Does commercial property tenant have to pay rent during Covid-19 lockdown?

Posted by: Connie in Finance 101

While the wage subsidy remedied for staff costs, there is currently no government assistance for commercial lease – which typically occupied the certain proportion of a business’s fixed costs.

Since New Zealand went into Covid-19 lockdown, thousands of commercial property tenants have been stuck at home, with their business slowed or completely stopped operation. They were wondering if they could stop paying their rent.

On the other hand, commercial property landlords, many of whom have mortgage payments to make, were trying to work out whether they could still charge rent for their properties not being used.

That’s why in this week’s blog, our guest senior solicitor from Turner Hopkins, Joy Yuan, discusses how to deal with the commercial lease if, due to the Covid-19 lockdown, a tenant is unable to access its premises to conduct its business, from different perspectives of tenants and landlords.

Should commercial property tenant pay rent during Covid-19 lockdown?

Video Timeline

1. First step: check your commercial lease 01:46

2. No Access in Emergency Clause: What is a Fair Proportion? 03:31

3. What if I don’t have 27.5 no access emergency clause in my commercial lease? 08:44

4. If you’re a commercial landlord, what to do when your tenants refuse to pay rent? 12:26

First step: check your commercial lease

Get a copy of the lease out and see which type of the lease you have. We commonly see that in New Zealand, most of the commercial lease has been signed based on the ADLS (Auckland District Law Society) form. If your lease is ADLS lease in 2012 afterwards edition, then you may have a clause in the lease that says no access in emergency.

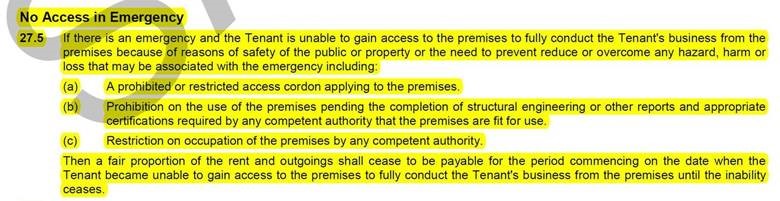

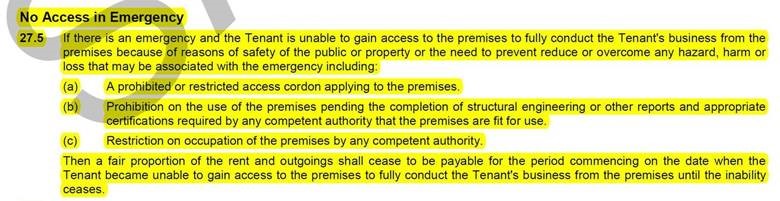

If you have that 27.5 no access emergency clause the next step is have a look at what that clause says. This is a clause basically applies in a situation where there is a public emergency arise and tenants are prevented from accessing its premises to fully conduct their business, then this clause will trigger. If you have that clause, then when that event happens (being the Covid-19 pandemic), the clause provides a fair portion of the rent and outgoings shall cease to be payable for the period that they cannot conduct their business due to inaccessibility.

No Access in Emergency Clause: What is a Fair Proportion?

Fair portion of the rent and outgoings can be ceased payable by the tenant. While this clause is helpful for those who are looking for some relief on paying their rent, it also raises another question – What percentage of the rent is a fair proportion and thus, how do you calculate it?

There is no defined meaning of fair portion under the ADLS lease. It has been left undefined as the situation for tenants and landlords is different. Therefore, the fair portion is something that needs to be interpreted, based on three key aspects:

- Contractual position - the lease agreement and its provisions

- Commercial position - What kind of business are tenants doing in the premises? Are they running the premises as an office, retail, restaurant, bar? Or they use the premises as a storage warehouse, or perhaps they are conducting essential service from that premises. So you need to look commercially. What does tenant do? And how much financial and commercial impact they are having as a result of the lockdown.

- Ethical position – in this difficult time, it is not all about what legal right you have, it's more about what ethical consequence that legal enforcement will result to. Both owners and tenants need to act in good faith to ethically reach an agreement.

Back to 2012 shortly after the earthquake in Christchurch, many business owners couldn’t access and conduct their business. Then this clause was included in the lease. Since then, there hasn’t been any emergency event trigging the clause 27.5, so there is yet to be any case law on that clause. However, in the situation of clause 27.3, where the premises have been partly damaged or destroyed, then the tenants can't access the premises and they are unable to fully conduct their business. There are some cases law being addressed in relation to that situation. For example, there was a high court case about a bar restaurant in 2015. The business was partially damaged due to an earthquake. Consequently, the business was affected due to the scaffolding outside of the entrance that blocked the restaurants appearance, which resulted in the loss of sales. In this particular case the court deemed that, due to the scaffolding and interruptions had caused to the tenant, the fair portion of rent was to be the equivalent of two months’ rent payable. In other words, the judge applied a 100% rent abatement.

