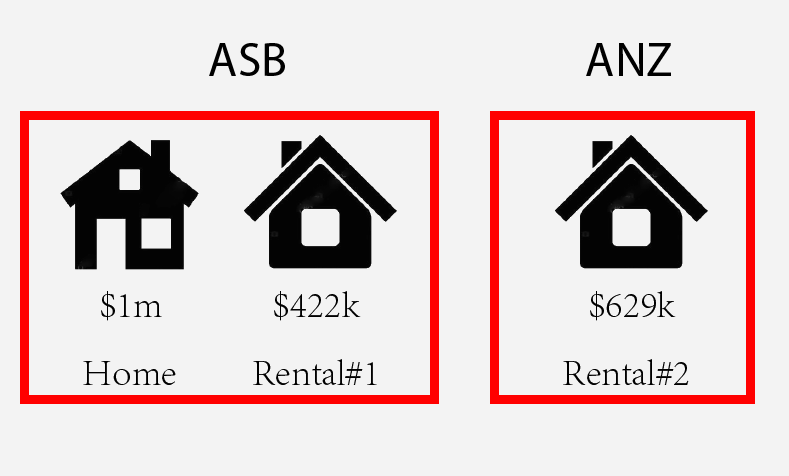

Two years ago, they owned one family home and one rental property in New Zealand, and both of their properties were secured by ASB. The couple approached us and discussed their situation with us to see how we could help them buy another investment property.

We helped them borrow 70% of the purchase price from ANZ. As they have sufficient equity on their properties that secured by ASB, we helped them top up from the equity as their deposit – rather than they have to take years to save.

By using equity from one house to buy another one, they achieved 100% home loan and brought a rental property without cash deposit, and they split their loans into different banks. That impressed the clients because they assumed that they had to borrow money from ASB again to buy their second investment property.

How a good loan structure can work well for you to save $900 on tax per year?

Video Timeline

1. Can I buy another house before I sell mine? 00:20

2. How do we help the clients save $900 on tax per year by using a smart loan structure? 04:50

Can I buy another house before I sell mine?

Two years later, the client approached us and planned to upgrade family home.

They said: “We plan to sell our current family home which is worth $1 million, and then buy another house.”

Then we asked them two questions:

“What’s your budget for your new home?”

“Why do you want to sell your current family home?”

Some people might assume they wouldn’t have borrowing power to buy another property until they sell their current property.

The client told us they would seriously control their budget within $1.2 million. They wanted to sell their existing house because they worried they wouldn’t be able to buy another house until they sell their current home. But in this situation, they can afford to buy another property without selling their current one, given their financial situation and budget. If they could qualify for sufficient home loan, they would consider not selling their family home at this stage. Then they could take their time to make some improvements on this house– not in a hurry to sell it now.

