Three tips to help you improve tax efficiency under the new interest deduction rules

Posted by: Connie in Property Investing

Since the government introduced the interest deductibility rule early this year, the interest expenses generated from the rental property acquired on or after 27th March 2021 will not be allowed to offset against the rental income from 1 October 2021. This change could significantly increase the costs of holding debt funded rental properties that are not “new builds”.

We noticed some aspects of home loans that people need to be aware. If you don't do them correctly, you may end up paying more tax, or your accountant may have a headache when they prepare your financials at the end of the financial year.

That’s why in this video, we're going to cover three tips to help you work out how you can manage your home loan structure that best conform your situation and be tax efficient.

Three tips to help you improve tax efficiency under the new interest deduction rules

Video Timeline

Tips 1: Offset VS. Revolving account 01:02

Tip 2: Don't combine your loans, especially for the rental property loans 05:56

Tip 3: How to wisely use a lump sum money to repay loans – if you do not wish to use the money for something else to purchase a new property 06:56

Tips 1: Offset VS. Revolving account

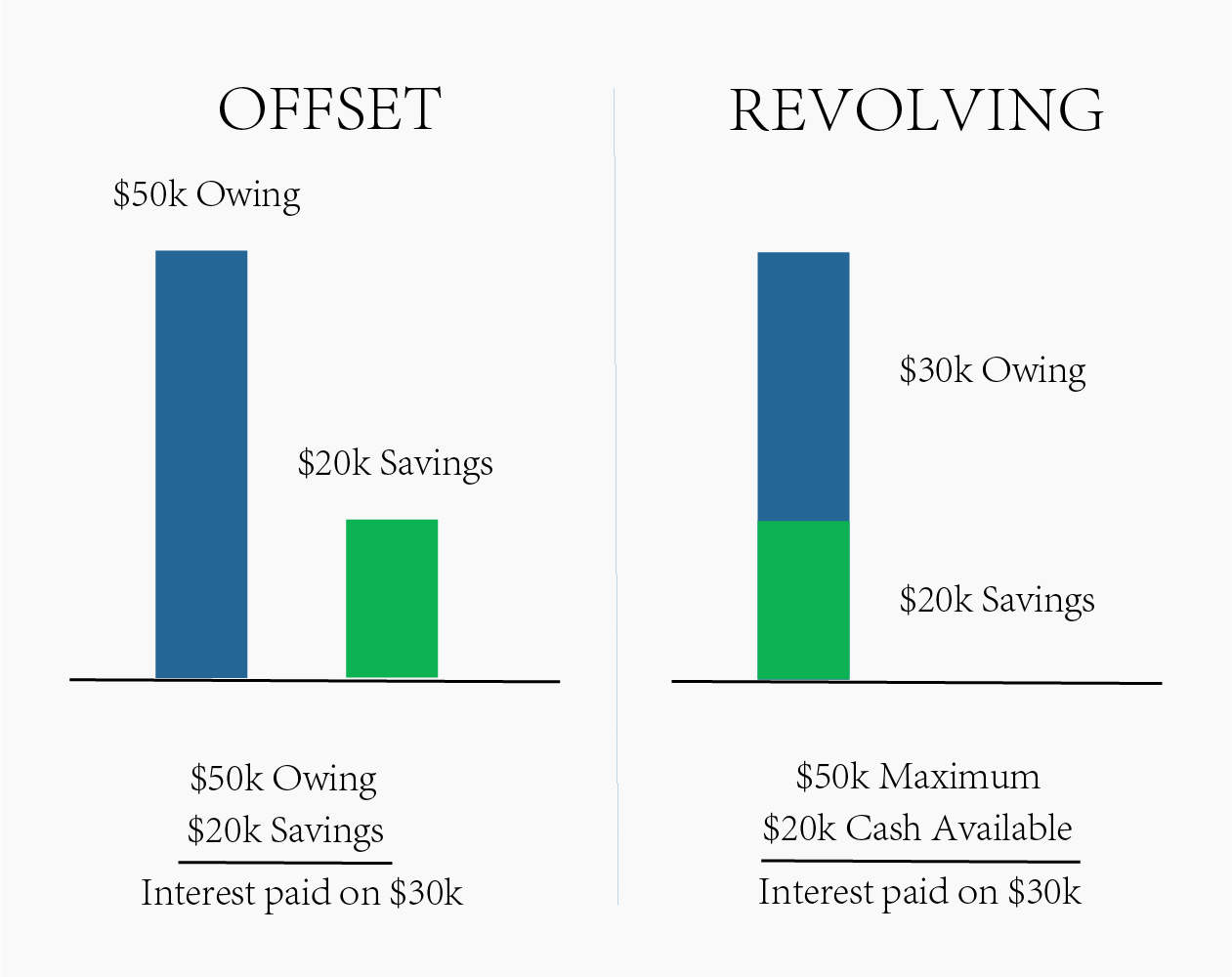

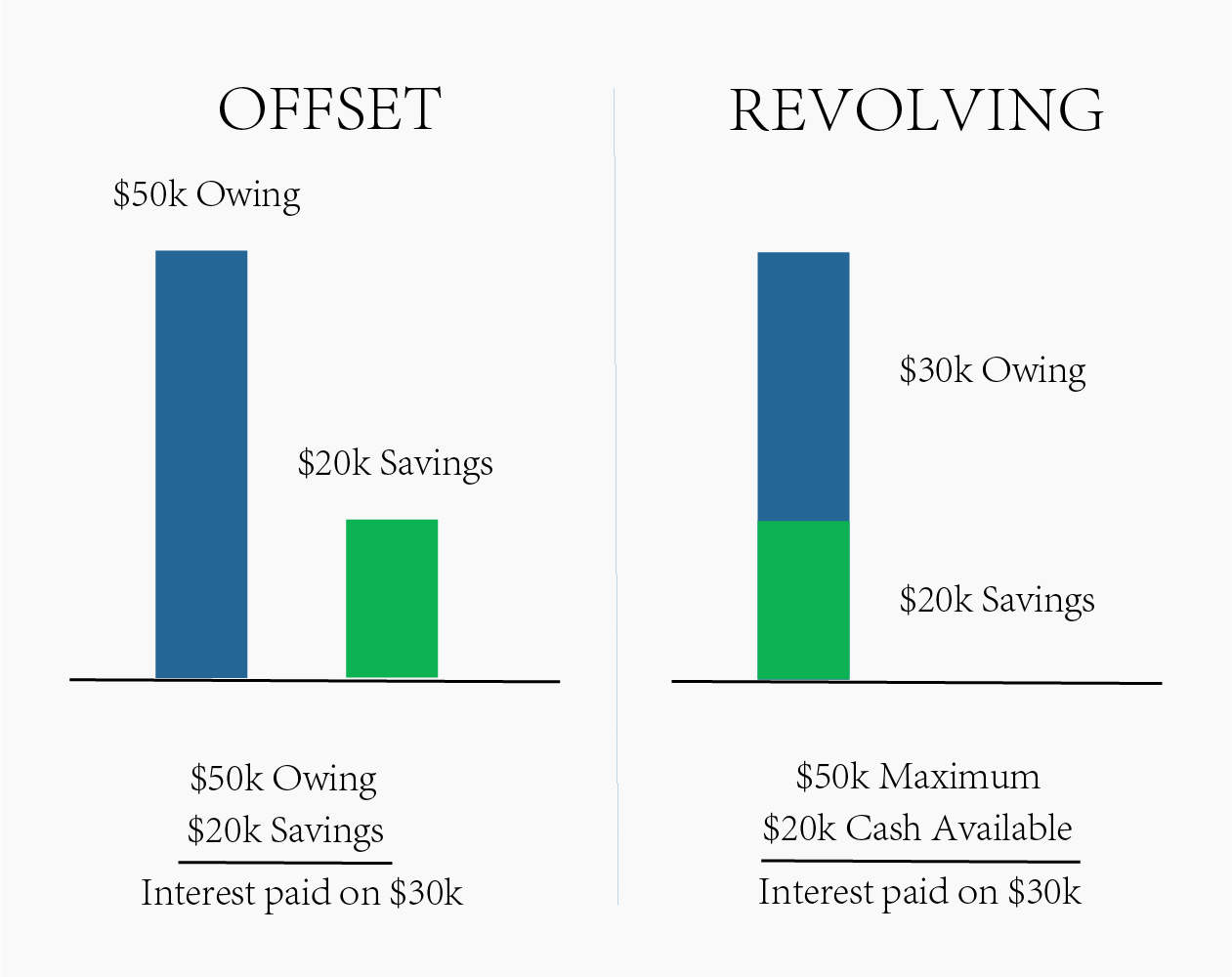

Generally, offset and revolving accounts are a type of home loan product secured against a residential property that works like a large overdraft or credit card. It helps borrowers achieve a similar goal, which is to use the savings to offset the loan interest in order to achieve the purpose of interest saving. We have separate videos that outlined the difference between these two accounts, in case you’re not clear about them.

Most banks have a revolving facility but call it fancy names: ANZ have Flexi, BNZ have Rapid Repay, Westpac have Choice Everyday, and ASB have Orbit. Whereas not all mainstream banks have an offset product. BNZ and Westpac are currently recognized as the best two banks in the market to provide Offset products. One is called Total Money, and another one called Choices Offset.