In the above case, the court looked at the nature of the business and the amount of the interruptions the business suffered. But it will not be certain that the same rules apply to clause 27.5 application. Landlords and tenants shall negotiate and come to discuss in a good faith. Look at those aspects and see what is reasonable and what is fair for both parties to agree on. Anything that parties agree on must be recorded in writing to prevent future dispute from happening. The last thing you want is, if you only have a telephone conversation with your landlord or tenant, and agree on something but any of the details haven’t been recorded, such as how long the rent discount will apply for and how much it is.

What if I don’t have 27.5 no access emergency clause in my commercial lease?

If your lease is not on the ADLS form, or you don’t have the 27.5 clause, then basically the tenants do have the obligation to meet their rent payment. But given the current Covid-19 crisis, it is still fair for the tenants to propose or discuss with your landlord, to see whether the landlord would agree on something that is acceptable for both parties. Because from the landlord's perspective, it is also important to have a tenant in place and trade insolvently. Ethically without the 27.5 clause won’t stop both parties to negotiate.

What’s more, there are still other possibilities if your lease doesn’t include the 27.5 clause. Look at if there is any force majeure clause. If not, then maybe look at the law of frustration which applies in the situation the fundamental change of the purpose of the contract. So there are other avenues that your solicitor can help you to find out what other legal remedies you may have and how you can strategize your negotiation with tenants or with the landlord and achieve a desirable result for the parties.

If you’re a commercial landlord, what to do when your tenants refuse to pay rent?

Some tenants might send their landlords a letter saying they are not going to pay their rent. But from the legal perspective, they are still obliged to pay their rent until they reach mutually agreement with their landlords on the rent abatement. It can't be just one way from tenant saying they're not going to pay on the lease.

The landlord should look at practical perspective about your tenant’s situation and your own situation, then you could have a good negotiation with your tenants. As a landlord, you might have mortgage to pay based on the rentals. Also think about If your tenant’s business is a restaurant for example and can’t afford the rent in this situation, or if they are still working remotely etc. We highly recommend you engage with your legal advisers and structure an acceptable solution.

Bear in mind, the relationship between tenant and landlord is a long-term relationship. Instead of only focusing on one month’s rent, or the rent abatement for the lockdown period, both parties should help each other out during the difficult time to reach a mutual win-win situation and minimize the losses for both parties.

Overall, the advice above is to find pragmatic solutions that enable both parties to survive this difficult and unprecedented time as best you can. This crisis is having a significant impact on both commercial landlords and tenants. If you need help with your commercial lease – contact Joy, a senior solicitor from Turner Hopkins specializing in commercial property, 09 975 2624 or joy@turnerhopkins.co.nz

Prosperity Finance – here to help

If you’re having trouble repaying your home loan in this difficult time, or you’re worrying about your plan in terms of upgrading your family home, buying an investment property, or anything related to change your property, change your loan, we’re professional mortgage broker and are here to help you. Call us at 09 930 8999 for a no-obligation chat with our adviser.

Read Further:

Coronavirus: How to reduce my mortgage repayment pressure?

Coronavirus: Further implications on NZ bank’s appetite for home loans

Does Coronavirus threaten your business? - 5 home loan tips for small business owners

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

While the wage subsidy remedied for staff costs, there is currently no government assistance for commercial lease – which typically occupied the certain proportion of a business’s fixed costs.

Since New Zealand went into Covid-19 lockdown, thousands of commercial property tenants have been stuck at home, with their business slowed or completely stopped operation. They were wondering if they could stop paying their rent.

On the other hand, commercial property landlords, many of whom have mortgage payments to make, were trying to work out whether they could still charge rent for their properties not being used.

That’s why in this week’s blog, our guest senior solicitor from Turner Hopkins, Joy Yuan, discusses how to deal with the commercial lease if, due to the Covid-19 lockdown, a tenant is unable to access its premises to conduct its business, from different perspectives of tenants and landlords.

Should commercial property tenant pay rent during Covid-19 lockdown?

Video Timeline

1. First step: check your commercial lease 01:46

2. No Access in Emergency Clause: What is a Fair Proportion? 03:31

3. What if I don’t have 27.5 no access emergency clause in my commercial lease? 08:44

4. If you’re a commercial landlord, what to do when your tenants refuse to pay rent? 12:26

First step: check your commercial lease

Get a copy of the lease out and see which type of the lease you have. We commonly see that in New Zealand, most of the commercial lease has been signed based on the ADLS (Auckland District Law Society) form. If your lease is ADLS lease in 2012 afterwards edition, then you may have a clause in the lease that says no access in emergency.

If you have that 27.5 no access emergency clause the next step is have a look at what that clause says. This is a clause basically applies in a situation where there is a public emergency arise and tenants are prevented from accessing its premises to fully conduct their business, then this clause will trigger. If you have that clause, then when that event happens (being the Covid-19 pandemic), the clause provides a fair portion of the rent and outgoings shall cease to be payable for the period that they cannot conduct their business due to inaccessibility.

No Access in Emergency Clause: What is a Fair Proportion?