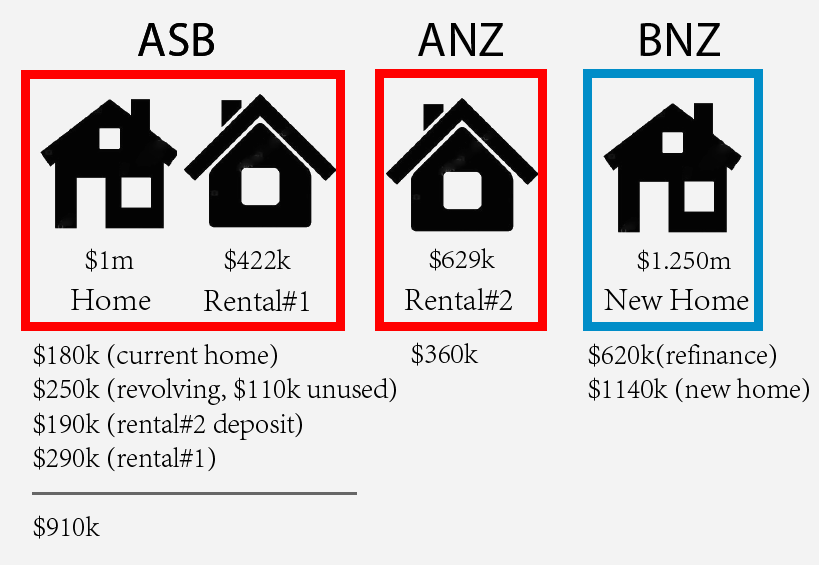

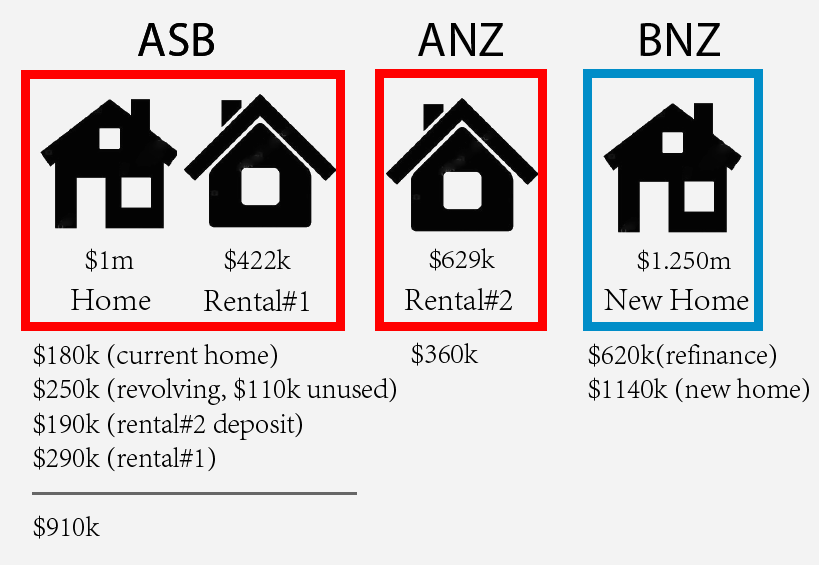

Their family home and one investment property were secured by ASB, with the combined loan amount of $910k:

- $180k (loan against their current family home)

- $250k (revolving facility including $110k unused credit)

- $190k (deposit for their second rental property)

- $290k (loan against their first rental property)

It is common to see that some people borrow money from the same bank when they purchase two or more properties. However, this might not be a good idea. When you have multiple properties secured with the same bank, they will interlink all of your properties for added security. That’s why we helped the clients split their banks.

When we calculated how much they could borrow for their new family home, we helped the clients apply for a home loan from BNZ because BNZ could lend them the most ($1.14 million), and also keep their new family home away from the other two rental properties. By adding up their unused revolving credit of $110k, the total loan amount they could afford was $1.25 million, which exceeded their budget.

How do we help the clients save $900 on tax per year by using a smart loan structure?

