Should I go to bank or finance companies for property development loan?

Posted by: Connie in Finance 101

By understanding the importance of evaluating feasibility on construction development projects from last week's blog content, today's topic mainly addresses and compares the main difference between choosing a bank or choosing a finance company when applying for a property development loan.

Should I go to banks or non-bank lenders for property development loan? It is one of the most common questions from our developer customers. Applying for a property development loan through a finance company is usually not as frightening as people think. On the contrary, applying for a property development loan through a bank is not necessarily the best option. As experienced finance advisers, we help our customers choose the best option base on their situation and goals to maximize their finance success.

Before we start today’s topic, the Blog Article we post on 05th Nov has addressed that ANZ Retail department is now accepting certain small scale development loan projects, however, today, our main comparative study is the development projects that do not meet the ANZ Retail small-scale development requirements. The comparison is for property development loan between banks’ Commercial department and finance companies.

TimeLine:

Recap from previous blog content - 01:11

Comparison between bank and finance companies for property development loan in detail - 02:11

Real Case Study - 17:23

Conclusion on chosen a bank or finance companies for property development loan - 19:30

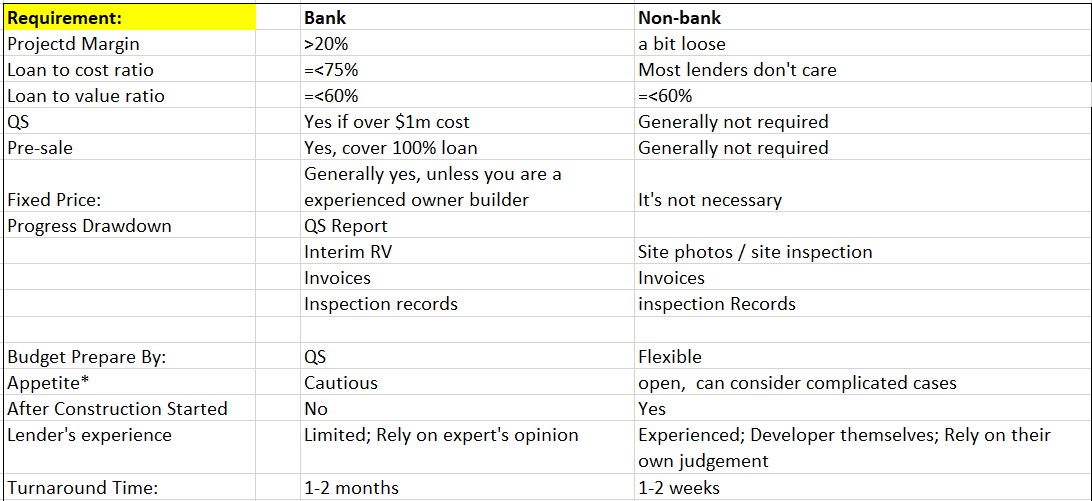

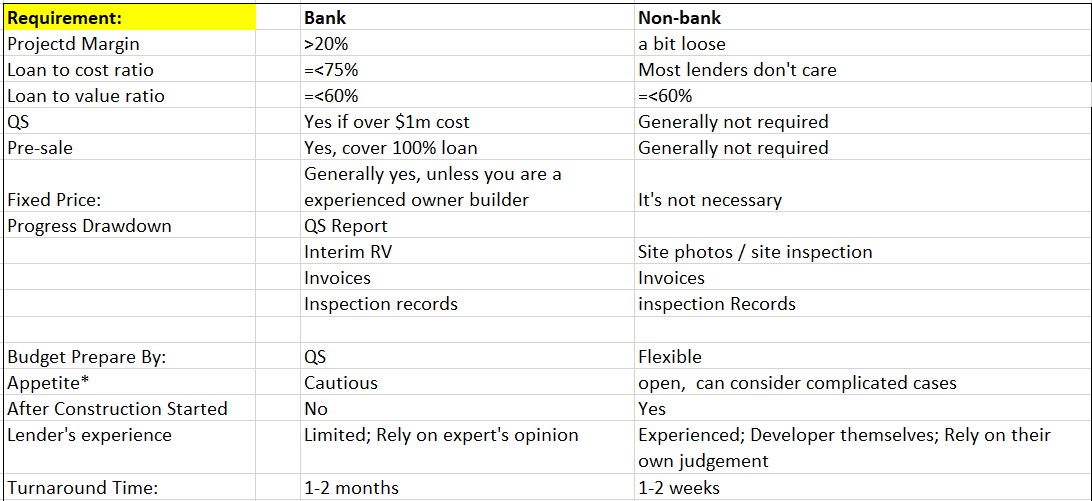

As shown in the above figure, the Project Margin, the Loan to Cost Ratio and the LVR are the feasibility calculation ratios covered in the previous Blog.

Project Margin:

The bank’s requirement for Project Margin must be 20% as a minimum development return. As a developer, it is critical to consider Project Margin prior to the development project to determine whether the project is worth developing now. The non-bank lender will consider Project Margin as well, however, there is no minimum Project Margin requirement.

Loan To Cost Ratio:

Banks require developers to invest at least 25% of the total cost in completing the development project and making sure developers take part in the cost contribution. Most non-bank lenders do not have this requirement. They are more focused on the loan to value ratio (LVR) base on total value of the development project, which is the selling price.

LVR:

The LVR registration on both banks and non-bank lenders are 60%. Non-bank lenders used to have more appetite but due to the current volatile property market and COVID risks, they want to keep the LVR within 60% now.

QS:

Banks require that if the total cost of a development project exceeds 1.2 million, QS is essential to get involved for the duration of the projects. In general, QS would occur a minimum of $50k to $70k to the total cost. In most cases, non-banks do not require QS to get involved, and lending requirements are relatively simple.

Pre-sale:

