Loan to value ratio (LVR) restrictions for investment property return to 70%

Posted by: Connie in Property Investing

The property market in New Zealand is hot and the loan to value ratio (LVR) for investment property is back on the table. Last week (11th November), ASB announced to move immediately to increase the minimum deposit required for investment property loan from 20 percent to 30 percent. Following ASB, ANZ said it would bring in 30 percent deposit rate from 7th December. Investors now are rushing to secure low deposit property loan while they still can, before 70% LVR restrictions being reintroduced.

LVR restrictions for investment property NZ return to 70%

Video Timeline

1. Review: LVR restrictions 2020 NZ - 00:11

2. Two New Zealand banks bring in 80% loan to value ratio for investment property, ahead of Reserve Bank rules - 02:06

3. Which New Zealand lenders/banks are still lending 80% LVR on investment property loan? – 03:01

4. Loan to value ratio for investment property returns from 80% to 70%, what difference it makes on leverage equity to buy another investment property? – 05:00

5. What action should you take before 70% of LVR restriction applies on investment property loan? - 08:30

6. How will you be impacted by the return of the 70% LVR restrictions on an investment property? - 15:01

1. Review: LVR restrictions 2020 NZ

On 1st May 2020, the New Zealand Reserve Bank(RBNZ) has removed mortgage loan-to-value ratio (LVR) restriction, as part of a range of economic stimulus measures designed to combat the recessionary effects of the COVID-19 pandemic earlier this year. The LVR restrictions were originally intended to be removed until May 2021, but the RBNZ is likely to bring that forward and reintroduce in March 2021.

Some borrowers had misunderstanding that they wouldn’t need a deposit to buy a rental property anymore, which was not the case. It just means banks don’t need to comply with the LVR rule. Considering banks have their own lending rules, they’ll never lender on 100%.

After the announcement of the LVR rules in May 2020, we’ve seen most of New Zealand banks, such as ANZ, ASB, BNZ, Kiwibank and Bank of China increased their loan to value ratio for investment property from 70% to 80%. This allows investors to have the chance of only having 20% deposit for buying an investment property. Only a few banks including Westpac, SBS and Co-operative Bank didn’t act. The increasing of LVR to 80% is good news for property investors, especially for those who have enough income but insufficient equity for buying another rental property. We’ll reveal more details in below.

2. Two New Zealand banks bring in 80% loan to value ratio for investment property, ahead of Reserve Bank rules

The property market seems a bit overheated and we’re witnessing rapid growth in mortgage lending volumes as well. We were quite surprised that the LVR restriction is back before the end of this year, and it’ll come into force in 3 weeks’ time.

There are two New Zealand banks setting their loan to value ratio for investment property back to 70% so far- ASB announced to set their LVR back to 70% and come into force immediately, followed by ANZ but investors still have 3 weeks to secure the current low deposit loan.

3. Which New Zealand lenders/banks are still lending 80% LVR on investment property loan?

If you’re eager to get 20% deposit loans for buying a rental property, there are still some banks/lenders lend 80% of LVR as we listed in the following:

ANZ – still lending 80% LVR on investment property loan until 7th December 2020.

BNZ – at the time of writing, they only allow their own customers to borrow on 80% LVR. However, BNZ applies different servicing rules for different LVR percentage, which means based on the same income, they may lend more on 80% LVR than 70% LVR for investment property.

Bank of China (New Zealand) – for now they are still lending on 80% LVR for investment property loan. Due to the strong sales activity in the market, banks are experiencing a high volume of requests. Bank of China currently close home loan pre-approvals and only open their doors for live deals with minimum loan size of $1 million. A live deal means you’ve signed the Sale and Purchase agreement on a property with a finance condition. These purchase often happens through negotiation, not auction.

Primary non-bank lenders – They have been lending on 80% of LVR for investment property for a long time, even before 1st May this year (when RBNZ removed the LVR restrictions). They are not traditional registered banks, but they provide lending services very similar to banks. When your bank or current lender says no, non-bank lenders may give you more lending options. They charge slightly higher interest rates than those offered by traditional banks, but still affordable. For example, a bank may charge you 2.39%, and a non-bank lender probably charges you between 3% and 4%.

4. Loan to value ratio for investment property returns from 80% to 70%, what difference it makes on leverage equity to buy another investment property?

