Coronavirus: How to reduce my mortgage repayment pressure?

Posted by: Connie in Finance 101

At 11.59 pm this Wednesday, New Zealand will enter a 4-week nationwide lockdown. People’s life may come to a screeching halt, as all non-essential businesses are ordered to close.

Economic disruption is beginning to emerge. Some industries, such as travel and airline, are reeling. Small business owners are starting to report their loss in sales volume – some people have already become unemployed, and others are worrying about losing their jobs.

Thousands of New Zealand households are expected to face financial burdens with the coronavirus pandemic. If you are facing reduced working hours, job loss, or you just expect drops in income caused by coronavirus disruption, you are probably worried about making your home loan repayments.

If you struggle to repay your home loan, it’s best to act as soon as possible and seek professional advice. Find out what you can do to make repaying more manageable and less stressful. The 13 tips below will help you proactively manage your mortgage when or before you are struggling, so that you can avoid missing your repayment.

How to reduce my mortgage repayment pressure?

Video Timeline

Tip 1: Have a revolving credit account or an offset account - 01:58

Tip 2: Increase your credit card limit - 02:55

Tip 3: Break and re-fix your home loan with lower interest rates - 03:18

Tip 4: Break and extend the term of your loan - 04:05

Tip 5: Switch your loan to interest-only for a period - 04:47

Tip 6: Taking mortgage payment holiday - 05:09

Tip 7: Temporarily stop your KiwiSaver contributions - 06:06

Tip 8: Reduce discretionary spending - 06:20

Tip 9: Rent out a room in your home - 06:44

Tip 10: Find a part-time job - 06:50

Tip 11: Renting out your current home and move in with your family - 06:57

Tip 12: Sell unused assets - 07:14

Tip 13: Sell your rental property - 07:30

If I have lost my job and can’t pay my mortgage

After a layoff, keeping your mortgage repayment on time can be a challenge. These strategies may help you repay your home loan during tough financial times.

- Income protection insurance – Talk to your insurer and make a claim.

- Work and income subsidy – Find out what subsidy options are available and if you are eligible for the subsidy.

- Apply to your bank for financial hardship – Hardship is the option only when an unexpected life change, job loss for example, makes it hard to afford mortgage repayments. By applying for hardship, if it’s successful, you will be allowed to reduce each loan payment amount or even stopping paying at all for a short period of time. This won’t be suitable for everyone but could provide help and time to get you back on track.

If I worried about reduced income, how can I minimise my mortgage payment risk?

If you are experiencing mortgage stress, or expect you will soon have trouble making your home loan repayments due to the potential cut in work hours, less income, or even having risk of job loss, here are some quick tips on easing your mortgage stress that you can act immediately.

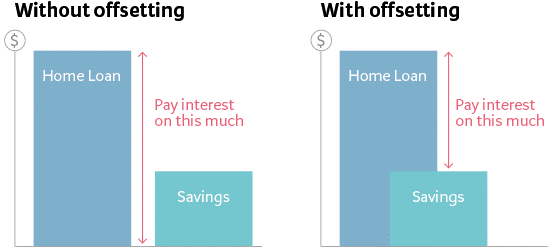

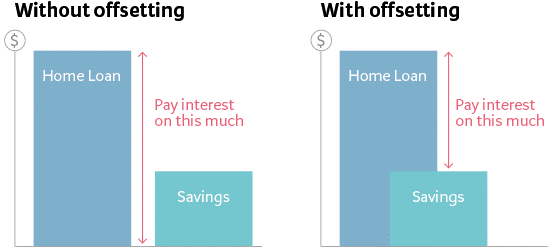

Tip 1: Have a revolving credit account or an offset account

Say you have $20k of spare cash in your saving or gift money. Instead of paying down your home loan, you could restructure your home loan, which means you take out $20K from your current loan and set it as a revolving or an offset account, then use your saving to offset against that $20K loan.

The main benefits of setting a revolving credit/ an offset account are:

- It reduces the amount of interest accruing on that $20K loan.

- The $20k cash is still accessible. You can spend the $20k at any time without needing the approval of the bank. It's more flexible than paying down your loan because if you choose to pay down your home loan with the $20k, you will lose the accessibility of that money. When you need the money, but you don't have sufficient income, your bank won't approve the top up of 20K.