The Pre-Sale customers are most likely retail customers. Pre-sale condition is hard to meet right now because of the new restrictions on retail lending policies such as CCCFA, and DTI, due to the update restrictions, the retail customers are facing a higher settlement risk and most of them do not want to take such risks. Some banks require even 120% pre-sale which is more difficult to meet. Non-banks generally do not need pre-sales, and non-banks are usually more accurate in grasping the market and measuring risks through subjective judgments. Therefore, in most cases, non-banks do not require developers to pre-sell.

Fixed-Price Contract:

In today’s construction market, because the material and labor costs have increased rapidly and the price is so unpredictable, therefore, the fixed-price contract is essential to get construction loans approved from banks under most circumstances. However, if the developer is a highly qualified and experienced builder , there is still the chance to get approved without a Fixed-Priced contract. Recently, we had a client with over 40 years of construction experience get approved eventually, but it took two and half months which is not ideal. With non-bank lenders, most of them are experienced developers themselves, which means they can evaluate if the cost the cost and sale price are achievable; it is not necessary to have a fixed-price contract from non-bank lenders.

Progress Drawdown:

Unlike home loans, property development loans are drawn down in tranches, which is also known as progress drawdown.. Banks and non-banks have different requirements. Banks need QS to review and produce reports to verify invoices, cost to complete and project progress .Banks also require interim valuation report, council inspection records, etc. Non-banks usually do not need any report from QS. Generally, non-banks are more flexible. In the process of progress drawdowns, non-banks will be implementing site inspections or using photos to confirm the progress of the development project. Check the invoice to ensure the expenditure status and the inspection records of the Council. In the phase of progress drawdown , we can see that because non-banks do not need valuation and QS reports, developers can save a lot of time and cost. It should be aware that the Progress Drawdown process from non-bank lenders normally takes a couple of days whereas the banks normally take a couple of weeks.

Budget Preparation:

Banks will only consider using QS to review all costs, not other budgeting methods. Non-banks are relatively flexible and can accept the developer's budget evaluation, and QS is not required.

Lending Appetite:

Banks are relatively more conservative and cautious and generally have low risk appetite. On the contrary, non-banks are willing to invest in reasonably challenging projects and prepared to deal with all kinds of situations. Because some of the non-bank companies themselves started as developers, and they have a more knowledge and accurate grasp of the market and projects. Banks rely more on reports from QS, valuers and other professionals in the approval process.

