Should I invest in new builds or existing properties? 13 pros and cons

Posted by: Connie in Property Investing

The government's recent tax changes are causing people to think, "should I invest in New Builds or existing properties?"

This has traditionally been a controversial topic in property investor circles.

However, these tax proposals truly upset the economics of property investment.

Yet, there's no one-size-fits-all approach, and new builds may not be the right investments for everyone.

In this video below, we weigh up the pros and cons of investing in new builds and existing properties so you can make an informed decision about the suitable property investments option for you.

Should I invest in new builds or existing properties?

Video Timeline

1. Tax deductibility rule (cashflow) - 01:41

2. Interest rates (cashflow) - 02:40

3. Bright Line Rule - 03:25

4. Healthy Home compliance - 03:52

5. Deposit - 04:32

6. Borrowing power - 04:45

7 Maintenance - 05:24

8. Rental yield - 06:35

9. location - 07:18

10. Adding value for properties - 07:40

11. Purchase price - 08:33

12. Organic capital growth - 08:52

13. The risk of off-the-plans - 10:11

1. Tax deductibility rule (cashflow)

Buying or building new properties:

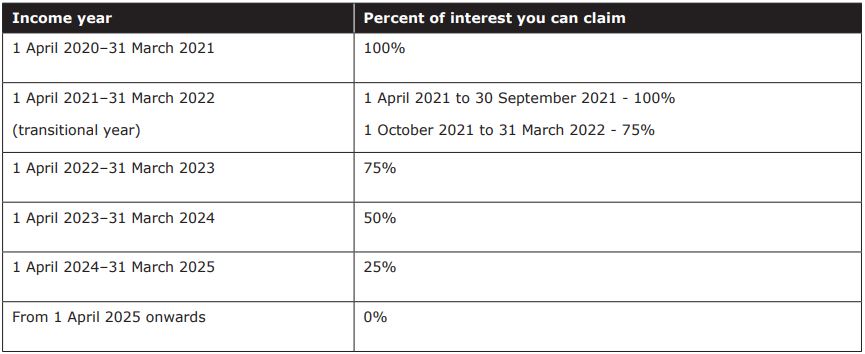

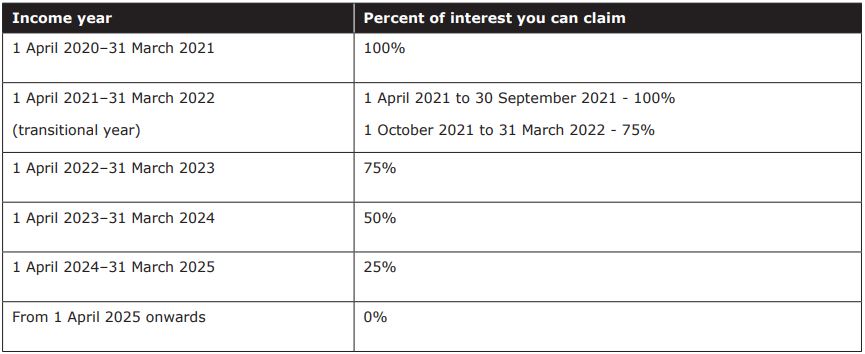

Due to the removal of interest deductibility – the interest costs can no longer offset with the rental income – investors will soon have to pay higher tax bills on their rental properties. However, new build properties are likely to be exempt from these tax rule changes.

Note, this is very likely the case but it’s still subject to confirmation by the government. The question is, we don't know how long you can fully offset the interest because a new build will eventually become an existing property.

Investing in existing property:

If you acquire a residential investment property on or after 27 March 2021, the interest expenses will not offset against the rental income starting from 1 October 2021.

2. Interest rates (cashflow)

Financing a new build:

ASB has launched a new product called "Back My Build" with a cut-price 1.79% variable home loan rate for buying off-the-plan or building new properties, as the lender attempts to encourage the lending for building a new home from scratch or purchasing a home and land package.

The special rate of 1.79% is substantially cheaper than the one-year fixed terms at the other major banks which sit around 2.19%.

