Your sale proceeds could be at risk when you hold multiple properties secured with one lender

Posted by: Connie in Property Investing

New Zealand property market is recovering well after Covid-19 lockdown. As a mortgage brokering business, we have been receiving flood of inquiries from the first home buyers and investors who are considering buying a property and need to apply for a pre-approval.

It is partially to do with the current low home loan interest rates - some banks offer less than 2.5%, helping us save money and pay off loan quicker. On the other hand, people expect that there might be some bargains out there, so it's good time to buy properties.

However, we would remind you that while you're busy with getting pre-approval to buy a home or an investment property, or upgrade home, bear in mind, good planning is extremely important - you not only plan for this upcoming transaction, but also you need to factor in your plan for the next couple years.

In the video, we shared a case study showing you the importance of planning ahead with the right loan structure. The clients have one family home and one rental property. Although at the time of buying their rental property, they were qualified with multiple banks, they eventually went back to their own bank where their family home was mortgaged to, resulting in two properties with the same bank. Early this year, they sold their rental property, planning to use the sale proceed to buy a business. But they never expected no sale proceeds left in their hands. Consequently, they had to apply for a business loan. But it’s not easy to get approved, especially during Covid-19 period.

Your property sale proceeds could be at risk when you hold multiple properties secured with one bank

Video Timeline

1. If the clients split their home loans with different banks, then when they sell their rental property, they could have not to pay back full sale proceeds to their bank 02:40

2. With no cash left after selling the rental property, the clients had to apply for a business loan to purchase because their bank took full control on the sale proceeds. 07:30

1. If the clients split their home loans with different banks, then when they sell their rental property, they could have not to pay back full sale proceeds to their bank

The clients are a married couple. They were on PAYE and had stable income.