After Construction Started:

If the project has already started, the bank will no longer consider the loan application. Non-banks are not affected by the progress of the development project, and non-banks can accept loan applications at any stage.

Lender’s Experience:

Banks have limited construction experience and rely more on expert advice such as QS, valuers and other professionals. Non-banks with more experience, and many non-banks are also developers themselves. Generally, they do not need the advice of other experts and rely more on their judgment.

Turnaround Time:

Bank approval speed is generally one to two months, and non-bank approval speed is generally one week or two weeks most.

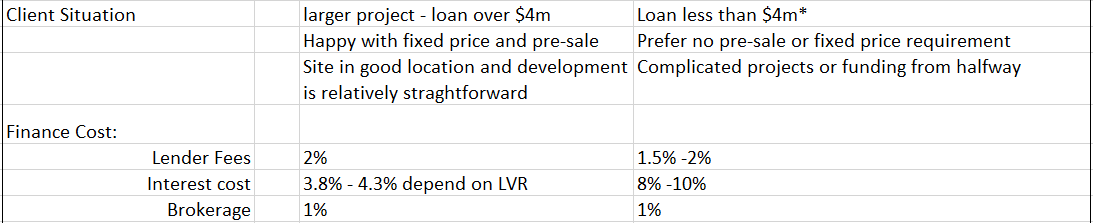

Finance Cost:

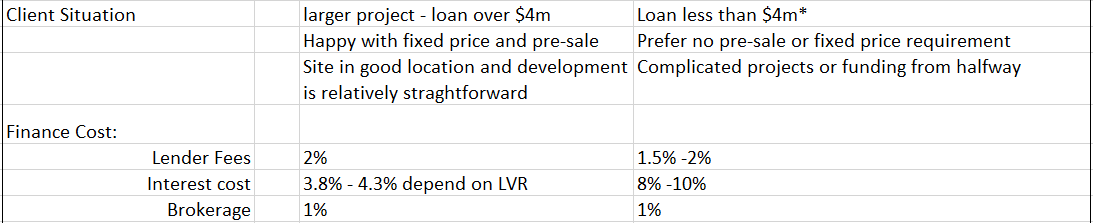

The finance cost is mainly divided into three parts: application fee, interest costs, and brokerage (loan consultant fee). Finance cost is also the most disadvantage aspect for non-banks compared with banks, reflected primarily on interest rates. In detail, let’s look at the differences in the following three aspects of financing costs.

- Application fee: The bank's commercial department normally requires the applicant to pay a 2% application fee, which differs from the home loan application; a home loan will not require any application fee. Out of the 2% application fee, 1% is the application fee, and the other 1% is called the line fee. The primary meaning of the line fee is that the bank will not earn interest income for their entire lending from day one due to progress drawdown nature but they have to reserve the funds for future progress drawdowns .. Banks will charge a line fee to make up the return for their money. The majority of non-bank application fees are usually between 1.5%-2%, so there is not much difference in application fees between banks and non-banks.

- Interest rate: Bank interest rate is generally around 4% depending on banks and the project itself. The annual interest for most non-bank lenders is generally between 8%-10%. We have worked with one non-bank lender who can offer a special 6.5% interest; however, this is an exception. When considering the total interest amount, it is essential to understand that the interest will only be charged the money has been lent to the developer. In general, the usage is around 50% - 60%. . Therefore, when you work out the interest cost difference, you should multiple the loan amount by usages and loan term.

- Brokerage: this is your financial adviser’s fee.