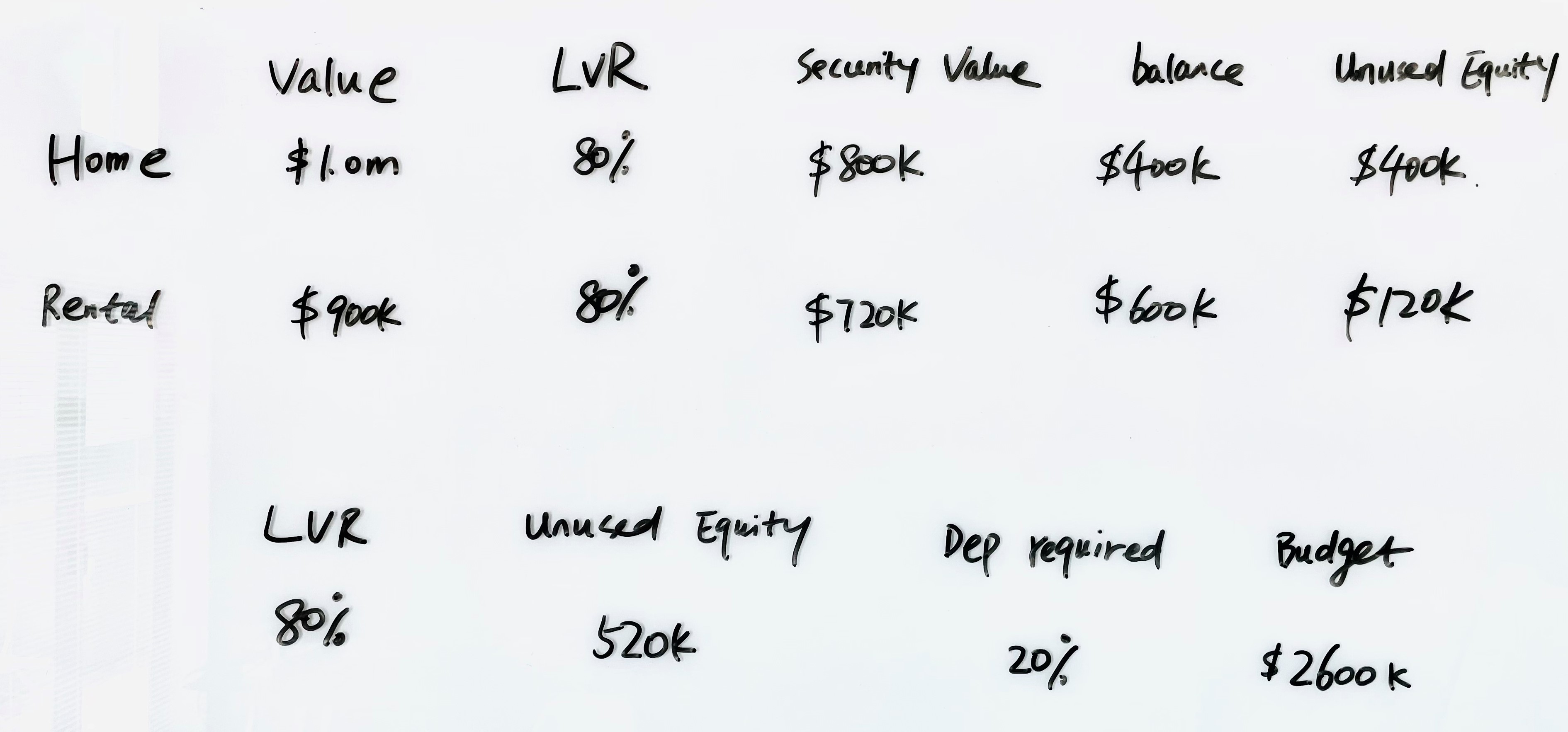

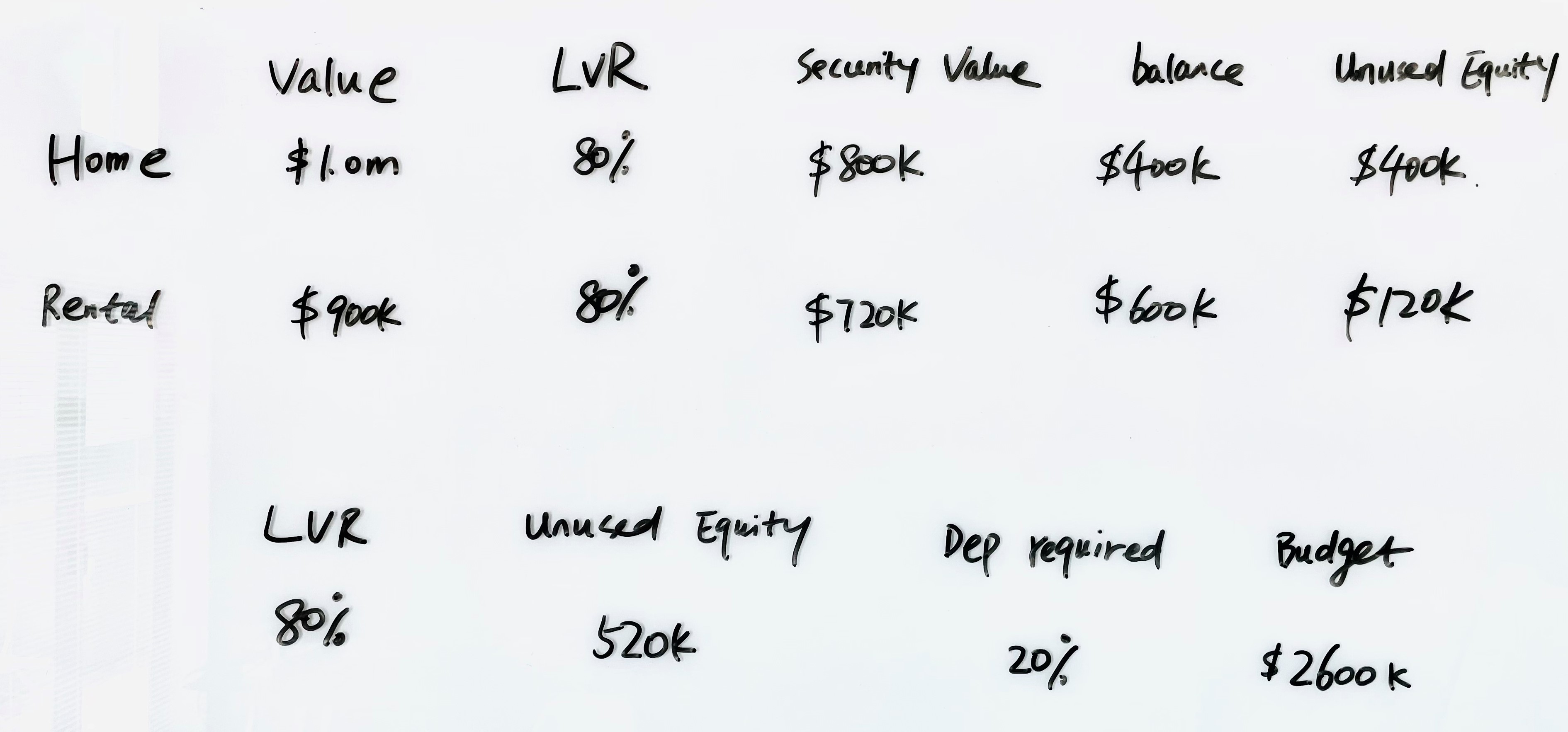

Say you have two properties. One is a family home and another one is a rental property. Your family home worth one million dollar. Based on 80% of LVR restriction for owner-occupied property, your bank can lend you up to $800k against that property. The current balance on your family home is $400k, then the unused equity is $400k ($800k minus $400k).

Based on 80% of LVR for investment property loan, how much can you borrow to buy another house?

Your rental property worth $900k. Under the scenario of 80% LVR, your bank is happy to secure the loan up to $720K. Now let's say the property already borrowed $600K, then the unsecured part on the rental property is $120K.

When 80% of LVR restriction applies to the rental property, the total of unused equity, in this case, is $520k. Considering only 20% deposit required for buying an investment property, you can buy another house that worth up to $2.6 million (assume your income is enough to service the loan) by leveraging equity in your existing properties, rather than cash deposit.

