How to take advantage of 80% LVR on investment property loan and lock it in?

Posted by: Connie in Property Investing

Since 1st May 2020, the New Zealand Reserve Bank has removed mortgage loan-to-value ratio (LVR) restriction. This change marks the end of LVR limits and as a result banks don’t need to comply with the LVR rule for the next 12 months.

After the announcement of the LVR rules, some borrows thought banks removed their internal LVR controls on mortgage lending which this is not the case – LVR restriction removal from the Reserve Bank doesn't mean no LVR rules required on home loan borrowers.

The good news is, we’ve seen three New Zealand banks, including ANZ, ASB and Kiwibank, increased their loan to value ratio for investment property loans from original 70% to 80% so far, while other banks still apply 70% LVR. In our view, these remaining banks will follow the leads very soon.

Then, 80% loan to value ratio for investment property – what are the implications?

First of all, when it comes to how much deposit for buying an investment property, only 20% of the purchase price is required. (The deposit can either come from your cash or equity from your existing properties.) Compared with 30% of deposit, considering if you don’t have enough cash or your current property value hasn’t gone up significantly over the last few years, then 20% may be more achievable.

Secondly, as the removal of the LVR restriction is only valid for 12 months, then by May 2021, Reserve Bank will review the LVR rules and they may reapply the LVR restrictions on investment property back to 70%. This means you might potentially lose some unused equity.

In this video, we discuss how to take the opportunity we’re having right now until May next year to leverage the equity in investment property, using a case study.

80% LVR (Loan to value ratio) for investment property loan

Video Timeline

1. Loan to value ratio for investment property has increased from 70% to 80% (valid until May 2021) – How to max out and leverage equity in investment property? - 02:54

2. How to lock in the unused equity in your existing properties? - 04:37

1. Loan to value ratio for investment property has increased from 70% to 80% (valid until May 2021) – How to max out and leverage equity in investment property?

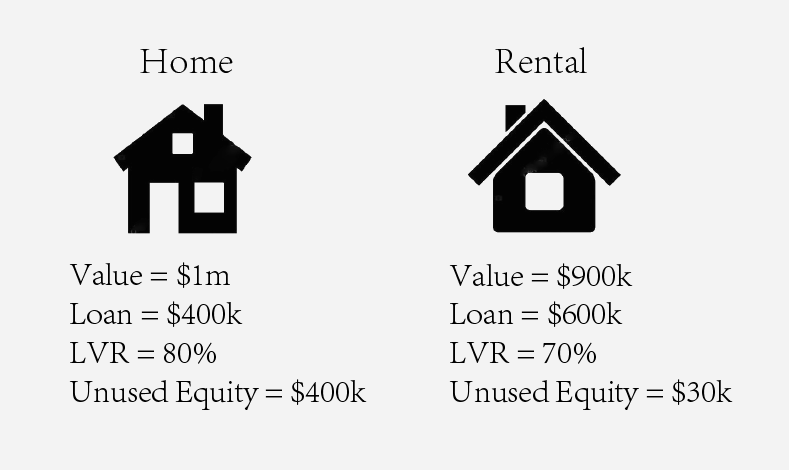

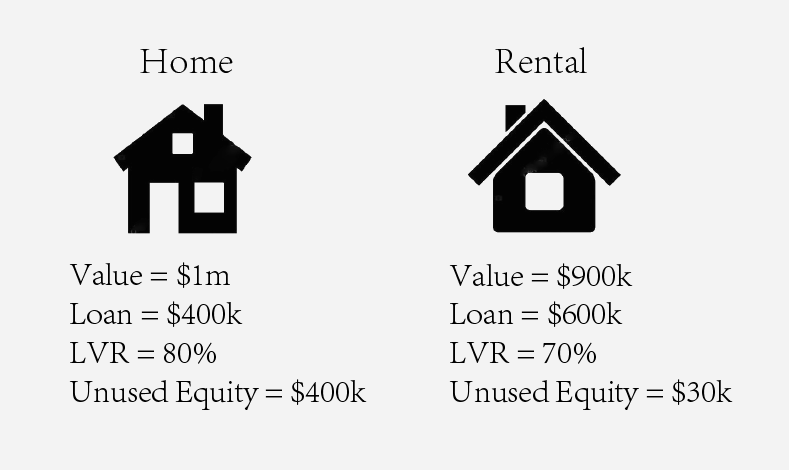

Say you have two properties. One is a family home and another one is a rental property.