Tip 2: Increase your credit card limit

Given the economic effects that coronavirus has brought to us, you can consider increasing your credit card limit and use your credit card for emergencies. It might help you release your mortgage stress, but only if you use them wisely.

Tip 3: Break and re-fix your home loan with lower interest rates

Majority of New Zealand banks have lowered their fixed-term interest rates after OCR cut, such as 3.05% for one-year fixed term – hitting the lowest in the New Zealand mortgage rates history.

If your fixed term is not about coming off to the end, you can consider breaking your home loan now and re-fix it at a lower rate. You may incur a one-off break fee if you break it early. Generally speaking, the fees is similar to the amount of interest saving. However, it may still worth taking this approach each loan repayment amount will be reduced. This will help you relieve your home loan repayment pressure.

If you have already worked with your bank for at least three or four years, you can consider refinancing your mortgage to another bank. Many banks offer cashback incentives to borrowers, which can be used to offset the cost of breaking existing loan.

Tip 4: Break and extend the term of your loan

Extending your loan term will reduce your regular repayments.

For example, your loan balance is $200k and the remaining loan term is 10 years. By breaking your current loan and extending to a term of 30 years, your regular loan repayments will be significantly reduced.

Similarly, a one-off break fee will occur. If you use a combined strategy of refinancing your mortgage to a new bank, and re-fixing it at a lower rate, and extending to a term of 30 years, you can significantly reduce the payment amount and also use the cashback to cover the cost of breaking.

Tip 5: Switch your loan to interest-only for a period

If you’re paying principal and interest on payment, consider switching your loan repayment tointerest-only. Since you only pay interest during this period, each payment will be smaller. However, paying interest-only mortgage is not always a good idea for borrowers because in the long run you end up with paying more on interests.

Tip 6: Taking mortgage payment holiday

The monthly mortgage payments are the biggest financial outgoing for many borrowers. If you’re struggling financially and can’t pay your mortgage due to coronavirus crisis, the option may be a mortgage payment holiday.

The mortgage payment holiday will offer flexibility in repaying your home loan by stopping the monthly loan payments for up to three months. This allows for some time to adjust your situation, find a job or sell your assets, and then get back on track.

If you are facing a temporary drop in income, a mortgage payment holiday can relieve some pressure for a while because you don’t pay nothing to the bank. However, there are some cons of a mortgage holiday you should bear in mind:

- You’re still racking up interest on the remaining loan balance while your payments are stopping for some period.

- Your outstanding loan balance will be higher than they were before the holiday due to the accrued interests.

A mortgage payment holiday is only a temporary option when you are experiencing financial difficulties issue. Not to mention not everyone will be granted a payment holiday and banks need to consider your case.

Tip 7: Temporarily stop your KiwiSaver contributions

You could consider taking a break from contributing to your KiwiSaver, which results in more net income.

Tip 8: Reduce discretionary spending

Re-consider some non-essential spending. For example, reduce your frequency of eating out, or defer purchasing a big item such as smartphone or appliances. until your financial situation changes, you could save thousands of dollars.

Tip 9: Rent out a room in your home

Got a spare room for family and friends? Renting out that room will give regular infusions of cash that can be applied to your loan repayment.

Tip 10: Find a part-time job

If your regular working hours have been cut, finding another part-time job might be your supplemental source of income.

Tip 11: Renting out your current home and move in with your family

If your parents, or siblings have a spare bedroom, you may consider living with them together. Then you’ll have additional income from renting out your house and your overall living expenses can be reduced as well.

Tip 12: Sell unused assets

Selling the household items that you no longer need or use, such as a spare car, is a smart way to boost your cash. You’ll have more money for your mortgage payment.

Tip 13: Sell your rental property

Finally, if you want to reduce your payment burden in the longer term, then probably consider selling your rental property to help you reduce the mortgage payments. It's better to do it early and do it by yourself so that you get most of the sale proceeds, rather than waiting for the bank to force you to do that. Bear in mind, that's probably the last resort.

The above are 13 tips that could help you overcome your cashflow issue and minimize your home loan payment pressure. Mortgage stress can affect anyone, especially during this challenging period of coronavirus.