In general, offset accounts offers a better option compared to revolving accounts because it does not only allow you to offset your own money but also being able to offset your parents' or children's money. On top of that, some banks such as Westpac won't charge the monthly fee for an offset account, whereas a monthly fee between $10 to $12 may apply on a revolving facility. Therefore, offset accounts tend to have more benefits than revolving accounts.

However, the scenario occurs differently since the government launched this interest deductibility rule. The situation has become more complex to all real estate investors, and it is vital to be more thoughtful when using an offset account.

Case study:

Recently, one of our clients came to us and want to get advice on how to use their gifted money. They currently have a home loan of $200K. At the same time, they have another $200K cash from their parents' gifting. They are planning to purchase another property with development potential which is likely to be developed and then rented out in the future as an investment property. When it comes to the money gifted, they have three options as follows, despite the first two options are not desirable.

The first option is to pay off the loan in full to minimise the interest costs. But considering they are still in the early stage of development, they would need money to pay some fees such as council fee, design fee, and consent fee. If this is the case, they have to go through the entire application process to apply for a top-up, which can be a time-consuming process.

The other two options are converting into offset or revolving accounts. Both ways would help to minimise interest costs when their money is not used yet and give them the flexibility of accessing money when needed. However, in terms of interest deductibility, these two options would bring completely different results.

If the home loan is converted into an offset account, home loan starts incurring interest again once they move the money from their offset account to cover some initial development costs because there's no cash to offset. They simply used their own money towards the development project. The interest occurred was for their family home.

However, if the money is converted into a revolving facility, there would be three beneficial aspects since the introduction of new interest deductibility policies: First, the clients can pay off their loan but they do have the ability to redraw the funds when they need it. Second, they do not need to obtain full approval through the bank to be eligible to use the funds. Lastly, the interest occurs when they start using the money to build a new property, however, the interest will become interest deductible against future rent, therefore, it will help the clients minimize their future rental profits. That's the reason why revolving is recommended in this case.

Tip 2: Don't combine your loans, especially for the rental property loans

As mentioned above, no interest deductions on a residential investment property (not new builds) acquired after 27th March 2021. For the property acquired before 27th March 2021, the interests on the home loan will become progressively non-tax deductible against rental income from 1st October 2021.

You may want to combine loans maybe because the amount is small or whatever the reason leads you to combine it with existing loans. Without getting professional advice, if you combine loans which are for properties acquired at different times, it may become very hard to trace later and make it difficult for your accountant to produce accurate financial statements. Even worse, it can have tax implications. To keep separate accounts for different purposes will provide simple tracking if required.

Tip 3: How to wisely use a lump sum money to repay loans if you do not wish to use the money for something else.

- Priority one: Pay down your home loan first – this will help you discharge your home sooner than later to protect your home

- Priority two: Pay down the loan against existing rental properties (not new build) purchased from 27th March this year. Because from 1st October you cannot deduct the interest against the rental. That’s why it is better to pay down this loan fast.

- If you still have extra money, you can pay down the loans for your rental properties which were purchased prior to 27th March one at a time.

The above three tips can not only help you manage your home loans with better tax efficiency, but also allow you to make the right decisions in a complex situation. Any questions? Or seek help? Call us at 09 930 8999 to have a no-obligation chat with one of the financial advisors at Prosperity Finance.

Read more:

Are higher interest rates coming?

Should you be concerned about DTI (debt-to-income ratio)?

Should I invest in new builds or existing properties? 13 pros and cons

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Since the government introduced the interest deductibility rule early this year, the interest expenses generated from the rental property acquired on or after 27th March 2021 will not be allowed to offset against the rental income from 1 October 2021. This change could significantly increase the costs of holding debt funded rental properties that are not “new builds”.

We noticed some aspects of home loans that people need to be aware. If you don't do them correctly, you may end up paying more tax, or your accountant may have a headache when they prepare your financials at the end of the financial year.

That’s why in this video, we're going to cover three tips to help you work out how you can manage your home loan structure that best conform your situation and be tax efficient.

Three tips to help you improve tax efficiency under the new interest deduction rules

Video Timeline

Tips 1: Offset VS. Revolving account 01:02

Tip 2: Don't combine your loans, especially for the rental property loans 05:56

Tip 3: How to wisely use a lump sum money to repay loans – if you do not wish to use the money for something else to purchase a new property 06:56

Tips 1: Offset VS. Revolving account

Generally, offset and revolving accounts are a type of home loan product secured against a residential property that works like a large overdraft or credit card. It helps borrowers achieve a similar goal, which is to use the savings to offset the loan interest in order to achieve the purpose of interest saving. We have separate videos that outlined the difference between these two accounts, in case you’re not clear about them.