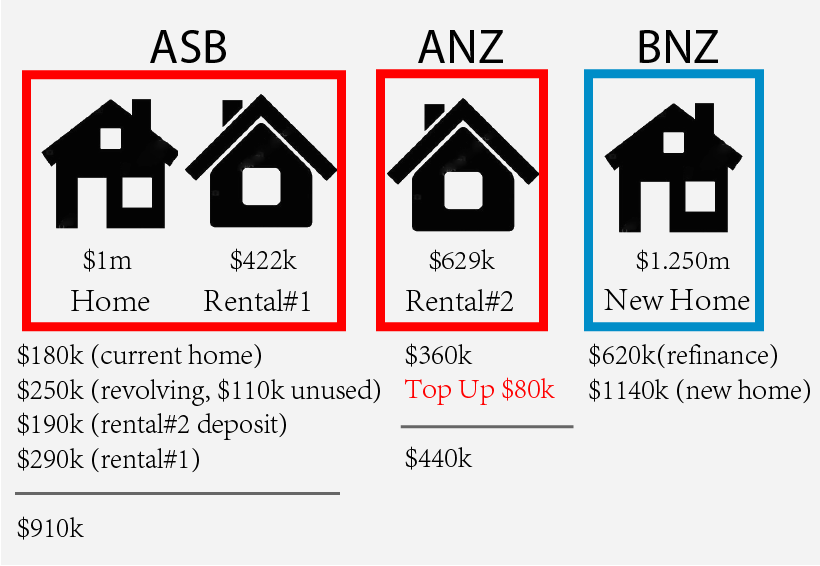

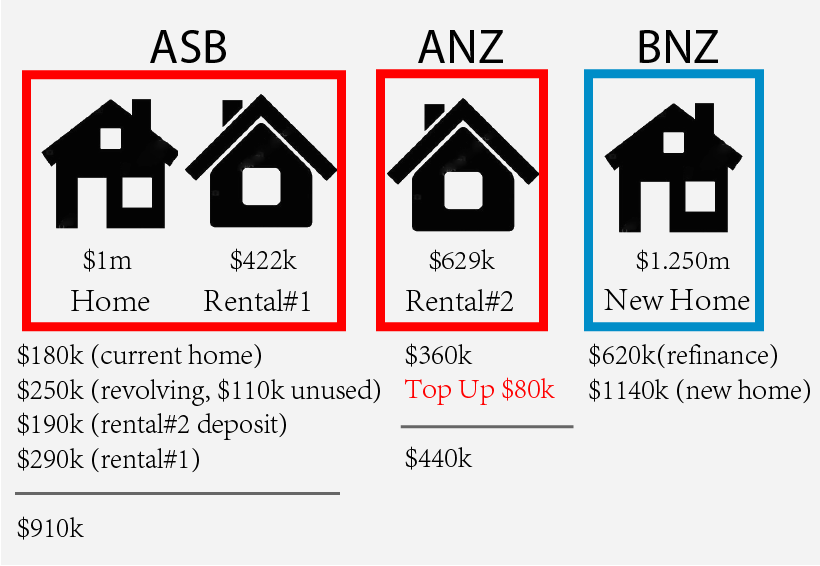

The total loan amount secured against their old family home was $620k, including $180k (old family home), $250k (revolving facility) and $190k (deposit for their second rental property). To use the equity from their old family home, we helped the clients refinance their $620k of home loan from ASB to BNZ.

By doing that, the combined loan amount under BNZ was $1.76 million:

- $620k (refinanced)

- $1140k (new family home)

If the clients sell their old family home ($1million) and keep their new home ($1.25 million), then the maximum loan they can retain at BNZ will be $1 million (80% of $1.25 million), and they will need to pay off the remaining loan balance of $760k, including $190k (deposit for their second rental property), which means the interest on $190k will be no longer able to offset rental income.

We noticed that the market value for their second rental property has increased from more than $500k to $629k. Based on their increased property value, we helped them top up $80k against the rental property. So, the loan balance against their second rental property increased from $360k to $ 440k.

By topping up $80k from their second rental property, they only need to transfer $110k loan against their rental property to family home. According to the mortgage rate of 3.4%, the $80k loan generates $2720 ($80k x 3.4%) in interests. At the 33% tax rate, we helped them save near $900 ($2720 x 33%) in tax.

What’s more, when clients are ready to sell their old family home, we can help them restructure by having revolving facility so that they can offset their BNZ loan against net sale proceeds and some more interests.

In conclusion, we helped the clients in the following areas:

1. Buying another property without selling their current house

2. Splitting their home loans with different banks, including ASB, ANZ and BNZ – minimizing the banks’ control over their properties.

3. Saving roughly $900 on tax per year.

4. Setting a revolving facility to offset the net sale proceeds from selling their family home – helping them make save in tax and increase the loan flexibility.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Prosperity Finance – here to help

That’s kind of values we add to our clients every day. As experienced mortgage adviser, we take a strategic and long-term approach towards finding you the best loan structure. If you are thinking about buying a property or just want to review your current loan structure, please feel free to get in touch with us by calling 09 930 8999, or email: support@profin.co.nz. We’re happy to help.

Other Blogs You Might Like:

Turning your home into a rental property? Get the structure right

Incorrectly converting home to investment property could cost you extra $7k a year

Why should you consider refinancing your mortgage?

Your sale proceeds could be at risk when you hold multiple properties secured with one lender

In this week’s blog, we look at one case study to discuss how a good loan structure could help our clients buy a new property without selling your current property, minimise bank’s control on your properties, and save 900 dollars on tax each year.

In the case study, a couple have $260k of annual family income. They have a child who is in middle school.

Two years ago, they owned one family home and one rental property in New Zealand, and both of their properties were secured by ASB. The couple approached us and discussed their situation with us to see how we could help them buy another investment property.

We helped them borrow 70% of the purchase price from ANZ. As they have sufficient equity on their properties that secured by ASB, we helped them top up from the equity as their deposit – rather than they have to take years to save.