Financing an existing property:

The best one-year home loan rate from other mainstream banks sits at 2.19%, and no further discount for new builds or construction loans.

3. Bright Line Rule

Buying and then selling new builds:

New builds will have a 5-year bright-line period. If selling the property after the period ends, capital tax won't be required.

Buying and then selling existing properties:

For the property acquired post 26th of March 2021, the period for the bright-line rule is 10 years.

4. Healthy Home compliance

From July this year, you need to make assessment to ensure that your rental property meets the compliance conditions of a healthy home. If not, upgrade your property to become compliant now or wait until you have new tenants. So, it involves time, money and, of course, stress.

New builds:

For a new build, everything ticks the box. So, you won’t need to do anything in terms of the healthy home aspect if you buy a new build for investment purpose.

Existing properties:

For existing properties, you probably have to spend your time and money to upgrade your property to meet the requirements for a healthy home.

5. Deposit

New build loans for investment purpose: 20% deposit

Home loans for existing properties: 40% deposit

6. Borrowing power

ANZ has decreased the percentage of rental income from existing properties they take into consideration when assessing new home loan application from 75 per cent to 65 per cent effective from May 2021. At the time of writing (18th June 2021), ANZ is the only bank that treats new builds and existing properties differently.

Financing a new build for investment purpose: ANZ still considers 75% of the rental income.

Financing an existing investment property: If the existing rental property you bought is after 26th March 2021, ANZ only considers 65% of the rental income, which means your borrowing power will be reduced as a result.

7. Maintenance

Buying a new build:

A new build means little or no repairs or ongoing costs for years to come. While new properties are typically more expensive to buy than existing ones, you will most likely be left with stress and unexpected bills in the long run.

Buying an existing property:

For example, one of our clients was told by the tenants that the property had a major issue. To fix the issue, the tenants had to move out. As a result, the client spent a huge amount of money fixing the issue, and even worse, they had a loss in rents.

8. Rental yield

New builds:

When comparing the properties with the same condition (e.g., the same number of bedrooms, same area), new builds often give you a better rental yield than existing ones.

Existing properties:

It often has less rental yield compared to new builds, which will reduce your cashflow.

9. location

Buying new builds:

Location is one of the most important factors when buying a property. Popular areas close to CBD are usually with little or no sections available to build new properties. If you want to buy new builds, they are often located in the area far away from the hustle of cities and can take you a longer time to commute.

Buying existing properties:

Existing properties are more likely located in the mature suburbs (near CBD) that are close to amenities, making it desirable for life and work.

10. Adding value for properties

There are two ways for a property to grow in value. One is organic growth, and the other is manually adding value to it.

New builds: when new properties are completed, they typically won’t have any potential to renovate. This means investors who focus on significant renovations won’t be able to add value to new builds.

Existing properties: investors have the potential to renovate existing properties to add value. For example, paint the wall, upgrade the bathroom, kitchen, or do some landscaping. On top of that, you may even add another dwelling or subdivide it.

11. Purchase price

Buying new builds: the price of new builds is set by the developers, which means there's little room for you to negotiate the price.

Buying existing properties: if the vendor is desperate to sell the property as soon as possible, you may potentially have some bargains.

12. Organic capital growth

New builds:

The recent tax changes, lending policies leaning to new build loans and other benefits we discussed above make new builds more attractive for investment purpose, pushing the price up in the short run.

Existing properties:

Existing houses often sit on bigger sections of land than new builds. What’s more, you potentially buy the property at a wholesale price because you may subdivide the land into multiple sections.

13. The risk of off-the-plans

Buying off-the-plan:

It is essential to note that some risks may be involved when buying off-the-plans, such as:

- you may have to wait for a long time for construction to be completed.

- The property market and lending policies often change frequently, and your situation can change as well.

- If it is expected to take over 12 months to complete the construction, your mortgage approval may not be valid at the time of settlement.

If you’re thinking about buying an off-the-plan, you need to consider the overall risks associated with so many uncertainties that can result from the nature of construction projects.

Buying existing properties:

Compared to off-the-plans, buying existing properties tends to have less waiting period and uncertainties.