Fair portion of the rent and outgoings can be ceased payable by the tenant. While this clause is helpful for those who are looking for some relief on paying their rent, it also raises another question – What percentage of the rent is a fair proportion and thus, how do you calculate it?

There is no defined meaning of fair portion under the ADLS lease. It has been left undefined as the situation for tenants and landlords is different. Therefore, the fair portion is something that needs to be interpreted, based on three key aspects:

- Contractual position - the lease agreement and its provisions

- Commercial position - What kind of business are tenants doing in the premises? Are they running the premises as an office, retail, restaurant, bar? Or they use the premises as a storage warehouse, or perhaps they are conducting essential service from that premises. So you need to look commercially. What does tenant do? And how much financial and commercial impact they are having as a result of the lockdown.

- Ethical position – in this difficult time, it is not all about what legal right you have, it's more about what ethical consequence that legal enforcement will result to. Both owners and tenants need to act in good faith to ethically reach an agreement.

Back to 2012 shortly after the earthquake in Christchurch, many business owners couldn’t access and conduct their business. Then this clause was included in the lease. Since then, there hasn’t been any emergency event trigging the clause 27.5, so there is yet to be any case law on that clause. However, in the situation of clause 27.3, where the premises have been partly damaged or destroyed, then the tenants can't access the premises and they are unable to fully conduct their business. There are some cases law being addressed in relation to that situation. For example, there was a high court case about a bar restaurant in 2015. The business was partially damaged due to an earthquake. Consequently, the business was affected due to the scaffolding outside of the entrance that blocked the restaurants appearance, which resulted in the loss of sales. In this particular case the court deemed that, due to the scaffolding and interruptions had caused to the tenant, the fair portion of rent was to be the equivalent of two months’ rent payable. In other words, the judge applied a 100% rent abatement.

In the above case, the court looked at the nature of the business and the amount of the interruptions the business suffered. But it will not be certain that the same rules apply to clause 27.5 application. Landlords and tenants shall negotiate and come to discuss in a good faith. Look at those aspects and see what is reasonable and what is fair for both parties to agree on. Anything that parties agree on must be recorded in writing to prevent future dispute from happening. The last thing you want is, if you only have a telephone conversation with your landlord or tenant, and agree on something but any of the details haven’t been recorded, such as how long the rent discount will apply for and how much it is.

What if I don’t have 27.5 no access emergency clause in my commercial lease?

If your lease is not on the ADLS form, or you don’t have the 27.5 clause, then basically the tenants do have the obligation to meet their rent payment. But given the current Covid-19 crisis, it is still fair for the tenants to propose or discuss with your landlord, to see whether the landlord would agree on something that is acceptable for both parties. Because from the landlord's perspective, it is also important to have a tenant in place and trade insolvently. Ethically without the 27.5 clause won’t stop both parties to negotiate.

What’s more, there are still other possibilities if your lease doesn’t include the 27.5 clause. Look at if there is any force majeure clause. If not, then maybe look at the law of frustration which applies in the situation the fundamental change of the purpose of the contract. So there are other avenues that your solicitor can help you to find out what other legal remedies you may have and how you can strategize your negotiation with tenants or with the landlord and achieve a desirable result for the parties.

If you’re a commercial landlord, what to do when your tenants refuse to pay rent?

Some tenants might send their landlords a letter saying they are not going to pay their rent. But from the legal perspective, they are still obliged to pay their rent until they reach mutually agreement with their landlords on the rent abatement. It can't be just one way from tenant saying they're not going to pay on the lease.

The landlord should look at practical perspective about your tenant’s situation and your own situation, then you could have a good negotiation with your tenants. As a landlord, you might have mortgage to pay based on the rentals. Also think about If your tenant’s business is a restaurant for example and can’t afford the rent in this situation, or if they are still working remotely etc. We highly recommend you engage with your legal advisers and structure an acceptable solution.

Bear in mind, the relationship between tenant and landlord is a long-term relationship. Instead of only focusing on one month’s rent, or the rent abatement for the lockdown period, both parties should help each other out during the difficult time to reach a mutual win-win situation and minimize the losses for both parties.

Overall, the advice above is to find pragmatic solutions that enable both parties to survive this difficult and unprecedented time as best you can. This crisis is having a significant impact on both commercial landlords and tenants. If you need help with your commercial lease – contact Joy, a senior solicitor from Turner Hopkins specializing in commercial property, 09 975 2624 or joy@turnerhopkins.co.nz

Prosperity Finance – here to help

If you’re having trouble repaying your home loan in this difficult time, or you’re worrying about your plan in terms of upgrading your family home, buying an investment property, or anything related to change your property, change your loan, we’re professional mortgage broker and are here to help you. Call us at 09 930 8999 for a no-obligation chat with our adviser.

Read Further:

Coronavirus: How to reduce my mortgage repayment pressure?

Coronavirus: Further implications on NZ bank’s appetite for home loans

Does Coronavirus threaten your business? - 5 home loan tips for small business owners

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)