| Property Value | Loan Amount | LVR | |

| Family Home | $1 million | $400k | 80% |

| Investment Property | $900k | $600k | Increasing from 70% to 80% |

You have $400k loan against your family home (worth $1 million). For an owner-occupied property, you can go up to 80% LVR, which means you can borrow up to $800k. As you already borrowed $400k on your family home, the unused equity is $400k.

Your investment property is worth $900k and the loan amount is $600k. If the LVR is 70%, then the equity comes to $630K. Considering you already borrowed $600K, your unused equity on the investment property is $30K. In total, you have $430K unused equity from your existing properties.

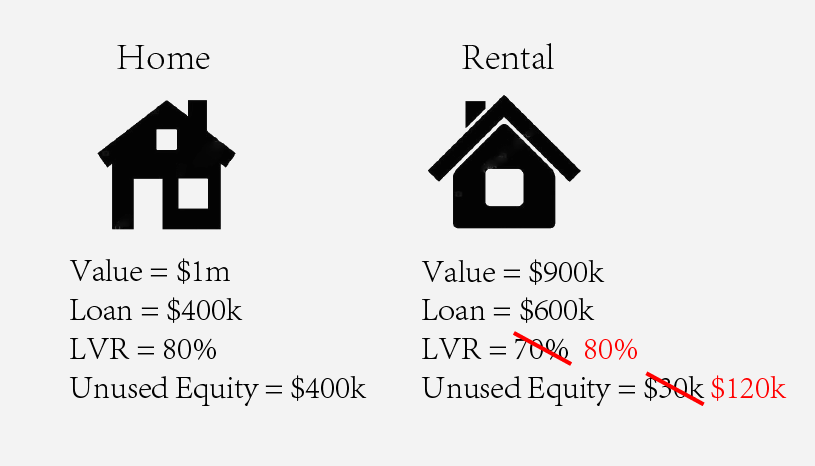

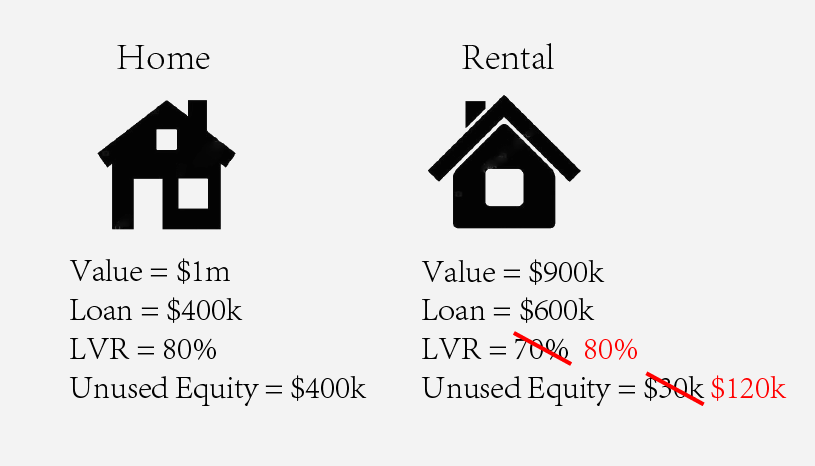

What if your bank is happy to lend you 80% LVR on your rental property? Then your unused equity from your rental property will increase from $30k to $120K. Compared this to the situation of 70% LVR, you’ll have additional $90k equity, which means your property purchasing budget can be increased by $300k (divide $90k by 30% deposit).