Most banks have a revolving facility but call it fancy names: ANZ have Flexi, BNZ have Rapid Repay, Westpac have Choice Everyday, and ASB have Orbit. Whereas not all mainstream banks have an offset product. BNZ and Westpac are currently recognized as the best two banks in the market to provide Offset products. One is called Total Money, and another one called Choices Offset.

In general, offset accounts offers a better option compared to revolving accounts because it does not only allow you to offset your own money but also being able to offset your parents' or children's money. On top of that, some banks such as Westpac won't charge the monthly fee for an offset account, whereas a monthly fee between $10 to $12 may apply on a revolving facility. Therefore, offset accounts tend to have more benefits than revolving accounts.

However, the scenario occurs differently since the government launched this interest deductibility rule. The situation has become more complex to all real estate investors, and it is vital to be more thoughtful when using an offset account.

Case study:

Recently, one of our clients came to us and want to get advice on how to use their gifted money. They currently have a home loan of $200K. At the same time, they have another $200K cash from their parents' gifting. They are planning to purchase another property with development potential which is likely to be developed and then rented out in the future as an investment property. When it comes to the money gifted, they have three options as follows, despite the first two options are not desirable.

The first option is to pay off the loan in full to minimise the interest costs. But considering they are still in the early stage of development, they would need money to pay some fees such as council fee, design fee, and consent fee. If this is the case, they have to go through the entire application process to apply for a top-up, which can be a time-consuming process.

The other two options are converting into offset or revolving accounts. Both ways would help to minimise interest costs when their money is not used yet and give them the flexibility of accessing money when needed. However, in terms of interest deductibility, these two options would bring completely different results.

If the home loan is converted into an offset account, home loan starts incurring interest again once they move the money from their offset account to cover some initial development costs because there's no cash to offset. They simply used their own money towards the development project. The interest occurred was for their family home.

However, if the money is converted into a revolving facility, there would be three beneficial aspects since the introduction of new interest deductibility policies: First, the clients can pay off their loan but they do have the ability to redraw the funds when they need it. Second, they do not need to obtain full approval through the bank to be eligible to use the funds. Lastly, the interest occurs when they start using the money to build a new property, however, the interest will become interest deductible against future rent, therefore, it will help the clients minimize their future rental profits. That's the reason why revolving is recommended in this case.

Tip 2: Don't combine your loans, especially for the rental property loans

As mentioned above, no interest deductions on a residential investment property (not new builds) acquired after 27th March 2021. For the property acquired before 27th March 2021, the interests on the home loan will become progressively non-tax deductible against rental income from 1st October 2021.

You may want to combine loans maybe because the amount is small or whatever the reason leads you to combine it with existing loans. Without getting professional advice, if you combine loans which are for properties acquired at different times, it may become very hard to trace later and make it difficult for your accountant to produce accurate financial statements. Even worse, it can have tax implications. To keep separate accounts for different purposes will provide simple tracking if required.

Tip 3: How to wisely use a lump sum money to repay loans if you do not wish to use the money for something else.

- Priority one: Pay down your home loan first – this will help you discharge your home sooner than later to protect your home

- Priority two: Pay down the loan against existing rental properties (not new build) purchased from 27th March this year. Because from 1st October you cannot deduct the interest against the rental. That’s why it is better to pay down this loan fast.

- If you still have extra money, you can pay down the loans for your rental properties which were purchased prior to 27th March one at a time.

The above three tips can not only help you manage your home loans with better tax efficiency, but also allow you to make the right decisions in a complex situation. Any questions? Or seek help? Call us at 09 930 8999 to have a no-obligation chat with one of the financial advisors at Prosperity Finance.

Read more:

Are higher interest rates coming?

Should you be concerned about DTI (debt-to-income ratio)?

Should I invest in new builds or existing properties? 13 pros and cons

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

- December 2025 (1)

- October 2025 (1)

- August 2025 (2)

- July 2025 (1)

- June 2025 (2)

- April 2025 (1)

- October 2024 (1)

- July 2024 (1)

- June 2024 (1)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (3)

- October 2023 (3)

- September 2023 (3)

- August 2023 (2)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (4)

- March 2023 (2)

- February 2023 (3)

- November 2022 (4)

- October 2022 (1)

- September 2022 (2)

- August 2022 (1)

- July 2022 (4)

- June 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (1)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (4)

- January 2021 (3)

- December 2020 (3)

- November 2020 (4)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (5)

- June 2020 (3)

- May 2020 (3)

- April 2020 (4)

- March 2020 (4)

- February 2020 (3)

- January 2020 (3)

- December 2019 (1)

- November 2019 (4)

- October 2019 (5)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (5)

- April 2019 (3)

- March 2019 (5)

- February 2019 (3)

- January 2019 (1)

- November 2018 (1)

- October 2018 (1)

- January 2018 (4)