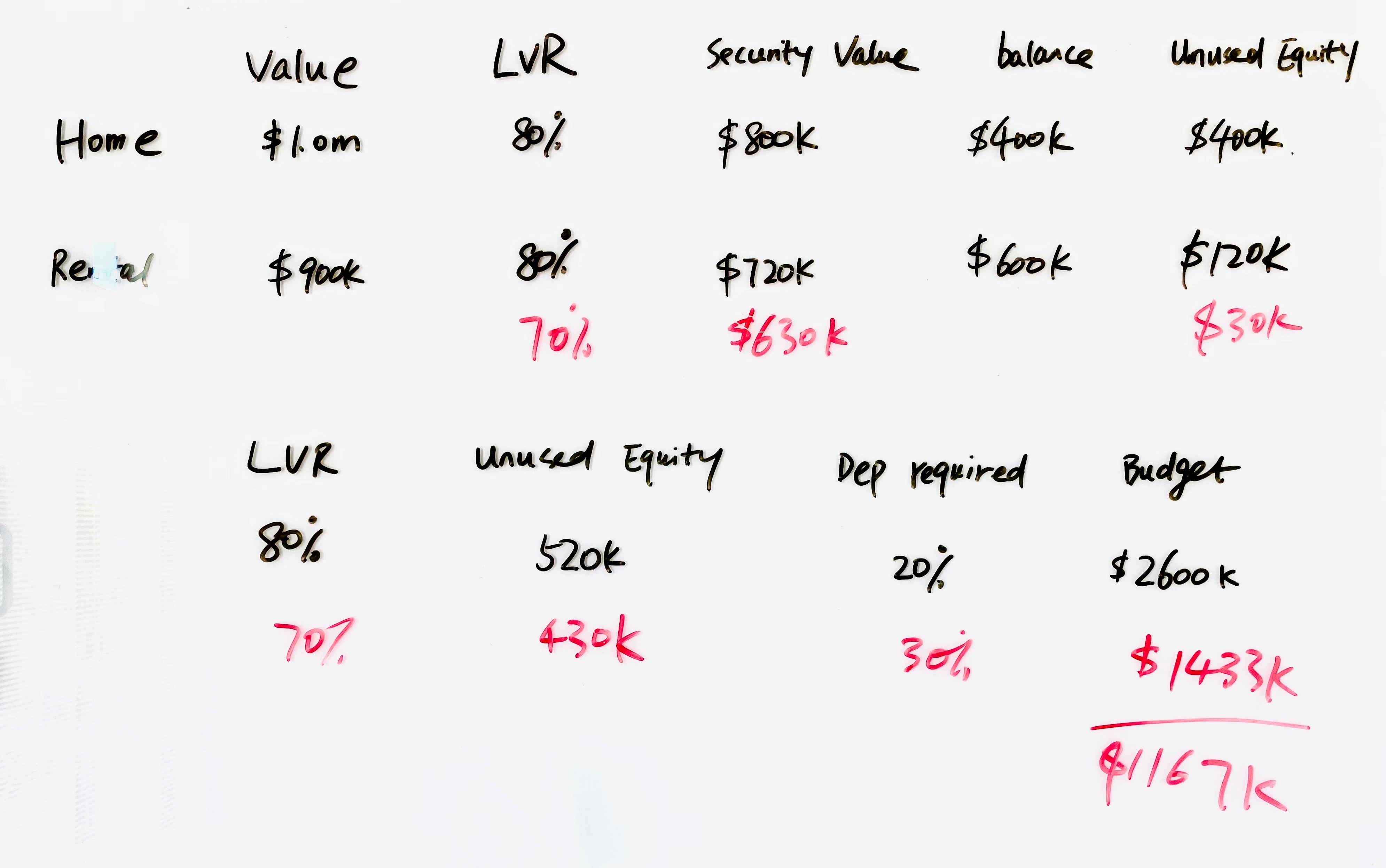

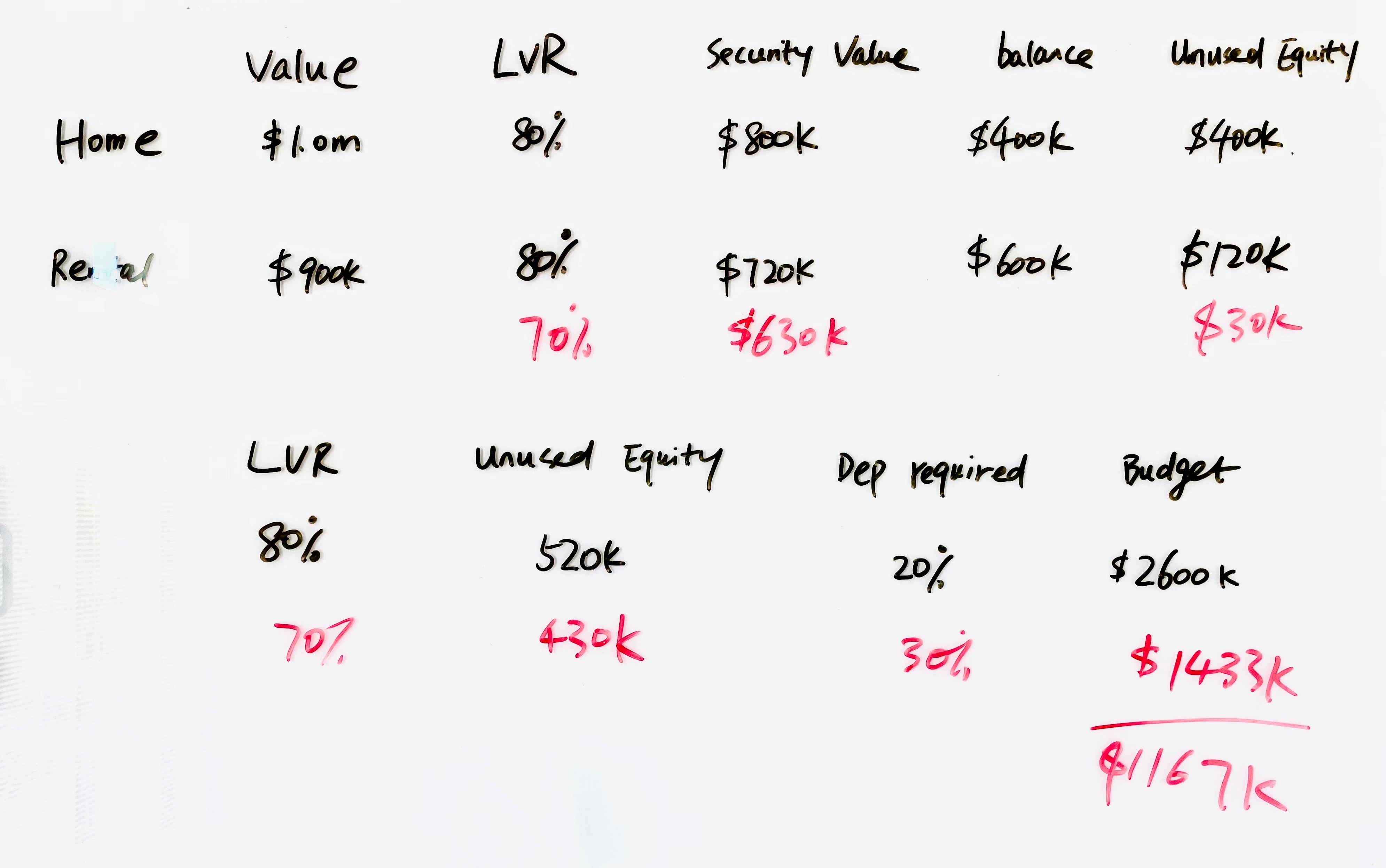

When 70% of LVR for investment property loan returns, how much can you borrow to buy another house?

When banks bring back 70% LVR for an investment property loan, the security value for the rental property, in this case, decrease to $630k. Then the unused equity in that property decrease to $30k as well, not $120k anymore. In this situation, the unused equity across the two is only $430K. When more deposit (30%) is required but your equity becomes less, your budget for buying next rental property reduces to $1.43 million (on the premise of having sufficient income to service the loan). The difference between the two scenarios is $1.167million, which means when the LVR is 80%, you may buy two rental properties but now only one. Plus, if you have many rental properties and you’re thinking about buying more by using the equity in your existing properties, the difference between 70% LVR and 80% LVR will be much more significant.

5. What action should you take before 70% of LVR restriction applies on investment property loan?

ASB and ANZ have already tightened up their LVR restriction for an investment property loan, but there are some other banks/lenders in the market currently applying 80% of LVR restriction. Before they may follow the leads, you can do something to lock in the unused equity in your existing properties, so that you can maximize your borrowing capacity for purchasing your next rental property. We covered this topic from the video published on 1st July this year. Here is the summary:

If your family home and investment property are mortgaged to the same bank:

Firstly, split your properties with different banks and borrow 80% on the existing rental property.

When you only deal with one bank and your properties are cross secured, sometimes you’re more at risk. We highly recommend you separate them by refinancing some of the properties and borrow 80% on the existing rental property, to take advantage of the current 80% of LVR. That way helps you reserve the equity, which means when the LVR returns to 70%, you won’t lose the equity and you’ll be able to borrow more for purchasing an investment property.

When it comes to which mortgage to be refinanced, there are a number of factors we need to factor in. For example, when you borrow the money, you get cashback from the bank. If you leave the bank within three or four years depends on which bank you deal with, they will claim all or some part of your cashback. Also, other factors like which bank is suitable for holding home and which bank for holding rental property. We don’t have a one-size-fits-all solution for your home loan. That’s why we need to look at your individual case, understand your needs and situation, then make a tailored solution for you.

Secondly, discharge some of the existing properties if possible.

When you have enough equity to secure the loan, you can potentially discharge any existing security. For example, in the case we discussed above, say you can borrow up to $1.5 million and you only have $1 million of debt. That means you have enough security to secure the loan. If you have a third property and also mortgaged to the same bank, then it's not necessary because the bank has enough security. So the property can be discharged.