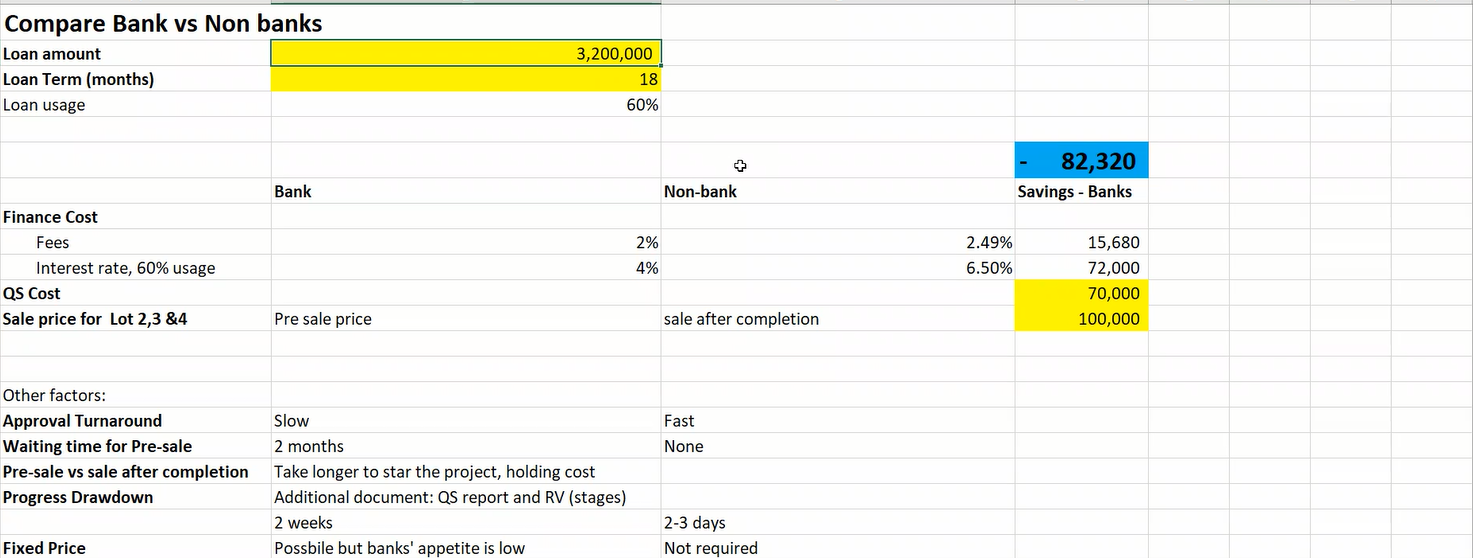

Real Case Study:

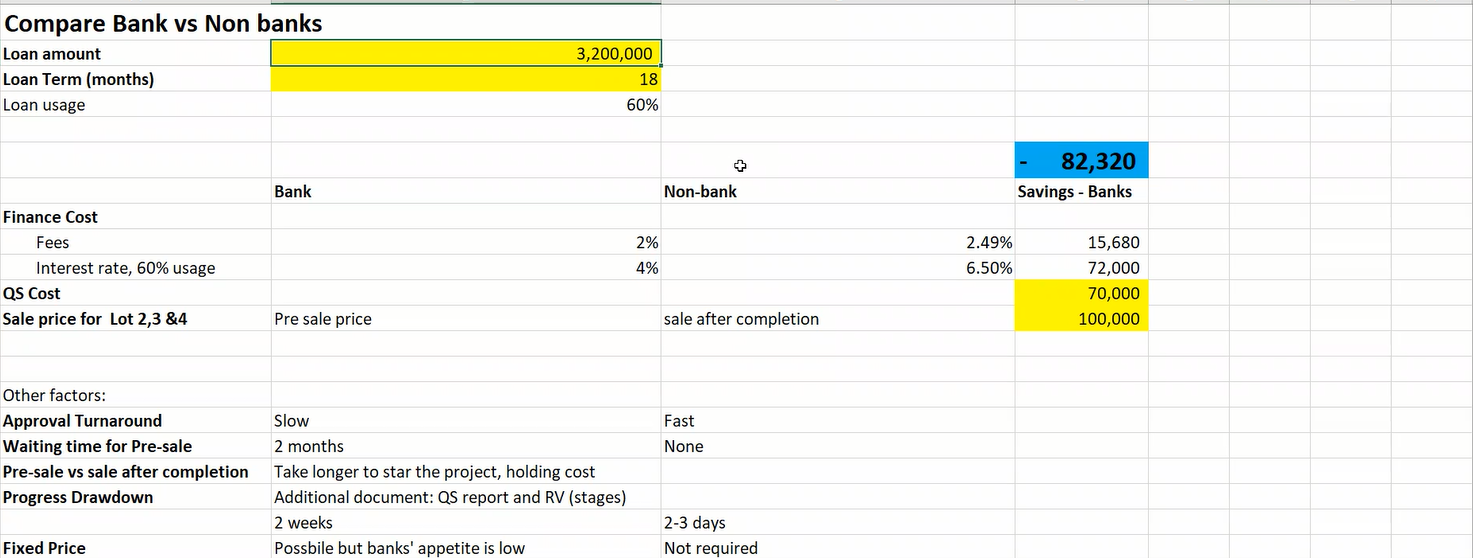

To better understanding the difference between banks and non-bank lenders, here is a real example from one of our current clients.

First, the applicant need to borrow $3.2 million. The loan period is approximately 18 months and the loan usage is 60%.

The above figure shows that the bank's application fee is 2%, and the non-bank's application fee is 2.49%, which is slightly higher than the bank. The cost difference is $15,680. At the same time, the borrower applied for a special interest rate of 6.5% at a non-bank lender, while the bank’s rate was 4%. Considering the 60% interest usage, banks will have an advantage on finance costs by saving about $72k compared to the non-bank lender. But at the same time, the client can save $70k in QS expenses if the client applies through the non-bank lender. Another $100k can be saved if the client chooses not to pre-sale. Therefore, the client can save a total of $82.32k by applying through the non-bank lender without considering other factors such as the speed of approval (Approval Turnaround), the waiting time for pre-sales, and the speed of lending (Progress Drawdown). Therefore, after a detailed comparison, it is no brainer that choosing the non-bank lender will maximum the developer’s finance return.

Recap:

The main advantage of banks lies in their low finance costs, especially in interest cost.

At the same time, the requirement for using some experts service such as QS will also increase a considerable amount of project cost, which can easily offset the bank’s benefit from offering a low interest.

From a developer perspective, pre-sale will challenge developers to offer discounted price to attract potential buyers because buyers take risks of purchasing an off-plan property. If the property value appears to go upwards in the current housing market, pre-sale will reduce the developer’s project return.

The fixed price will cost developers more as well.

Generally speaking, there are still many developers who choose non-banks for small and medium-sized development projects with a cost of less than four to five million. Banks are relatively more suitable for some large-scale real estate development projects with a cost of more than four to five million. This is because the large-scale developers are more inclined to conduct a pre-sale and have a fix-price contract to secure the return first and seeking the support from professionals such as QS to minimise the risks. The cost of non-bank lenders financing for development projects of more than 5 million is too high especially on interest cost compared to banks, and some of the advantages in other aspects are no longer obvious. On the other hand, there is a lack of non-bank lenders in the current market are able to finance over five million.

Wether you should choose a bank or non-bank lender lies with your situation and preference. We can help you to make informed decisions.

I hope that through today's content, especially those who planning to start a develop project has a deeper understanding of banks and non-banks on development loans. To help you better complete your development projects, we will continue to share more valuable content in the future. If you have any questions about financing your project, Please feel free to contact us and let Prosperity Finance team provide you with a tailor-made solution.

Read More:

Evaluate your property development project by conducting a simple financial feasibility analysis

What you need to be aware of before applying for a construction loan

Great news for small property development project

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

By understanding the importance of evaluating feasibility on construction development projects from last week's blog content, today's topic mainly addresses and compares the main difference between choosing a bank or choosing a finance company when applying for a property development loan.

Should I go to banks or non-bank lenders for property development loan? It is one of the most common questions from our developer customers. Applying for a property development loan through a finance company is usually not as frightening as people think. On the contrary, applying for a property development loan through a bank is not necessarily the best option. As experienced finance advisers, we help our customers choose the best option base on their situation and goals to maximize their finance success.

Before we start today’s topic, the Blog Article we post on 05th Nov has addressed that ANZ Retail department is now accepting certain small scale development loan projects, however, today, our main comparative study is the development projects that do not meet the ANZ Retail small-scale development requirements. The comparison is for property development loan between banks’ Commercial department and finance companies.