The above breaks down the arguments for and against new builds so you can make an informed decision about buying new builds or buying existing ones. Again, neither of the property types is the right fit for all investors, and the difference comes down to the strategy you use and your personal situation.

To sum up, who are new builds the right fit for?

- Investors who are tight on deposit or cashflow

- Less capacity (time and money) of adding value or maintaining properties

- Less experienced investors

Who are existing properties the right fit for?

- Investors who have strong equity and cashflow

- Experienced investors

It’s important to note that you need to consider having a good balance between new builds and existing properties. If you plan to buy multiple properties in the future, we’d suggest buying at least some existing properties. It will help you build equity faster rather than saving for the deposit so that you can use the equity to borrow for your next rental property and grow your property portfolio in the long run.

Prosperity Finance - Here to Help

Looking to apply for a home loan? Call us at 09 930 8999 to have a no-obligation chat with one of the financial advisors at Prosperity Finance to discuss your situation further.

Read more:

Everything you need to know about the ASB Back My Build home loan product

Is it still a good time to invest in property?

ANZ tightens servicing for rental property income, will this affect you?

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

The government's recent tax changes are causing people to think, "should I invest in New Builds or existing properties?"

This has traditionally been a controversial topic in property investor circles.

However, these tax proposals truly upset the economics of property investment.

Yet, there's no one-size-fits-all approach, and new builds may not be the right investments for everyone.

In this video below, we weigh up the pros and cons of investing in new builds and existing properties so you can make an informed decision about the suitable property investments option for you.

Should I invest in new builds or existing properties?

Video Timeline

1. Tax deductibility rule (cashflow) - 01:41

2. Interest rates (cashflow) - 02:40

3. Bright Line Rule - 03:25

4. Healthy Home compliance - 03:52

5. Deposit - 04:32

6. Borrowing power - 04:45

7 Maintenance - 05:24

8. Rental yield - 06:35

9. location - 07:18

10. Adding value for properties - 07:40

11. Purchase price - 08:33

12. Organic capital growth - 08:52

13. The risk of off-the-plans - 10:11

1. Tax deductibility rule (cashflow)

Buying or building new properties:

Due to the removal of interest deductibility – the interest costs can no longer offset with the rental income – investors will soon have to pay higher tax bills on their rental properties. However, new build properties are likely to be exempt from these tax rule changes.

Note, this is very likely the case but it’s still subject to confirmation by the government. The question is, we don't know how long you can fully offset the interest because a new build will eventually become an existing property.

Investing in existing property:

If you acquire a residential investment property on or after 27 March 2021, the interest expenses will not offset against the rental income starting from 1 October 2021.

2. Interest rates (cashflow)

Financing a new build:

ASB has launched a new product called "Back My Build" with a cut-price 1.79% variable home loan rate for buying off-the-plan or building new properties, as the lender attempts to encourage the lending for building a new home from scratch or purchasing a home and land package.

The special rate of 1.79% is substantially cheaper than the one-year fixed terms at the other major banks which sit around 2.19%.

Financing an existing property:

The best one-year home loan rate from other mainstream banks sits at 2.19%, and no further discount for new builds or construction loans.

3. Bright Line Rule

Buying and then selling new builds:

New builds will have a 5-year bright-line period. If selling the property after the period ends, capital tax won't be required.

Buying and then selling existing properties:

For the property acquired post 26th of March 2021, the period for the bright-line rule is 10 years.

4. Healthy Home compliance

From July this year, you need to make assessment to ensure that your rental property meets the compliance conditions of a healthy home. If not, upgrade your property to become compliant now or wait until you have new tenants. So, it involves time, money and, of course, stress.

New builds:

For a new build, everything ticks the box. So, you won’t need to do anything in terms of the healthy home aspect if you buy a new build for investment purpose.

Existing properties:

For existing properties, you probably have to spend your time and money to upgrade your property to meet the requirements for a healthy home.

5. Deposit

New build loans for investment purpose: 20% deposit

Home loans for existing properties: 40% deposit

6. Borrowing power

ANZ has decreased the percentage of rental income from existing properties they take into consideration when assessing new home loan application from 75 per cent to 65 per cent effective from May 2021. At the time of writing (18th June 2021), ANZ is the only bank that treats new builds and existing properties differently.