Why should you discharge the property? When your bank no longer holds the property as security for the home loan, you’ll avoid the bank’s control over your assets. On top of that, if you are planning to continue borrowing against that mortgage-free property, you can go to the bank that can lend you the maximum, rather than sticking to your existing bank.

If your family home and investment property have already mortgaged to different banks:

When you already split the banks, we would recommend review if your rental property is secured with the bank that can lend you 80% of the LVR. If not, think about refinancing to another bank who can lend you 80%. However, be aware some costs associated with refinancing may occur, such as breaking costs if you are still on the fixed-term loan, and paying back partial or full of the cashback if you’re in the clause periods (typically three or four years).

If the bank that holds your rental property still allow 80% of LVR, but you haven’t borrow that amount, then top up your loan against the rental property to 80% and use the top up money to repay the loan against your family home. By this way, all your equity will sit with your family home. Even though the LVR is back to 70%, you don’t need to worry that bank asks you to repay that amount because you’ve already borrowed 80% on the investment property.

Get a property valuation by a valuer

How does the bank value your property as a mortgage? Banks use EV (Estimated Valuation) as a valuation report from a third-party provider. This report contains an estimated value calculated by looking at recent and historical comparable sales in the surrounding area. However, given the rapid growth of the current housing market, the EV may underestimate the real value of a property.

If you believe the real value of your property is higher than the figure from EV, then a Registered Valuation (RV) might be helpful. A registered valuation is provided by a valuer at the cost of around 0.1% of the property value, and usually accepted by the bank to secure a loan on the property. A registered valuation can be added as a condition to a home loan offer. That means you can potentially get more equity out, and you won’t need to prove the real value of your property to your bank until your application is approved.

6. How will you be impacted by the return of the 70% LVR restrictions on an investment property?

In the last few days, one of the most frequently asked questions was: “I’m ready to apply for/have got a home loan pre-approval, how will the return of the 70% LVR restriction on investment property loan affect me?

Our suggestion is, if you’re planning to apply for a loan pre-approval but haven’t started yet, you’ll need to submit the application as soon as possible as other banks may move quickly and apply the new rule any time from now on.

If you already have a pre-approval for buying an investment property, try your best to secure a suitable property before it expires. Otherwise, you have to follow the new rules.

Thinking about buying another investment property?

If you’re planning to apply for a home loan to buy your next investment property, we highly recommend you start the process now. This is because a longer time required to process home loan applications due to the Christmas peak season, coupled with hot property market sales activity, have made banks’ turnaround time worse than ever in 2020. Plus, banks like ANZ start applying their new LVR restrictions from 7th December, which may cause more investors rush into the property market, resulting in the potential longer turnaround time for banks.

Got questions? Or seek help? We’re more than happy to chat. Call us at 09 930 8999 for a chat with one of our mortgage advisors. At Prosperity Finance, we don’t have a one-size-fits-all solution for your home loan. We look at your case, understand your needs and situation then make a tailored solution for you.

More Articles:

LVR restrictions 2021: loan-to-value ratio for investment property reduced to 60%

How to take advantage of 80% LVR on investment property loan and lock it in?

NZ housing market forecast 2021: Will house prices keep increasing?

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

The property market in New Zealand is hot and the loan to value ratio (LVR) for investment property is back on the table. Last week (11th November), ASB announced to move immediately to increase the minimum deposit required for investment property loan from 20 percent to 30 percent. Following ASB, ANZ said it would bring in 30 percent deposit rate from 7th December. Investors now are rushing to secure low deposit property loan while they still can, before 70% LVR restrictions being reintroduced.

LVR restrictions for investment property NZ return to 70%

Video Timeline

1. Review: LVR restrictions 2020 NZ - 00:11

2. Two New Zealand banks bring in 80% loan to value ratio for investment property, ahead of Reserve Bank rules - 02:06

3. Which New Zealand lenders/banks are still lending 80% LVR on investment property loan? – 03:01

4. Loan to value ratio for investment property returns from 80% to 70%, what difference it makes on leverage equity to buy another investment property? – 05:00

5. What action should you take before 70% of LVR restriction applies on investment property loan? - 08:30

6. How will you be impacted by the return of the 70% LVR restrictions on an investment property? - 15:01

1. Review: LVR restrictions 2020 NZ

On 1st May 2020, the New Zealand Reserve Bank(RBNZ) has removed mortgage loan-to-value ratio (LVR) restriction, as part of a range of economic stimulus measures designed to combat the recessionary effects of the COVID-19 pandemic earlier this year. The LVR restrictions were originally intended to be removed until May 2021, but the RBNZ is likely to bring that forward and reintroduce in March 2021.