| Market Value | Loan Amount | Bank | |

| Family Home | $1 million | $350k | ANZ |

| Rental Property | $850k | $700k | ANZ |

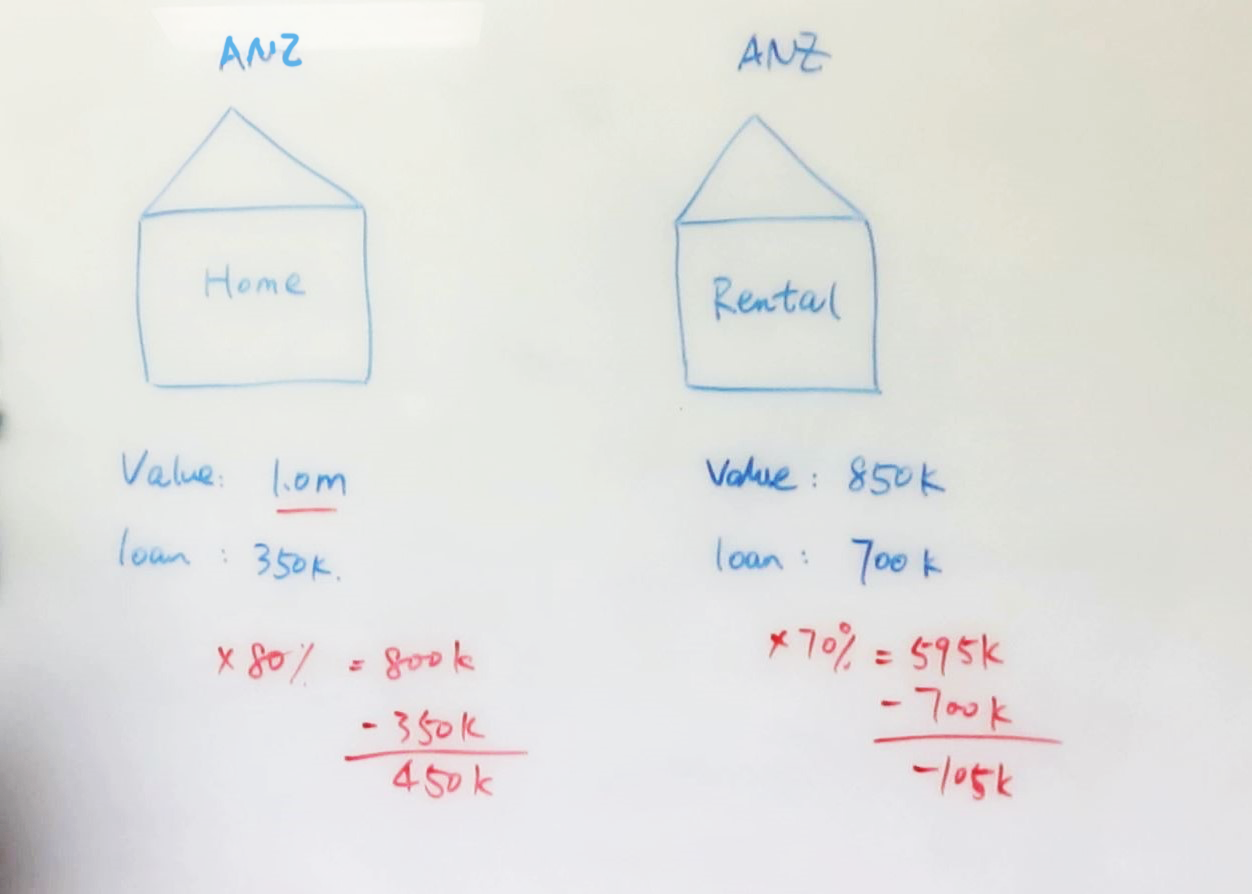

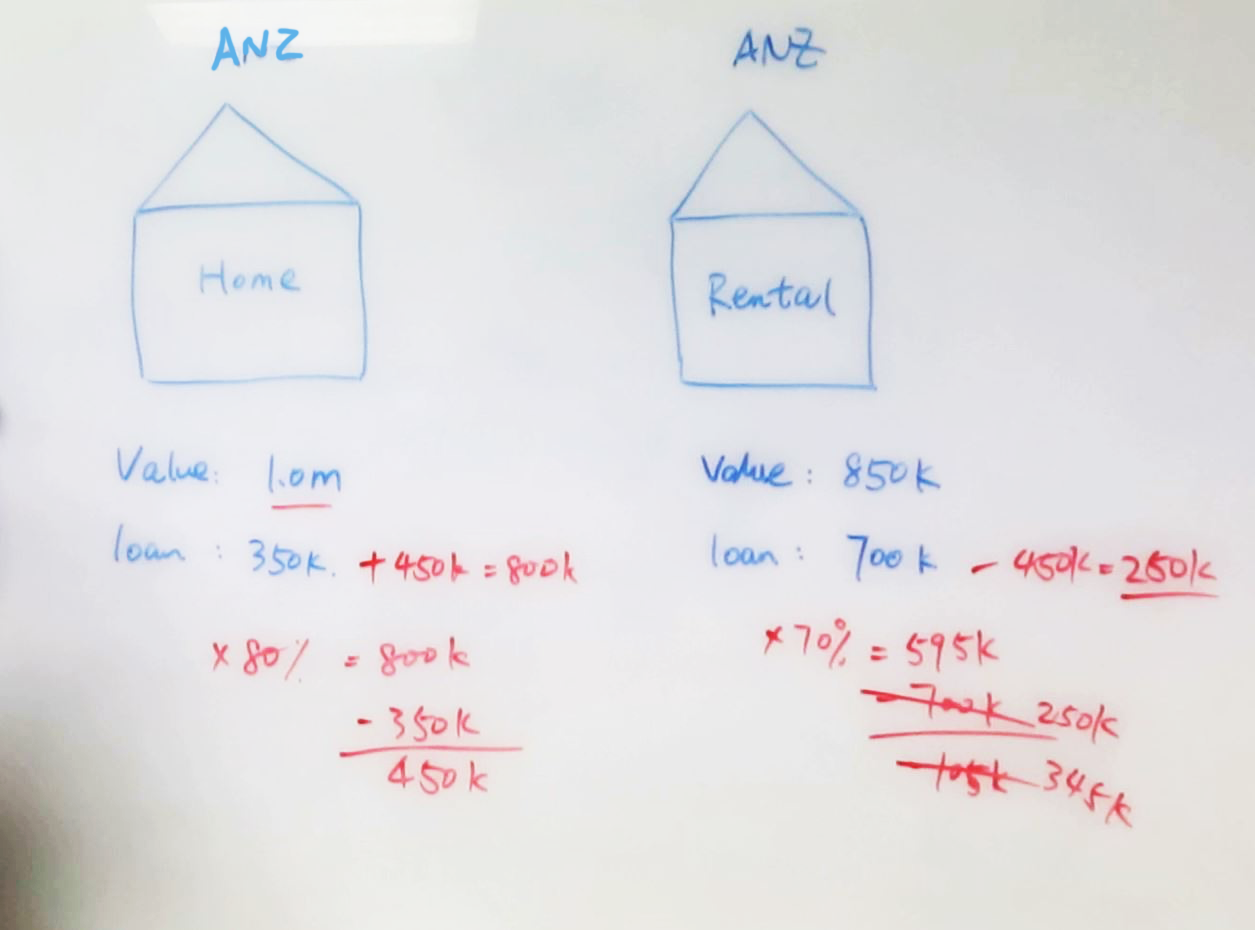

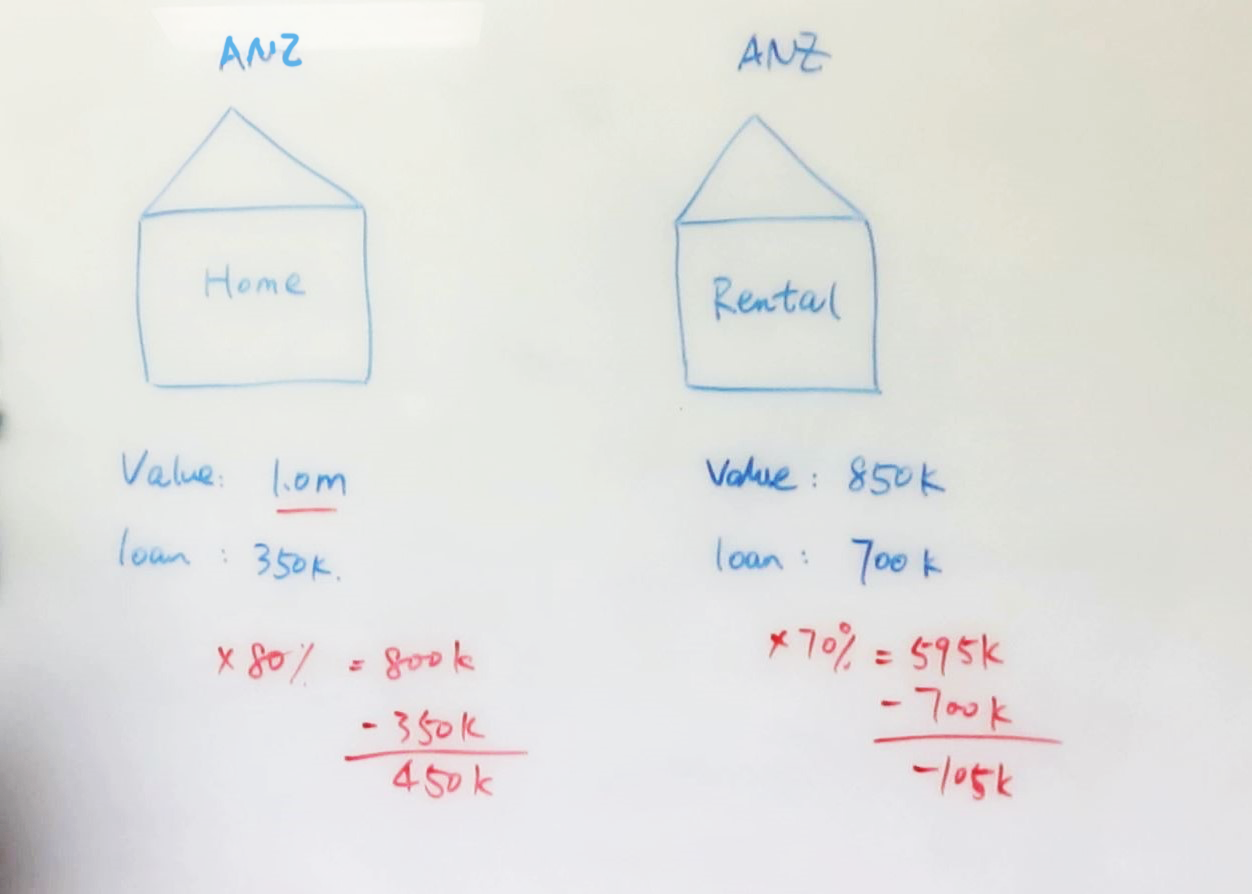

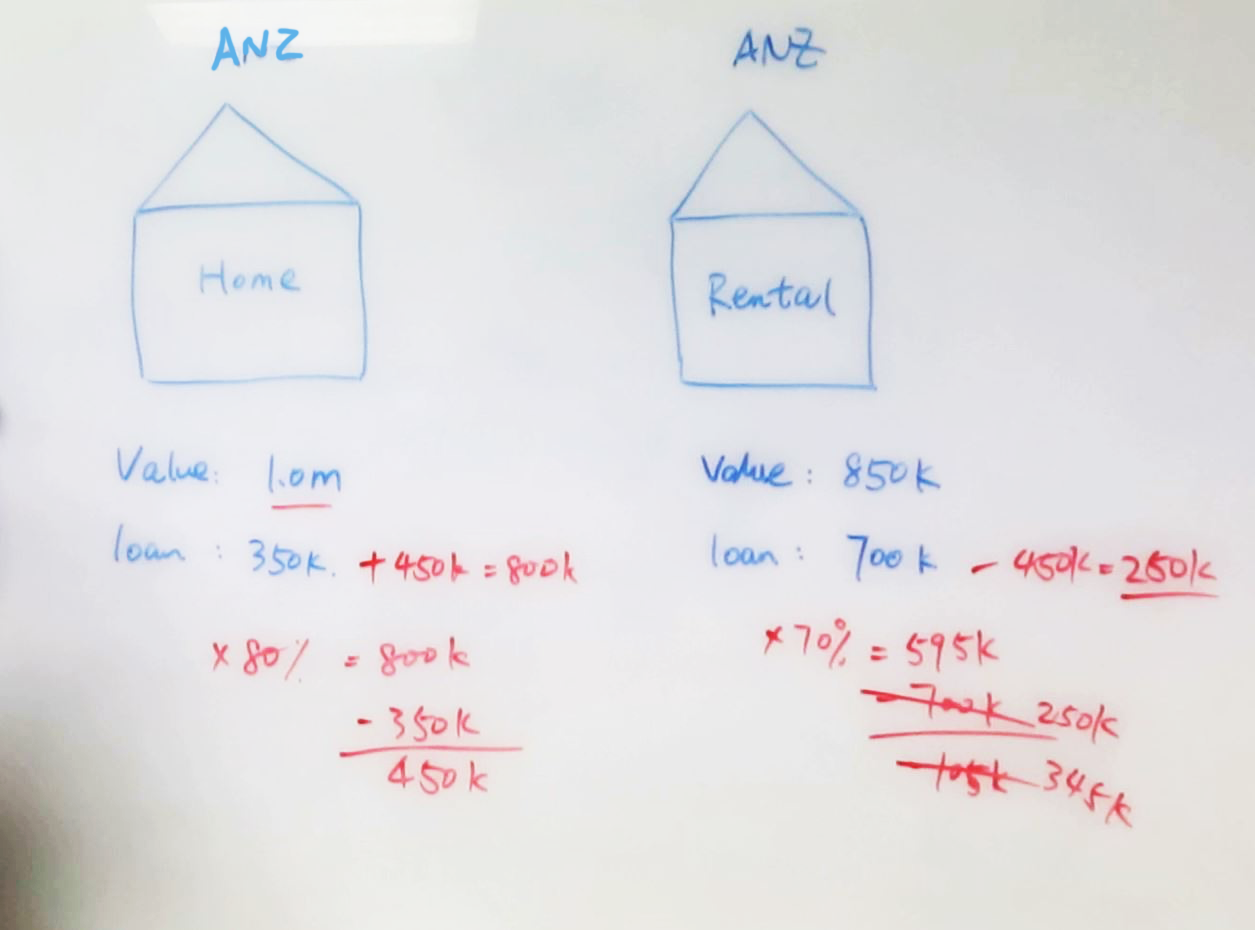

They had two properties. One is a family home worth about a million dollars and the loan against that was $350K. They also have a rental property. The value at the time was $850K and the loan was $700K. As we mentioned earlier, they dealt with the same bank (ANZ) where both properties were mortgaged to.

Last year they came to us and at the time they were considering buying their second rental property. Before the clients came to us, they went to ANZ and tried to borrow for their second rental property but was told they could only borrow $300k or $400k, which was far behind their expectation. Based on this, they thought they couldn’t afford to buy another rental. However, that was the problem as they went to the wrong bank. After we analysed their situation, we confirmed they had sufficient income and equity to buy another one.