Financing a new build for investment purpose: ANZ still considers 75% of the rental income.

Financing an existing investment property: If the existing rental property you bought is after 26th March 2021, ANZ only considers 65% of the rental income, which means your borrowing power will be reduced as a result.

7. Maintenance

Buying a new build:

A new build means little or no repairs or ongoing costs for years to come. While new properties are typically more expensive to buy than existing ones, you will most likely be left with stress and unexpected bills in the long run.

Buying an existing property:

For example, one of our clients was told by the tenants that the property had a major issue. To fix the issue, the tenants had to move out. As a result, the client spent a huge amount of money fixing the issue, and even worse, they had a loss in rents.

8. Rental yield

New builds:

When comparing the properties with the same condition (e.g., the same number of bedrooms, same area), new builds often give you a better rental yield than existing ones.

Existing properties:

It often has less rental yield compared to new builds, which will reduce your cashflow.

9. location

Buying new builds:

Location is one of the most important factors when buying a property. Popular areas close to CBD are usually with little or no sections available to build new properties. If you want to buy new builds, they are often located in the area far away from the hustle of cities and can take you a longer time to commute.

Buying existing properties:

Existing properties are more likely located in the mature suburbs (near CBD) that are close to amenities, making it desirable for life and work.

10. Adding value for properties

There are two ways for a property to grow in value. One is organic growth, and the other is manually adding value to it.

New builds: when new properties are completed, they typically won’t have any potential to renovate. This means investors who focus on significant renovations won’t be able to add value to new builds.

Existing properties: investors have the potential to renovate existing properties to add value. For example, paint the wall, upgrade the bathroom, kitchen, or do some landscaping. On top of that, you may even add another dwelling or subdivide it.

11. Purchase price

Buying new builds: the price of new builds is set by the developers, which means there's little room for you to negotiate the price.

Buying existing properties: if the vendor is desperate to sell the property as soon as possible, you may potentially have some bargains.

12. Organic capital growth

New builds:

The recent tax changes, lending policies leaning to new build loans and other benefits we discussed above make new builds more attractive for investment purpose, pushing the price up in the short run.

Existing properties:

Existing houses often sit on bigger sections of land than new builds. What’s more, you potentially buy the property at a wholesale price because you may subdivide the land into multiple sections.

13. The risk of off-the-plans

Buying off-the-plan:

It is essential to note that some risks may be involved when buying off-the-plans, such as:

- you may have to wait for a long time for construction to be completed.

- The property market and lending policies often change frequently, and your situation can change as well.

- If it is expected to take over 12 months to complete the construction, your mortgage approval may not be valid at the time of settlement.

If you’re thinking about buying an off-the-plan, you need to consider the overall risks associated with so many uncertainties that can result from the nature of construction projects.

Buying existing properties:

Compared to off-the-plans, buying existing properties tends to have less waiting period and uncertainties.

The above breaks down the arguments for and against new builds so you can make an informed decision about buying new builds or buying existing ones. Again, neither of the property types is the right fit for all investors, and the difference comes down to the strategy you use and your personal situation.

To sum up, who are new builds the right fit for?

- Investors who are tight on deposit or cashflow

- Less capacity (time and money) of adding value or maintaining properties

- Less experienced investors

Who are existing properties the right fit for?

- Investors who have strong equity and cashflow

- Experienced investors

It’s important to note that you need to consider having a good balance between new builds and existing properties. If you plan to buy multiple properties in the future, we’d suggest buying at least some existing properties. It will help you build equity faster rather than saving for the deposit so that you can use the equity to borrow for your next rental property and grow your property portfolio in the long run.

Prosperity Finance - Here to Help

Looking to apply for a home loan? Call us at 09 930 8999 to have a no-obligation chat with one of the financial advisors at Prosperity Finance to discuss your situation further.

Read more:

Everything you need to know about the ASB Back My Build home loan product

Is it still a good time to invest in property?

ANZ tightens servicing for rental property income, will this affect you?

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)