Some borrowers had misunderstanding that they wouldn’t need a deposit to buy a rental property anymore, which was not the case. It just means banks don’t need to comply with the LVR rule. Considering banks have their own lending rules, they’ll never lender on 100%.

After the announcement of the LVR rules in May 2020, we’ve seen most of New Zealand banks, such as ANZ, ASB, BNZ, Kiwibank and Bank of China increased their loan to value ratio for investment property from 70% to 80%. This allows investors to have the chance of only having 20% deposit for buying an investment property. Only a few banks including Westpac, SBS and Co-operative Bank didn’t act. The increasing of LVR to 80% is good news for property investors, especially for those who have enough income but insufficient equity for buying another rental property. We’ll reveal more details in below.

2. Two New Zealand banks bring in 80% loan to value ratio for investment property, ahead of Reserve Bank rules

The property market seems a bit overheated and we’re witnessing rapid growth in mortgage lending volumes as well. We were quite surprised that the LVR restriction is back before the end of this year, and it’ll come into force in 3 weeks’ time.

There are two New Zealand banks setting their loan to value ratio for investment property back to 70% so far- ASB announced to set their LVR back to 70% and come into force immediately, followed by ANZ but investors still have 3 weeks to secure the current low deposit loan.

3. Which New Zealand lenders/banks are still lending 80% LVR on investment property loan?

If you’re eager to get 20% deposit loans for buying a rental property, there are still some banks/lenders lend 80% of LVR as we listed in the following:

ANZ – still lending 80% LVR on investment property loan until 7th December 2020.

BNZ – at the time of writing, they only allow their own customers to borrow on 80% LVR. However, BNZ applies different servicing rules for different LVR percentage, which means based on the same income, they may lend more on 80% LVR than 70% LVR for investment property.

Bank of China (New Zealand) – for now they are still lending on 80% LVR for investment property loan. Due to the strong sales activity in the market, banks are experiencing a high volume of requests. Bank of China currently close home loan pre-approvals and only open their doors for live deals with minimum loan size of $1 million. A live deal means you’ve signed the Sale and Purchase agreement on a property with a finance condition. These purchase often happens through negotiation, not auction.

Primary non-bank lenders – They have been lending on 80% of LVR for investment property for a long time, even before 1st May this year (when RBNZ removed the LVR restrictions). They are not traditional registered banks, but they provide lending services very similar to banks. When your bank or current lender says no, non-bank lenders may give you more lending options. They charge slightly higher interest rates than those offered by traditional banks, but still affordable. For example, a bank may charge you 2.39%, and a non-bank lender probably charges you between 3% and 4%.

4. Loan to value ratio for investment property returns from 80% to 70%, what difference it makes on leverage equity to buy another investment property?

Say you have two properties. One is a family home and another one is a rental property. Your family home worth one million dollar. Based on 80% of LVR restriction for owner-occupied property, your bank can lend you up to $800k against that property. The current balance on your family home is $400k, then the unused equity is $400k ($800k minus $400k).

Based on 80% of LVR for investment property loan, how much can you borrow to buy another house?

Your rental property worth $900k. Under the scenario of 80% LVR, your bank is happy to secure the loan up to $720K. Now let's say the property already borrowed $600K, then the unsecured part on the rental property is $120K.

When 80% of LVR restriction applies to the rental property, the total of unused equity, in this case, is $520k. Considering only 20% deposit required for buying an investment property, you can buy another house that worth up to $2.6 million (assume your income is enough to service the loan) by leveraging equity in your existing properties, rather than cash deposit.

When 70% of LVR for investment property loan returns, how much can you borrow to buy another house?

When banks bring back 70% LVR for an investment property loan, the security value for the rental property, in this case, decrease to $630k. Then the unused equity in that property decrease to $30k as well, not $120k anymore. In this situation, the unused equity across the two is only $430K. When more deposit (30%) is required but your equity becomes less, your budget for buying next rental property reduces to $1.43 million (on the premise of having sufficient income to service the loan). The difference between the two scenarios is $1.167million, which means when the LVR is 80%, you may buy two rental properties but now only one. Plus, if you have many rental properties and you’re thinking about buying more by using the equity in your existing properties, the difference between 70% LVR and 80% LVR will be much more significant.

5. What action should you take before 70% of LVR restriction applies on investment property loan?

ASB and ANZ have already tightened up their LVR restriction for an investment property loan, but there are some other banks/lenders in the market currently applying 80% of LVR restriction. Before they may follow the leads, you can do something to lock in the unused equity in your existing properties, so that you can maximize your borrowing capacity for purchasing your next rental property. We covered this topic from the video published on 1st July this year. Here is the summary:

If your family home and investment property are mortgaged to the same bank:

Firstly, split your properties with different banks and borrow 80% on the existing rental property.