Let's first look at the equity level. The LVR for first home is 80%. For a one-million-dollar house, they could borrow up to $800K against that property. As they already borrowed $350K, therefore the equity on their family home was $450K. The same applied to their rental property. Based on 70% LVR for the rental property and the current loan amount ($700k), the equity for their rental property was negative $105k ($595k - $700k). So the overall equity across these two properties was $345k ($450k - $105k), which would make it sufficient equity to buy a million dollar rental property (base on 70% LVR) subject to the servicing ability.

From serving perspective, even though their income situation remained the same, they might end up with very different borrowing capacity or servicing ability because lending policies are different from bank to bank. That’s why we recommended them carry their equity to a bank where they could borrow enough to buy their second rental property.

However, before they buy another house, we recommend them to split their existing loans against two properties into different banks first. There are two main reasons:

Number one is the serviceability side.

When banks assess your situation, they not only look at the equity level, but also look at your servicing ability. In fact, serviceability is more important than equity because serviceability stands for your ability to repay the loan. If you cannot demonstrate you have that ability, then it doesn't matter how strong equity you have. At the end of the day, bank will not lend you money if you cannot afford.

Equity is to help banks protect themselves. In the worst-case scenario, banks have the choice to sell your property and recover the debt if you couldn’t repay your loan. Obviously, mortgagee sale is not the ideal way to exit. The first way out is to use your cashflow to repay over a number of years and eventually pay off the property.

Another reason is the sale proceeds could be at risk when you hold multiple properties with one lender.

Borrowers often have the assumption that if they sell their house, they only need to pay off the loan against that property. However, this is not the case when you hold multiple properties with just one lender.

When you hold multiple properties with one lender, they takes full control over your property security, which means should you sell down one of your rental properties they can decide how much you need to repay from the sale proceeds. Your lender will decide if the equity level on the remaining security is sufficient – and could also review your borrowing capacity based on your ongoing income. If either test fails, you may end up with higher than expected repayments. In the worst scenario, you have to pay back all net sale proceeds.

In this case, if the clients had split two property loans with different banks, then they only need to pay off the loan from one bank and keep the remaining net sale proceeds.

2. With no cash left after selling the rental property, the clients had to apply for a business loan to purchase because their bank took full control on the sale proceeds.

Unfortunately, the clients didn't take our advice. They didn’t split their loans with different banks, and they didn’t buy another investment property.

Early this year, the husband got redundant and the wife’s working hours was reduced, resulting in the rapid decrease in their family income. So, they were thinking about buying a business, options include a laundry shop, lunch bar, and a café.

To have enough money to buy a new business, the clients sold out their rental property. But they never expect that they had to repay all sale proceeds after real estate agent commission and legal fee (approx.$800k) because ANZ reassessed their situation on the way out – as tremendous decrease in their family income, they could only service roughly $200k of home loan. Consequently, they had to pay down their loan from a total $1.05 million to around $200K.

The clients ended up with no cash left in their hands to buy a business. If they knew they couldn’t keep any cents, then they might not sell it.