TimeLine:

Recap from previous blog content - 01:11

Comparison between bank and finance companies for property development loan in detail - 02:11

Real Case Study - 17:23

Conclusion on chosen a bank or finance companies for property development loan - 19:30

As shown in the above figure, the Project Margin, the Loan to Cost Ratio and the LVR are the feasibility calculation ratios covered in the previous Blog.

Project Margin:

The bank’s requirement for Project Margin must be 20% as a minimum development return. As a developer, it is critical to consider Project Margin prior to the development project to determine whether the project is worth developing now. The non-bank lender will consider Project Margin as well, however, there is no minimum Project Margin requirement.

Loan To Cost Ratio:

Banks require developers to invest at least 25% of the total cost in completing the development project and making sure developers take part in the cost contribution. Most non-bank lenders do not have this requirement. They are more focused on the loan to value ratio (LVR) base on total value of the development project, which is the selling price.

LVR:

The LVR registration on both banks and non-bank lenders are 60%. Non-bank lenders used to have more appetite but due to the current volatile property market and COVID risks, they want to keep the LVR within 60% now.

QS:

Banks require that if the total cost of a development project exceeds 1.2 million, QS is essential to get involved for the duration of the projects. In general, QS would occur a minimum of $50k to $70k to the total cost. In most cases, non-banks do not require QS to get involved, and lending requirements are relatively simple.

Pre-sale:

The Pre-Sale customers are most likely retail customers. Pre-sale condition is hard to meet right now because of the new restrictions on retail lending policies such as CCCFA, and DTI, due to the update restrictions, the retail customers are facing a higher settlement risk and most of them do not want to take such risks. Some banks require even 120% pre-sale which is more difficult to meet. Non-banks generally do not need pre-sales, and non-banks are usually more accurate in grasping the market and measuring risks through subjective judgments. Therefore, in most cases, non-banks do not require developers to pre-sell.

Fixed-Price Contract:

In today’s construction market, because the material and labor costs have increased rapidly and the price is so unpredictable, therefore, the fixed-price contract is essential to get construction loans approved from banks under most circumstances. However, if the developer is a highly qualified and experienced builder , there is still the chance to get approved without a Fixed-Priced contract. Recently, we had a client with over 40 years of construction experience get approved eventually, but it took two and half months which is not ideal. With non-bank lenders, most of them are experienced developers themselves, which means they can evaluate if the cost the cost and sale price are achievable; it is not necessary to have a fixed-price contract from non-bank lenders.

Progress Drawdown:

Unlike home loans, property development loans are drawn down in tranches, which is also known as progress drawdown.. Banks and non-banks have different requirements. Banks need QS to review and produce reports to verify invoices, cost to complete and project progress .Banks also require interim valuation report, council inspection records, etc. Non-banks usually do not need any report from QS. Generally, non-banks are more flexible. In the process of progress drawdowns, non-banks will be implementing site inspections or using photos to confirm the progress of the development project. Check the invoice to ensure the expenditure status and the inspection records of the Council. In the phase of progress drawdown , we can see that because non-banks do not need valuation and QS reports, developers can save a lot of time and cost. It should be aware that the Progress Drawdown process from non-bank lenders normally takes a couple of days whereas the banks normally take a couple of weeks.

Budget Preparation:

Banks will only consider using QS to review all costs, not other budgeting methods. Non-banks are relatively flexible and can accept the developer's budget evaluation, and QS is not required.

Lending Appetite:

Banks are relatively more conservative and cautious and generally have low risk appetite. On the contrary, non-banks are willing to invest in reasonably challenging projects and prepared to deal with all kinds of situations. Because some of the non-bank companies themselves started as developers, and they have a more knowledge and accurate grasp of the market and projects. Banks rely more on reports from QS, valuers and other professionals in the approval process.

After Construction Started:

If the project has already started, the bank will no longer consider the loan application. Non-banks are not affected by the progress of the development project, and non-banks can accept loan applications at any stage.

Lender’s Experience:

Banks have limited construction experience and rely more on expert advice such as QS, valuers and other professionals. Non-banks with more experience, and many non-banks are also developers themselves. Generally, they do not need the advice of other experts and rely more on their judgment.