When you only deal with one bank and your properties are cross secured, sometimes you’re more at risk. We highly recommend you separate them by refinancing some of the properties and borrow 80% on the existing rental property, to take advantage of the current 80% of LVR. That way helps you reserve the equity, which means when the LVR returns to 70%, you won’t lose the equity and you’ll be able to borrow more for purchasing an investment property.

When it comes to which mortgage to be refinanced, there are a number of factors we need to factor in. For example, when you borrow the money, you get cashback from the bank. If you leave the bank within three or four years depends on which bank you deal with, they will claim all or some part of your cashback. Also, other factors like which bank is suitable for holding home and which bank for holding rental property. We don’t have a one-size-fits-all solution for your home loan. That’s why we need to look at your individual case, understand your needs and situation, then make a tailored solution for you.

Secondly, discharge some of the existing properties if possible.

When you have enough equity to secure the loan, you can potentially discharge any existing security. For example, in the case we discussed above, say you can borrow up to $1.5 million and you only have $1 million of debt. That means you have enough security to secure the loan. If you have a third property and also mortgaged to the same bank, then it's not necessary because the bank has enough security. So the property can be discharged.

Why should you discharge the property? When your bank no longer holds the property as security for the home loan, you’ll avoid the bank’s control over your assets. On top of that, if you are planning to continue borrowing against that mortgage-free property, you can go to the bank that can lend you the maximum, rather than sticking to your existing bank.

If your family home and investment property have already mortgaged to different banks:

When you already split the banks, we would recommend review if your rental property is secured with the bank that can lend you 80% of the LVR. If not, think about refinancing to another bank who can lend you 80%. However, be aware some costs associated with refinancing may occur, such as breaking costs if you are still on the fixed-term loan, and paying back partial or full of the cashback if you’re in the clause periods (typically three or four years).

If the bank that holds your rental property still allow 80% of LVR, but you haven’t borrow that amount, then top up your loan against the rental property to 80% and use the top up money to repay the loan against your family home. By this way, all your equity will sit with your family home. Even though the LVR is back to 70%, you don’t need to worry that bank asks you to repay that amount because you’ve already borrowed 80% on the investment property.

Get a property valuation by a valuer

How does the bank value your property as a mortgage? Banks use EV (Estimated Valuation) as a valuation report from a third-party provider. This report contains an estimated value calculated by looking at recent and historical comparable sales in the surrounding area. However, given the rapid growth of the current housing market, the EV may underestimate the real value of a property.

If you believe the real value of your property is higher than the figure from EV, then a Registered Valuation (RV) might be helpful. A registered valuation is provided by a valuer at the cost of around 0.1% of the property value, and usually accepted by the bank to secure a loan on the property. A registered valuation can be added as a condition to a home loan offer. That means you can potentially get more equity out, and you won’t need to prove the real value of your property to your bank until your application is approved.

6. How will you be impacted by the return of the 70% LVR restrictions on an investment property?

In the last few days, one of the most frequently asked questions was: “I’m ready to apply for/have got a home loan pre-approval, how will the return of the 70% LVR restriction on investment property loan affect me?

Our suggestion is, if you’re planning to apply for a loan pre-approval but haven’t started yet, you’ll need to submit the application as soon as possible as other banks may move quickly and apply the new rule any time from now on.

If you already have a pre-approval for buying an investment property, try your best to secure a suitable property before it expires. Otherwise, you have to follow the new rules.

Thinking about buying another investment property?

If you’re planning to apply for a home loan to buy your next investment property, we highly recommend you start the process now. This is because a longer time required to process home loan applications due to the Christmas peak season, coupled with hot property market sales activity, have made banks’ turnaround time worse than ever in 2020. Plus, banks like ANZ start applying their new LVR restrictions from 7th December, which may cause more investors rush into the property market, resulting in the potential longer turnaround time for banks.

Got questions? Or seek help? We’re more than happy to chat. Call us at 09 930 8999 for a chat with one of our mortgage advisors. At Prosperity Finance, we don’t have a one-size-fits-all solution for your home loan. We look at your case, understand your needs and situation then make a tailored solution for you.

More Articles:

LVR restrictions 2021: loan-to-value ratio for investment property reduced to 60%

How to take advantage of 80% LVR on investment property loan and lock it in?

NZ housing market forecast 2021: Will house prices keep increasing?

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)