Prosperity Finance – here to help

The best solution for managing mortgage repayment stress is to implement suitable strategies as soon as possible and avoid missing a payment, rather than waiting for the last minute. If you are experiencing financial stress, or believe you’ll soon struggle to make loan repayments, talk to us straightaway. We’re professional mortgage broker and we can help you make the decision that’s right for you.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Read further:

Coronavirus: Further implications on NZ bank’s appetite for home loans

Does Coronavirus threaten your business? - 5 home loan tips for small business owners

At 11.59 pm this Wednesday, New Zealand will enter a 4-week nationwide lockdown. People’s life may come to a screeching halt, as all non-essential businesses are ordered to close.

Economic disruption is beginning to emerge. Some industries, such as travel and airline, are reeling. Small business owners are starting to report their loss in sales volume – some people have already become unemployed, and others are worrying about losing their jobs.

Thousands of New Zealand households are expected to face financial burdens with the coronavirus pandemic. If you are facing reduced working hours, job loss, or you just expect drops in income caused by coronavirus disruption, you are probably worried about making your home loan repayments.

If you struggle to repay your home loan, it’s best to act as soon as possible and seek professional advice. Find out what you can do to make repaying more manageable and less stressful. The 13 tips below will help you proactively manage your mortgage when or before you are struggling, so that you can avoid missing your repayment.

How to reduce my mortgage repayment pressure?

Video Timeline

Tip 1: Have a revolving credit account or an offset account - 01:58

Tip 2: Increase your credit card limit - 02:55

Tip 3: Break and re-fix your home loan with lower interest rates - 03:18

Tip 4: Break and extend the term of your loan - 04:05

Tip 5: Switch your loan to interest-only for a period - 04:47

Tip 6: Taking mortgage payment holiday - 05:09

Tip 7: Temporarily stop your KiwiSaver contributions - 06:06

Tip 8: Reduce discretionary spending - 06:20

Tip 9: Rent out a room in your home - 06:44

Tip 10: Find a part-time job - 06:50

Tip 11: Renting out your current home and move in with your family - 06:57

Tip 12: Sell unused assets - 07:14

Tip 13: Sell your rental property - 07:30

If I have lost my job and can’t pay my mortgage

After a layoff, keeping your mortgage repayment on time can be a challenge. These strategies may help you repay your home loan during tough financial times.

- Income protection insurance – Talk to your insurer and make a claim.

- Work and income subsidy – Find out what subsidy options are available and if you are eligible for the subsidy.

- Apply to your bank for financial hardship – Hardship is the option only when an unexpected life change, job loss for example, makes it hard to afford mortgage repayments. By applying for hardship, if it’s successful, you will be allowed to reduce each loan payment amount or even stopping paying at all for a short period of time. This won’t be suitable for everyone but could provide help and time to get you back on track.

If I worried about reduced income, how can I minimise my mortgage payment risk?

If you are experiencing mortgage stress, or expect you will soon have trouble making your home loan repayments due to the potential cut in work hours, less income, or even having risk of job loss, here are some quick tips on easing your mortgage stress that you can act immediately.

Tip 1: Have a revolving credit account or an offset account

Say you have $20k of spare cash in your saving or gift money. Instead of paying down your home loan, you could restructure your home loan, which means you take out $20K from your current loan and set it as a revolving or an offset account, then use your saving to offset against that $20K loan.

The main benefits of setting a revolving credit/ an offset account are:

- It reduces the amount of interest accruing on that $20K loan.

- The $20k cash is still accessible. You can spend the $20k at any time without needing the approval of the bank. It's more flexible than paying down your loan because if you choose to pay down your home loan with the $20k, you will lose the accessibility of that money. When you need the money, but you don't have sufficient income, your bank won't approve the top up of 20K.

Tip 2: Increase your credit card limit

Given the economic effects that coronavirus has brought to us, you can consider increasing your credit card limit and use your credit card for emergencies. It might help you release your mortgage stress, but only if you use them wisely.

Tip 3: Break and re-fix your home loan with lower interest rates

Majority of New Zealand banks have lowered their fixed-term interest rates after OCR cut, such as 3.05% for one-year fixed term – hitting the lowest in the New Zealand mortgage rates history.