By using equity from one house to buy another one, they achieved 100% home loan and brought a rental property without cash deposit, and they split their loans into different banks. That impressed the clients because they assumed that they had to borrow money from ASB again to buy their second investment property.

How a good loan structure can work well for you to save $900 on tax per year?

Video Timeline

1. Can I buy another house before I sell mine? 00:20

2. How do we help the clients save $900 on tax per year by using a smart loan structure? 04:50

Can I buy another house before I sell mine?

Two years later, the client approached us and planned to upgrade family home.

They said: “We plan to sell our current family home which is worth $1 million, and then buy another house.”

Then we asked them two questions:

“What’s your budget for your new home?”

“Why do you want to sell your current family home?”

Some people might assume they wouldn’t have borrowing power to buy another property until they sell their current property.

The client told us they would seriously control their budget within $1.2 million. They wanted to sell their existing house because they worried they wouldn’t be able to buy another house until they sell their current home. But in this situation, they can afford to buy another property without selling their current one, given their financial situation and budget. If they could qualify for sufficient home loan, they would consider not selling their family home at this stage. Then they could take their time to make some improvements on this house– not in a hurry to sell it now.

Their family home and one investment property were secured by ASB, with the combined loan amount of $910k:

- $180k (loan against their current family home)

- $250k (revolving facility including $110k unused credit)

- $190k (deposit for their second rental property)

- $290k (loan against their first rental property)

It is common to see that some people borrow money from the same bank when they purchase two or more properties. However, this might not be a good idea. When you have multiple properties secured with the same bank, they will interlink all of your properties for added security. That’s why we helped the clients split their banks.

When we calculated how much they could borrow for their new family home, we helped the clients apply for a home loan from BNZ because BNZ could lend them the most ($1.14 million), and also keep their new family home away from the other two rental properties. By adding up their unused revolving credit of $110k, the total loan amount they could afford was $1.25 million, which exceeded their budget.

How do we help the clients save $900 on tax per year by using a smart loan structure?

The total loan amount secured against their old family home was $620k, including $180k (old family home), $250k (revolving facility) and $190k (deposit for their second rental property). To use the equity from their old family home, we helped the clients refinance their $620k of home loan from ASB to BNZ.

By doing that, the combined loan amount under BNZ was $1.76 million:

- $620k (refinanced)

- $1140k (new family home)

If the clients sell their old family home ($1million) and keep their new home ($1.25 million), then the maximum loan they can retain at BNZ will be $1 million (80% of $1.25 million), and they will need to pay off the remaining loan balance of $760k, including $190k (deposit for their second rental property), which means the interest on $190k will be no longer able to offset rental income.

We noticed that the market value for their second rental property has increased from more than $500k to $629k. Based on their increased property value, we helped them top up $80k against the rental property. So, the loan balance against their second rental property increased from $360k to $ 440k.

By topping up $80k from their second rental property, they only need to transfer $110k loan against their rental property to family home. According to the mortgage rate of 3.4%, the $80k loan generates $2720 ($80k x 3.4%) in interests. At the 33% tax rate, we helped them save near $900 ($2720 x 33%) in tax.

What’s more, when clients are ready to sell their old family home, we can help them restructure by having revolving facility so that they can offset their BNZ loan against net sale proceeds and some more interests.

In conclusion, we helped the clients in the following areas:

1. Buying another property without selling their current house

2. Splitting their home loans with different banks, including ASB, ANZ and BNZ – minimizing the banks’ control over their properties.

3. Saving roughly $900 on tax per year.

4. Setting a revolving facility to offset the net sale proceeds from selling their family home – helping them make save in tax and increase the loan flexibility.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Prosperity Finance – here to help

That’s kind of values we add to our clients every day. As experienced mortgage adviser, we take a strategic and long-term approach towards finding you the best loan structure. If you are thinking about buying a property or just want to review your current loan structure, please feel free to get in touch with us by calling 09 930 8999, or email: support@profin.co.nz. We’re happy to help.

Other Blogs You Might Like:

Turning your home into a rental property? Get the structure right

Incorrectly converting home to investment property could cost you extra $7k a year

Why should you consider refinancing your mortgage?

Your sale proceeds could be at risk when you hold multiple properties secured with one lender

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)