With no cash to buy a business, they had no other choice but to apply for a business loan. Luckily, they still have equity up to $800K on their family home and only $200K of loan. Theoretically, they can borrow roughly $600k to purchase a business. Still, the bank will consider many other factors when it comes to business finance, such as lease term, financial statements, forecast, and business plan etc. Also, banks are very sensitive to some industries, hospitality for example is suffering a heavy loss under the Covid-19 environment. After a few tries, the clients couldn’t get finance.

However, if the clients could take our advice – refinance the rental property to another bank and only take $250k to the new bank (remaining $800k keep at ANZ by maximising equity against their family home).By this way, when they sell the rental, they would only need to repay $250k to their new bank and they would have about $600k cash in hands, and most importantly, the bank would not have control on the cash and they could use the money to buy a business, rather than borrowing.

Prosperity Finance – here to help

It’s a sad story but a good example to show you the importance of planning ahead with the right loan structure. Here at Prosperity Finance, we don’t have a one-size-fits-all solutions for your home loan. Every borrower’s needs, requirements and financial situation is unique – and their loan should be too. That’s why we like to structure your loan in its best way to suit you. Call us at 09 930 8999 for a no-obligation chat with our adviser.

Read Further:

How can a good loan structure work well for you to save $900 on tax per year?

Do you have multiple properties secured with the same bank?

LVR restriction removed and what does it mean for you?

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

New Zealand property market is recovering well after Covid-19 lockdown. As a mortgage brokering business, we have been receiving flood of inquiries from the first home buyers and investors who are considering buying a property and need to apply for a pre-approval.

It is partially to do with the current low home loan interest rates - some banks offer less than 2.5%, helping us save money and pay off loan quicker. On the other hand, people expect that there might be some bargains out there, so it's good time to buy properties.

However, we would remind you that while you're busy with getting pre-approval to buy a home or an investment property, or upgrade home, bear in mind, good planning is extremely important - you not only plan for this upcoming transaction, but also you need to factor in your plan for the next couple years.

In the video, we shared a case study showing you the importance of planning ahead with the right loan structure. The clients have one family home and one rental property. Although at the time of buying their rental property, they were qualified with multiple banks, they eventually went back to their own bank where their family home was mortgaged to, resulting in two properties with the same bank. Early this year, they sold their rental property, planning to use the sale proceed to buy a business. But they never expected no sale proceeds left in their hands. Consequently, they had to apply for a business loan. But it’s not easy to get approved, especially during Covid-19 period.

Your property sale proceeds could be at risk when you hold multiple properties secured with one bank

Video Timeline

1. If the clients split their home loans with different banks, then when they sell their rental property, they could have not to pay back full sale proceeds to their bank 02:40

2. With no cash left after selling the rental property, the clients had to apply for a business loan to purchase because their bank took full control on the sale proceeds. 07:30

1. If the clients split their home loans with different banks, then when they sell their rental property, they could have not to pay back full sale proceeds to their bank

The clients are a married couple. They were on PAYE and had stable income.

| Market Value | Loan Amount | Bank | |

| Family Home | $1 million | $350k | ANZ |

| Rental Property | $850k | $700k | ANZ |

They had two properties. One is a family home worth about a million dollars and the loan against that was $350K. They also have a rental property. The value at the time was $850K and the loan was $700K. As we mentioned earlier, they dealt with the same bank (ANZ) where both properties were mortgaged to.

Last year they came to us and at the time they were considering buying their second rental property. Before the clients came to us, they went to ANZ and tried to borrow for their second rental property but was told they could only borrow $300k or $400k, which was far behind their expectation. Based on this, they thought they couldn’t afford to buy another rental. However, that was the problem as they went to the wrong bank. After we analysed their situation, we confirmed they had sufficient income and equity to buy another one.

Let's first look at the equity level. The LVR for first home is 80%. For a one-million-dollar house, they could borrow up to $800K against that property. As they already borrowed $350K, therefore the equity on their family home was $450K. The same applied to their rental property. Based on 70% LVR for the rental property and the current loan amount ($700k), the equity for their rental property was negative $105k ($595k - $700k). So the overall equity across these two properties was $345k ($450k - $105k), which would make it sufficient equity to buy a million dollar rental property (base on 70% LVR) subject to the servicing ability.