2. How to lock in the unused equity in your existing properties?

If you haven’t take action by May next year, and the Reserve Bank reimpose the LVR rules on investment property back to 70%, then you suddenly lose $90K unutilized equity and that means you lose the budget of $300K.

This situation of 80% LVR for investment property might not last forever. If you’re thinking about buying another investment property, what do you need to do then to leverage your equity?

Assumption 1: If your family home and investment property are mortgaged to different banks

We recommend you top up your loan against the investment property to 80% LVR. In this case, you can top up $120K. The purpose of this is to repay the loan that has your home as a mortgage. Your loan for the family home will reduce to from $400k to $280k.

By this way, all your equity will sit with your family home. Even though the LVR may back to 70% in the years to come, you don’t need to worry that bank asks you to repay that $120k loan because you’ve already borrowed 80% on investment property.

Assumption 2: Two properties are mortgaged to one bank

If you only deal with one bank and your properties are cross secured, sometimes you’re more at risk. We highly recommend you separate them by refinancing one of the properties.

When it comes to which mortgage to be refinanced, there are a number of factors we need to factor in. For example, when you borrow the money, you get cash back from the bank. If you leave the bank within three or four years depends on which bank you deal with, they will claim all or some part of your cash back. Also, other factors like which bank is suitable for holding home and which bank for holding rental property. We don’t have a one-size-fits-all solution for your home loan. That’s why we need to look at your individual case, understand your needs and situation, then make a tailored solution for you.

It can be confusing to work out which property needs to be refinanced. As a rule of thumb, your rental property should be mortgaged to a bank that is different from your family home, then top up your loan against your investment property to 80% of the LVR. By this way, you lock the maximum equity and you can leverage your equity when buying your next investment property.

Thinking about financing options for investment property? Review your home loan structure now

Ten months are remaining until May 2021 and how LVR rules are going to change…is not predictable. If you are thinking about buying your next investment property, then get in touch with us immediately – by reviewing your current home loan structure, we’ll help you ensure that the equity in your existing properties can be maxed out.

Plus, start planning right now and you’ll have enough time to wait for your loan coming off with fixed term, or the cash back clause expired, so that you can avoid these unnecessary costs. Call us at 09 930 8999 for a no-obligation chat with our adviser.

Other Blogs You Might Like:

Loan to value ratio (LVR) restrictions for investment property return to 70%

LVR restriction removed and what does it mean for you?

Do you have multiple properties secured with the same bank?

Your sale proceeds could be at risk when you hold multiple properties secured with one lender

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Since 1st May 2020, the New Zealand Reserve Bank has removed mortgage loan-to-value ratio (LVR) restriction. This change marks the end of LVR limits and as a result banks don’t need to comply with the LVR rule for the next 12 months.

After the announcement of the LVR rules, some borrows thought banks removed their internal LVR controls on mortgage lending which this is not the case – LVR restriction removal from the Reserve Bank doesn't mean no LVR rules required on home loan borrowers.

The good news is, we’ve seen three New Zealand banks, including ANZ, ASB and Kiwibank, increased their loan to value ratio for investment property loans from original 70% to 80% so far, while other banks still apply 70% LVR. In our view, these remaining banks will follow the leads very soon.

Then, 80% loan to value ratio for investment property – what are the implications?

First of all, when it comes to how much deposit for buying an investment property, only 20% of the purchase price is required. (The deposit can either come from your cash or equity from your existing properties.) Compared with 30% of deposit, considering if you don’t have enough cash or your current property value hasn’t gone up significantly over the last few years, then 20% may be more achievable.

Secondly, as the removal of the LVR restriction is only valid for 12 months, then by May 2021, Reserve Bank will review the LVR rules and they may reapply the LVR restrictions on investment property back to 70%. This means you might potentially lose some unused equity.

In this video, we discuss how to take the opportunity we’re having right now until May next year to leverage the equity in investment property, using a case study.