Turnaround Time:

Bank approval speed is generally one to two months, and non-bank approval speed is generally one week or two weeks most.

Finance Cost:

The finance cost is mainly divided into three parts: application fee, interest costs, and brokerage (loan consultant fee). Finance cost is also the most disadvantage aspect for non-banks compared with banks, reflected primarily on interest rates. In detail, let’s look at the differences in the following three aspects of financing costs.

- Application fee: The bank's commercial department normally requires the applicant to pay a 2% application fee, which differs from the home loan application; a home loan will not require any application fee. Out of the 2% application fee, 1% is the application fee, and the other 1% is called the line fee. The primary meaning of the line fee is that the bank will not earn interest income for their entire lending from day one due to progress drawdown nature but they have to reserve the funds for future progress drawdowns .. Banks will charge a line fee to make up the return for their money. The majority of non-bank application fees are usually between 1.5%-2%, so there is not much difference in application fees between banks and non-banks.

- Interest rate: Bank interest rate is generally around 4% depending on banks and the project itself. The annual interest for most non-bank lenders is generally between 8%-10%. We have worked with one non-bank lender who can offer a special 6.5% interest; however, this is an exception. When considering the total interest amount, it is essential to understand that the interest will only be charged the money has been lent to the developer. In general, the usage is around 50% - 60%. . Therefore, when you work out the interest cost difference, you should multiple the loan amount by usages and loan term.

- Brokerage: this is your financial adviser’s fee.

Real Case Study:

To better understanding the difference between banks and non-bank lenders, here is a real example from one of our current clients.

First, the applicant need to borrow $3.2 million. The loan period is approximately 18 months and the loan usage is 60%.

The above figure shows that the bank's application fee is 2%, and the non-bank's application fee is 2.49%, which is slightly higher than the bank. The cost difference is $15,680. At the same time, the borrower applied for a special interest rate of 6.5% at a non-bank lender, while the bank’s rate was 4%. Considering the 60% interest usage, banks will have an advantage on finance costs by saving about $72k compared to the non-bank lender. But at the same time, the client can save $70k in QS expenses if the client applies through the non-bank lender. Another $100k can be saved if the client chooses not to pre-sale. Therefore, the client can save a total of $82.32k by applying through the non-bank lender without considering other factors such as the speed of approval (Approval Turnaround), the waiting time for pre-sales, and the speed of lending (Progress Drawdown). Therefore, after a detailed comparison, it is no brainer that choosing the non-bank lender will maximum the developer’s finance return.

Recap:

The main advantage of banks lies in their low finance costs, especially in interest cost.

At the same time, the requirement for using some experts service such as QS will also increase a considerable amount of project cost, which can easily offset the bank’s benefit from offering a low interest.

From a developer perspective, pre-sale will challenge developers to offer discounted price to attract potential buyers because buyers take risks of purchasing an off-plan property. If the property value appears to go upwards in the current housing market, pre-sale will reduce the developer’s project return.

The fixed price will cost developers more as well.

Generally speaking, there are still many developers who choose non-banks for small and medium-sized development projects with a cost of less than four to five million. Banks are relatively more suitable for some large-scale real estate development projects with a cost of more than four to five million. This is because the large-scale developers are more inclined to conduct a pre-sale and have a fix-price contract to secure the return first and seeking the support from professionals such as QS to minimise the risks. The cost of non-bank lenders financing for development projects of more than 5 million is too high especially on interest cost compared to banks, and some of the advantages in other aspects are no longer obvious. On the other hand, there is a lack of non-bank lenders in the current market are able to finance over five million.

Wether you should choose a bank or non-bank lender lies with your situation and preference. We can help you to make informed decisions.

I hope that through today's content, especially those who planning to start a develop project has a deeper understanding of banks and non-banks on development loans. To help you better complete your development projects, we will continue to share more valuable content in the future. If you have any questions about financing your project, Please feel free to contact us and let Prosperity Finance team provide you with a tailor-made solution.

Read More:

Evaluate your property development project by conducting a simple financial feasibility analysis

What you need to be aware of before applying for a construction loan

Great news for small property development project

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)