From serving perspective, even though their income situation remained the same, they might end up with very different borrowing capacity or servicing ability because lending policies are different from bank to bank. That’s why we recommended them carry their equity to a bank where they could borrow enough to buy their second rental property.

However, before they buy another house, we recommend them to split their existing loans against two properties into different banks first. There are two main reasons:

Number one is the serviceability side.

When banks assess your situation, they not only look at the equity level, but also look at your servicing ability. In fact, serviceability is more important than equity because serviceability stands for your ability to repay the loan. If you cannot demonstrate you have that ability, then it doesn't matter how strong equity you have. At the end of the day, bank will not lend you money if you cannot afford.

Equity is to help banks protect themselves. In the worst-case scenario, banks have the choice to sell your property and recover the debt if you couldn’t repay your loan. Obviously, mortgagee sale is not the ideal way to exit. The first way out is to use your cashflow to repay over a number of years and eventually pay off the property.

Another reason is the sale proceeds could be at risk when you hold multiple properties with one lender.

Borrowers often have the assumption that if they sell their house, they only need to pay off the loan against that property. However, this is not the case when you hold multiple properties with just one lender.

When you hold multiple properties with one lender, they takes full control over your property security, which means should you sell down one of your rental properties they can decide how much you need to repay from the sale proceeds. Your lender will decide if the equity level on the remaining security is sufficient – and could also review your borrowing capacity based on your ongoing income. If either test fails, you may end up with higher than expected repayments. In the worst scenario, you have to pay back all net sale proceeds.

In this case, if the clients had split two property loans with different banks, then they only need to pay off the loan from one bank and keep the remaining net sale proceeds.

2. With no cash left after selling the rental property, the clients had to apply for a business loan to purchase because their bank took full control on the sale proceeds.

Unfortunately, the clients didn't take our advice. They didn’t split their loans with different banks, and they didn’t buy another investment property.

Early this year, the husband got redundant and the wife’s working hours was reduced, resulting in the rapid decrease in their family income. So, they were thinking about buying a business, options include a laundry shop, lunch bar, and a café.

To have enough money to buy a new business, the clients sold out their rental property. But they never expect that they had to repay all sale proceeds after real estate agent commission and legal fee (approx.$800k) because ANZ reassessed their situation on the way out – as tremendous decrease in their family income, they could only service roughly $200k of home loan. Consequently, they had to pay down their loan from a total $1.05 million to around $200K.

The clients ended up with no cash left in their hands to buy a business. If they knew they couldn’t keep any cents, then they might not sell it.

With no cash to buy a business, they had no other choice but to apply for a business loan. Luckily, they still have equity up to $800K on their family home and only $200K of loan. Theoretically, they can borrow roughly $600k to purchase a business. Still, the bank will consider many other factors when it comes to business finance, such as lease term, financial statements, forecast, and business plan etc. Also, banks are very sensitive to some industries, hospitality for example is suffering a heavy loss under the Covid-19 environment. After a few tries, the clients couldn’t get finance.

However, if the clients could take our advice – refinance the rental property to another bank and only take $250k to the new bank (remaining $800k keep at ANZ by maximising equity against their family home).By this way, when they sell the rental, they would only need to repay $250k to their new bank and they would have about $600k cash in hands, and most importantly, the bank would not have control on the cash and they could use the money to buy a business, rather than borrowing.

Prosperity Finance – here to help

It’s a sad story but a good example to show you the importance of planning ahead with the right loan structure. Here at Prosperity Finance, we don’t have a one-size-fits-all solutions for your home loan. Every borrower’s needs, requirements and financial situation is unique – and their loan should be too. That’s why we like to structure your loan in its best way to suit you. Call us at 09 930 8999 for a no-obligation chat with our adviser.

Read Further:

How can a good loan structure work well for you to save $900 on tax per year?

Do you have multiple properties secured with the same bank?

LVR restriction removed and what does it mean for you?

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- February 2026 (1)

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)