80% LVR (Loan to value ratio) for investment property loan

Video Timeline

1. Loan to value ratio for investment property has increased from 70% to 80% (valid until May 2021) – How to max out and leverage equity in investment property? - 02:54

2. How to lock in the unused equity in your existing properties? - 04:37

1. Loan to value ratio for investment property has increased from 70% to 80% (valid until May 2021) – How to max out and leverage equity in investment property?

Say you have two properties. One is a family home and another one is a rental property.

| Property Value | Loan Amount | LVR | |

| Family Home | $1 million | $400k | 80% |

| Investment Property | $900k | $600k | Increasing from 70% to 80% |

You have $400k loan against your family home (worth $1 million). For an owner-occupied property, you can go up to 80% LVR, which means you can borrow up to $800k. As you already borrowed $400k on your family home, the unused equity is $400k.

Your investment property is worth $900k and the loan amount is $600k. If the LVR is 70%, then the equity comes to $630K. Considering you already borrowed $600K, your unused equity on the investment property is $30K. In total, you have $430K unused equity from your existing properties.

What if your bank is happy to lend you 80% LVR on your rental property? Then your unused equity from your rental property will increase from $30k to $120K. Compared this to the situation of 70% LVR, you’ll have additional $90k equity, which means your property purchasing budget can be increased by $300k (divide $90k by 30% deposit).

2. How to lock in the unused equity in your existing properties?

If you haven’t take action by May next year, and the Reserve Bank reimpose the LVR rules on investment property back to 70%, then you suddenly lose $90K unutilized equity and that means you lose the budget of $300K.

This situation of 80% LVR for investment property might not last forever. If you’re thinking about buying another investment property, what do you need to do then to leverage your equity?

Assumption 1: If your family home and investment property are mortgaged to different banks

We recommend you top up your loan against the investment property to 80% LVR. In this case, you can top up $120K. The purpose of this is to repay the loan that has your home as a mortgage. Your loan for the family home will reduce to from $400k to $280k.

By this way, all your equity will sit with your family home. Even though the LVR may back to 70% in the years to come, you don’t need to worry that bank asks you to repay that $120k loan because you’ve already borrowed 80% on investment property.

Assumption 2: Two properties are mortgaged to one bank

If you only deal with one bank and your properties are cross secured, sometimes you’re more at risk. We highly recommend you separate them by refinancing one of the properties.

When it comes to which mortgage to be refinanced, there are a number of factors we need to factor in. For example, when you borrow the money, you get cash back from the bank. If you leave the bank within three or four years depends on which bank you deal with, they will claim all or some part of your cash back. Also, other factors like which bank is suitable for holding home and which bank for holding rental property. We don’t have a one-size-fits-all solution for your home loan. That’s why we need to look at your individual case, understand your needs and situation, then make a tailored solution for you.

It can be confusing to work out which property needs to be refinanced. As a rule of thumb, your rental property should be mortgaged to a bank that is different from your family home, then top up your loan against your investment property to 80% of the LVR. By this way, you lock the maximum equity and you can leverage your equity when buying your next investment property.

Thinking about financing options for investment property? Review your home loan structure now

Ten months are remaining until May 2021 and how LVR rules are going to change…is not predictable. If you are thinking about buying your next investment property, then get in touch with us immediately – by reviewing your current home loan structure, we’ll help you ensure that the equity in your existing properties can be maxed out.

Plus, start planning right now and you’ll have enough time to wait for your loan coming off with fixed term, or the cash back clause expired, so that you can avoid these unnecessary costs. Call us at 09 930 8999 for a no-obligation chat with our adviser.

Other Blogs You Might Like:

Loan to value ratio (LVR) restrictions for investment property return to 70%

LVR restriction removed and what does it mean for you?

Do you have multiple properties secured with the same bank?

Your sale proceeds could be at risk when you hold multiple properties secured with one lender

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)