If your fixed term is not about coming off to the end, you can consider breaking your home loan now and re-fix it at a lower rate. You may incur a one-off break fee if you break it early. Generally speaking, the fees is similar to the amount of interest saving. However, it may still worth taking this approach each loan repayment amount will be reduced. This will help you relieve your home loan repayment pressure.

If you have already worked with your bank for at least three or four years, you can consider refinancing your mortgage to another bank. Many banks offer cashback incentives to borrowers, which can be used to offset the cost of breaking existing loan.

Tip 4: Break and extend the term of your loan

Extending your loan term will reduce your regular repayments.

For example, your loan balance is $200k and the remaining loan term is 10 years. By breaking your current loan and extending to a term of 30 years, your regular loan repayments will be significantly reduced.

Similarly, a one-off break fee will occur. If you use a combined strategy of refinancing your mortgage to a new bank, and re-fixing it at a lower rate, and extending to a term of 30 years, you can significantly reduce the payment amount and also use the cashback to cover the cost of breaking.

Tip 5: Switch your loan to interest-only for a period

If you’re paying principal and interest on payment, consider switching your loan repayment tointerest-only. Since you only pay interest during this period, each payment will be smaller. However, paying interest-only mortgage is not always a good idea for borrowers because in the long run you end up with paying more on interests.

Tip 6: Taking mortgage payment holiday

The monthly mortgage payments are the biggest financial outgoing for many borrowers. If you’re struggling financially and can’t pay your mortgage due to coronavirus crisis, the option may be a mortgage payment holiday.

The mortgage payment holiday will offer flexibility in repaying your home loan by stopping the monthly loan payments for up to three months. This allows for some time to adjust your situation, find a job or sell your assets, and then get back on track.

If you are facing a temporary drop in income, a mortgage payment holiday can relieve some pressure for a while because you don’t pay nothing to the bank. However, there are some cons of a mortgage holiday you should bear in mind:

- You’re still racking up interest on the remaining loan balance while your payments are stopping for some period.

- Your outstanding loan balance will be higher than they were before the holiday due to the accrued interests.

A mortgage payment holiday is only a temporary option when you are experiencing financial difficulties issue. Not to mention not everyone will be granted a payment holiday and banks need to consider your case.

Tip 7: Temporarily stop your KiwiSaver contributions

You could consider taking a break from contributing to your KiwiSaver, which results in more net income.

Tip 8: Reduce discretionary spending

Re-consider some non-essential spending. For example, reduce your frequency of eating out, or defer purchasing a big item such as smartphone or appliances. until your financial situation changes, you could save thousands of dollars.

Tip 9: Rent out a room in your home

Got a spare room for family and friends? Renting out that room will give regular infusions of cash that can be applied to your loan repayment.

Tip 10: Find a part-time job

If your regular working hours have been cut, finding another part-time job might be your supplemental source of income.

Tip 11: Renting out your current home and move in with your family

If your parents, or siblings have a spare bedroom, you may consider living with them together. Then you’ll have additional income from renting out your house and your overall living expenses can be reduced as well.

Tip 12: Sell unused assets

Selling the household items that you no longer need or use, such as a spare car, is a smart way to boost your cash. You’ll have more money for your mortgage payment.

Tip 13: Sell your rental property

Finally, if you want to reduce your payment burden in the longer term, then probably consider selling your rental property to help you reduce the mortgage payments. It's better to do it early and do it by yourself so that you get most of the sale proceeds, rather than waiting for the bank to force you to do that. Bear in mind, that's probably the last resort.

The above are 13 tips that could help you overcome your cashflow issue and minimize your home loan payment pressure. Mortgage stress can affect anyone, especially during this challenging period of coronavirus.

Prosperity Finance – here to help

The best solution for managing mortgage repayment stress is to implement suitable strategies as soon as possible and avoid missing a payment, rather than waiting for the last minute. If you are experiencing financial stress, or believe you’ll soon struggle to make loan repayments, talk to us straightaway. We’re professional mortgage broker and we can help you make the decision that’s right for you.

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Read further:

Coronavirus: Further implications on NZ bank’s appetite for home loans

Does Coronavirus threaten your business? - 5 home loan tips for small business owners

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)